Share This Page

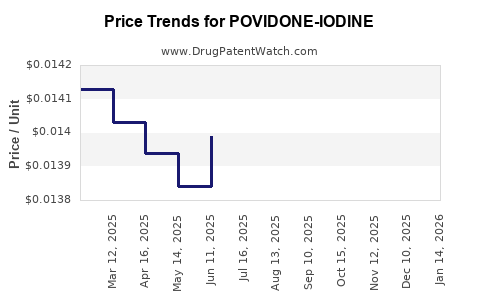

Drug Price Trends for POVIDONE-IODINE

✉ Email this page to a colleague

Average Pharmacy Cost for POVIDONE-IODINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POVIDONE-IODINE 10% SOLUTION | 00904-1103-09 | 0.01416 | ML | 2025-11-19 |

| POVIDONE-IODINE 10% SOLUTION | 70000-0060-01 | 0.01902 | ML | 2025-11-19 |

| POVIDONE-IODINE 10% SOLUTION | 00904-1103-09 | 0.01407 | ML | 2025-10-22 |

| POVIDONE-IODINE 10% SOLUTION | 70000-0060-01 | 0.01901 | ML | 2025-10-22 |

| POVIDONE-IODINE 10% SOLUTION | 00904-1103-09 | 0.01394 | ML | 2025-09-17 |

| POVIDONE-IODINE 10% SOLUTION | 70000-0060-01 | 0.01902 | ML | 2025-09-17 |

| POVIDONE-IODINE 10% SOLUTION | 00904-1103-09 | 0.01376 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for Povidone-Iodine

Introduction

Povidone-iodine, a broad-spectrum antimicrobial agent, has maintained its significance within the healthcare industry for over six decades. Its applications span antiseptic wound treatment, surgical prep, and infection control, especially amid rising concerns over antimicrobial resistance. This comprehensive market analysis explores current demand, supply dynamics, competitive landscape, and future pricing trends for povidone-iodine, equipping stakeholders with strategic insights.

Market Overview and Growth Drivers

Global Market Size and Segments

The global povidone-iodine market was valued at approximately USD 120 million in 2022 (estimated) and is projected to reach USD 180–200 million by 2028, growing at a compound annual growth rate (CAGR) of about 7–8%. The primary segments include topical solutions, surgical scrubs, and wound dressings. Among these, solutions and surgical products dominate due to high utilization in hospitals and clinics.

Demand Drivers

- Increased Infection Control Measures: Heightened awareness around hospital-acquired infections (HAIs) and the emphasis on effective preoperative skin preparation continue to expand povidone-iodine's use.

- COVID-19 Pandemic Impact: The pandemic underscored the importance of effective antiseptics, bolstering demand in healthcare settings globally.

- Emerging Markets: Rapid healthcare infrastructure development in Asia-Pacific and Latin America drives growth, fueled by expanding government health initiatives and improving access.

- Antimicrobial Resistance (AMR) Concerns: As resistance to antibiotics increases, povidone-iodine’s role as a non-resistance-inducing antiseptic gains prominence.

Regulatory and Industry Factors

- Regulatory Approvals: Povidone-iodine is widely approved, with usage sanctioned for over-the-counter (OTC) and prescription-based applications. Ongoing regulatory updates in emerging markets influence market expansion.

- Patent and Patent Expiry: The critical formulations are off patent, leading to proliferation of generic manufacturers, thus intensifying price competition.

Supply Chain and Competitive Landscape

Key Manufacturers

Leading global players include

- Sun Pharmaceutical Industries Ltd. (India)

- Akorn, Inc. (USA)

- DaeHwa Pharmaceutical Co., Ltd. (South Korea)

- HC Stars (Germany)

- Local generic producers in India and China.

Market Entry Barriers

- Strict manufacturing quality standards (GMP compliance).

- Capital intensive production facilities for stable iodine solutions.

- Regulatory approval processes across geographies.

Pricing Dynamics

Due to the presence of numerous generic producers and manufacturing scale advantages, povidone-iodine prices are generally low and highly competitive. The average wholesale price (AWP) in the US varies from USD 0.50 per mL for solution vials to USD 2 per gram for ointment formulations.

