Last updated: July 27, 2025

Introduction

Pramipexole, marketed notably under the brand Mirapex among others, is a dopamine agonist primarily prescribed for Parkinson’s disease and Restless Leg Syndrome (RLS). As a critical therapeutic agent, its market dynamics are influenced by patent protections, competition, regulatory pathways, and emerging biosimilar or generic alternatives. This analysis explores current market conditions, pricing trends, and future projections, providing actionable insights for stakeholders.

Current Market Landscape

Therapeutic Indications and Patient Demographics

Pramipexole is predominantly prescribed to Parkinson’s disease patients, with estimates indicating over 10 million individuals globally affected by Parkinson’s, and approximately 7-8% of these patients receiving dopamine agonists like pramipexole [1]. RLS affects roughly 10% of the adult population, with pramipexole being a first-line pharmacotherapy.

Market Size and Revenue

The global Parkinson’s disease treatment market was valued at approximately USD 4.5 billion in 2022, with dopamine agonists comprising a significant segment [2]. Pramipexole accounts for an estimated 25-30% share within this segment, translating to annual revenues of roughly USD 1.1–1.4 billion.

Patent Status and Market Exclusivity

Pfizer and Boehringer Ingelheim originally developed pramipexole, with patent protections expiring between 2018 and 2020 in key markets such as the U.S. and EU. Consequently, generic formulations have entered, intensifying price competition [3].

Competitive Landscape

Post-patent expiration, multiple generic manufacturers have introduced pramipexole. The entry of generics reduces prices significantly—average discounts of 40-70% are observed in markets with high generic penetration [4].

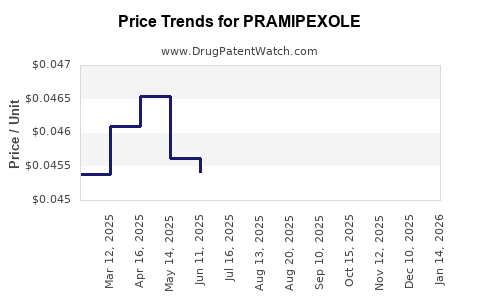

Pricing Trends and Influencing Factors

Brand vs. Generic Pricing

- Brand Pramipexole: Historically, branded formulations sold at USD 10–15 per 0.75 mg tablet. For example, Mirapex's retail price ranged between USD 300–500 per month, depending on dosage and insurance coverage.

- Generics: Post-generic entry, prices declined sharply, with wholesale prices dropping to USD 3–5 per tablet. Retail prices for generics in the U.S. now average USD 15–25 per month, driven by competition [5].

Regulatory and Market Dynamics

- Regulation: Increased regulatory encouragement for biosimilars and generics supports downward price pressures.

- Market Penetration: Countries with single-payer or stringent pricing controls, like Canada or several European nations, demonstrate lower prices compared to the U.S.

Impact of New Formulations and Indications

- Extended-release formulations and combination therapies are under development, potentially impacting pricing strategies.

- Investigational data showing superior efficacy or reduced side effects could sustain premium pricing for new formulations.

Forecasting Price Trends

Upcoming Patent Expirations and Market Entry

- Pending patents related to manufacturing processes could delay generic proliferation in select markets until 2024–2025.

- Entry of biosimilars or more cost-effective generics could further depress prices over the next 3–5 years.

Regulatory and Policy Drivers

- Countries adopting stricter drug pricing regulations and international reference pricing mechanisms will exert additional downward pressure.

- Value-based pricing models may place a cap on prices for innovative formulations.

Market Demand and Innovation

- As Parkinson’s and RLS cases increase with aging populations, demand stabilization may occur.

- Innovation towards targeted delivery systems and combination therapies could preserve premium pricing for differentiated products.

Price Projection Summary

| Time Horizon |

Expected Trend |

Estimated Price Range (per tablet) |

| 2023–2025 |

Transition to generic dominance; decreased prices |

USD 3–5 (wholesale); USD 15–25 (retail) |

| 2026–2030 |

Possible stabilization; emergence of new formulations |

USD 4–7 (wholesale); USD 20–30 (retail) |

| 2030+ |

Worldwide biosimilar integration; cost-effectiveness focus |

USD 2–4 (wholesale); USD 10–20 (retail) |

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Investing in biosimilars and innovative formulations could justify maintained or increased pricing.

- Payers and Policymakers: Emphasizing generic substitution and value-based pricing can contain costs.

- Investors and Market Entrants: Monitoring patent expirations and regulatory changes is crucial for timing market entry.

Key Takeaways

- The pramipexole market is experiencing significant price erosion following patent expirations and generic entry.

- Pricing will likely stabilize at lower levels, with potential for slight increases if new formulations or indications prove advantageous.

- Regions with lax price controls may sustain higher prices longer; thus, market entry strategies should be tailored accordingly.

- Continued innovation and differentiation remain essential to sustain premium pricing in competitive markets.

FAQs

1. When do patent protections for pramipexole expire globally?

Patent expirations vary by country but generally occurred between 2018 and 2020, leading to widespread generic entry.

2. How do generic versions of pramipexole impact global affordability?

Generics reduce drug prices significantly, increasing accessibility—particularly in countries with international reference pricing and price controls.

3. What are the future opportunities for pramipexole formulations?

Innovations such as extended-release formulations, combination pills, and biosimilars could create new pricing niches.

4. How does the regulatory environment influence pramipexole pricing?

Stringent regulations and faster approval processes for generics and biosimilars around the globe accelerate price reductions.

5. Are there any new indications that could affect pramipexole’s market?

Research into expanding indications (e.g., depression, fibromyalgia) may influence demand and pricing dynamics if successfully developed.

References

[1] World Health Organization. (2022). Parkinson’s Disease Epidemiology.

[2] Persistence Market Research. (2022). Global Parkinson’s Disease Treatment Market Analysis.

[3] U.S. Patent and Trademark Office. (2018–2020). Patent expiration dates for pramipexole.

[4] IQVIA. (2022). Global Generic Drug Pricing Report.

[5] GoodRx. (2023). Pramipexole Price Trends in the U.S.

This comprehensive analysis facilitates informed decision-making for pharmaceutical stakeholders, payers, investors, and policy regulators navigating the evolving landscape of pramipexole.