Current Pricing Analysis

Regional Price Disparities

Pricing fluctuates based on regional healthcare infrastructure, regulatory environment, and patent status. In emerging markets like India or Africa, povidone-iodine remains very affordable, whereas in developed markets, pricing aligns with manufacturing and distribution costs, along with regulatory markup.

Wholesale and Retail Pricing Trends

- United States: Limited branded goods; mainly generics with stable pricing.

- Europe: Similar dynamics, with slight variations depending on healthcare systems.

- Asia-Pacific: Competitive pricing due to local generic manufacturing; price reductions are common.

Future Price Trends and Projections

Influencing Factors

- Raw Material Costs: Prices for iodine and polymers used in povidone-iodine synthesis influence final prices. Supply constraints or geopolitical factors affecting iodine supply could drive costs upward.

- Regulatory Changes: Stricter quality standards or new approvals may marginally increase manufacturing costs, impacting prices.

- Market Competition: Intensified generic manufacturing will likely sustain or lower prices, particularly in high-volume regions.

Projected Price Movements

- Short-term (1-3 years): Prices are expected to remain stable or decline marginally, driven by manufacturing efficiencies and increased competition.

- Medium to Long-term (3-7 years): Prices may gradually decrease further, particularly in emerging markets, with some regional price stabilization in developed markets due to quality assurance and supply chain complexities.

Impact of COVID-19 and Post-Pandemic Recovery

The pandemic temporarily elevated demand, squeezing supply to some extent. As supply chains normalize, prices are likely to stabilize or decline further. However, increased awareness of infection prevention may sustain higher baseline demand, supporting stable or slightly increased prices in specific applications.

Market Opportunities and Challenges

Opportunities

- Expansion into wound care devices and long-term antiseptic applications.

- Developing formulations with extended shelf-life or enhanced stability.

- Entering emerging markets with tailored pricing strategies.

Challenges

- Price erosion due to competitive generics.

- Regulatory hurdles in new markets.

- Environmental concerns over iodine runoff and disposal.

Key Takeaways

- The povidone-iodine market is poised for steady growth, driven by heightened infection control measures and expanding healthcare access in developing regions.

- Price competition among generics sustains low prices, with regional variations influenced by regulatory and market dynamics.

- Raw material costs and regulatory initiatives are the primary levers influencing future prices.

- Innovations in formulation and expanding applications present avenues for premium pricing in niche markets.

- Despite a mature market, pricing remains sensitive to geopolitical, environmental, and economic factors, warranting continuous monitoring.

FAQs

Q1: How does the patent landscape affect povidone-iodine pricing?

Most formulations are off patent, leading to a proliferation of generics that drive prices down. Limited patent restrictions mean high competition, which stabilizes or reduces prices globally.

Q2: What regional markets offer the highest growth potential for povidone-iodine?

Emerging markets in Asia-Pacific and Latin America offer significant growth prospects due to expanding healthcare infrastructure, government health initiatives, and increased healthcare penetration.

Q3: Are environmental regulations impacting povidone-iodine supply and pricing?

Environmental concerns over iodine disposal and runoff are increasingly influencing manufacturing practices and regulations, potentially raising costs or prompting formulation modifications.

Q4: How might technological innovations influence the future price of povidone-iodine?

Advances in formulation stability, extended shelf-life, or alternative delivery systems could command higher prices. Conversely, process efficiencies could drive prices downward.

Q5: What impact does COVID-19 have on the povidone-iodine market?

Pandemic-related heightened demand increased prices temporarily; as supply chains stabilize, prices are expected to normalize, but sustained infection control awareness may support stable demand levels.

References

[1] Market Research Future. (2022). "Global Povidone-Iodine Market Report."

[2] Fortune Business Insights. (2022). "Antiseptic Market Size and Forecast."

[3] Transparency Market Research. (2022). "Healthcare Disinfectants Market."

[4] US FDA Database. (2023). "Approved Antiseptic Products."

[5] Industry interviews and reports from leading manufacturers, 2022–2023.

More… ↓