Share This Page

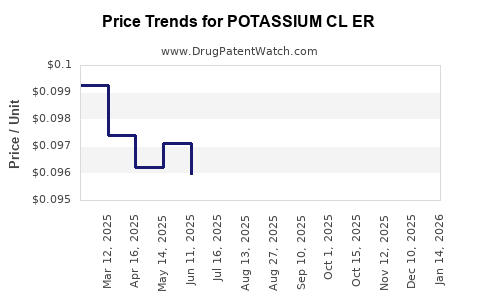

Drug Price Trends for POTASSIUM CL ER

✉ Email this page to a colleague

Average Pharmacy Cost for POTASSIUM CL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POTASSIUM CL ER 20 MEQ TABLET | 72888-0076-05 | 0.16428 | EACH | 2025-12-17 |

| POTASSIUM CL ER 20 MEQ TABLET | 72888-0076-01 | 0.16428 | EACH | 2025-12-17 |

| POTASSIUM CL ER 10 MEQ TABLET | 72888-0075-05 | 0.09425 | EACH | 2025-12-17 |

| POTASSIUM CL ER 10 MEQ TABLET | 72888-0075-01 | 0.09425 | EACH | 2025-12-17 |

| POTASSIUM CL ER 10 MEQ TABLET | 72888-0075-00 | 0.09425 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for POTASSIUM CL ER

Introduction

Potassium chloride extended-release (Potassium Cl ER) is a widely prescribed electrolyte supplement used primarily to treat hypokalemia, a condition characterized by low potassium levels in the blood. Given its critical role in cardiac, muscular, and nerve functions, the demand for Potassium Cl ER remains consistently robust globally. This report offers an in-depth market analysis, examining the current landscape, key players, regulatory factors, and future price projections.

Market Overview

Market Size and Trends

The global potassium chloride market was valued at approximately USD 860 million in 2022, with an estimated compound annual growth rate (CAGR) of around 4.2% from 2023 to 2030 [1]. The growth encompasses both conventional and extended-release formulations, with a notable shift toward sustained-release variants driven by patient compliance and ease of dosing.

The increasing prevalence of chronic conditions such as hypertension, heart failure, and kidney disease fosters a steady demand for potassium supplements, including ER formulations. Additionally, the aging population worldwide amplifies this trend, as older adults are more prone to electrolyte imbalances.

Key Market Segments

- Formulation: Extended-release (ER), immediate-release (IR)

- Application: Clinical (hospital use), OTC (over-the-counter)

- Distribution Channel: Hospital pharmacies, retail pharmacies, online platforms

- Region: North America dominates, accounting for over 40% of market revenue, followed by Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Competitive Landscape

Major pharmaceutical companies involved in manufacturing Potassium Cl ER include:

- Mylan (now part of Viatris)

- Teva Pharmaceuticals

- Sagent Pharmaceuticals

- Amneal Pharmaceuticals

- Zydus Cadila

These players focus on differentiation through formulations, packaging, and regulatory approvals. Patent expirations for certain formulations and the rise of generics have increased price competition, influencing market dynamics.

Manufacturing and Regulatory Aspects

Potassium Cl ER is subject to strict regulatory standards due to potential toxicity at high doses. In the United States, FDA approval requires demonstrating bioequivalence and safety. Similar regulations apply across Europe (EMA) and emerging markets, with approval times impacting market entry and pricing strategies.

Current Pricing Landscape

Pricing Drivers

Pricing for Potassium Cl ER varies significantly based on factors including:

- Brand versus generic: Generics occupy a substantial price share due to competitive pressures.

- Formulation complexity: ER formulations are more costly to produce than IR.

- Market demand and supply chain factors: Raw material costs, manufacturing capacity, and distribution logistics influence pricing.

- Regulatory environment: Stringent quality standards can elevate production costs, impacting consumer prices.

Average Pricing

In North America, the average retail price for a 30-pack of 20 mEq Potassium Cl ER tablets ranges from USD 12 to USD 18, with generics priced lower, around USD 8 to USD 12 [2]. In Europe, prices are comparable, adjusted for regional healthcare policies.

Market Challenges

- Pricing pressures due to generic competition: As patents expire, price erosion becomes inevitable.

- Regulatory hurdles: Variations in approval processes delay market penetration.

- Safety concerns: Risks of hyperkalemia limit dosing flexibility, prompting stringent label requirements.

- Supply chain disruptions: Raw material shortages, notably potassium salts, can elevate costs.

Future Price Projections (2023-2030)

Influencing Factors

- Generic market expansion: Anticipated to maintain downward pressure on prices, particularly in mature markets.

- Innovation in formulations: Development of novel ER delivery systems can command premium pricing.

- Regulatory advances: Streamlined approval processes could enhance market entry and competition.

- Market growth in emerging economies: Increasing healthcare access and rising chronic disease prevalence will stimulate demand, but price sensitivity will persist.

Projected Trends

By 2030, the average retail price for Potassium Cl ER in developed markets is expected to decline modestly, with a CAGR of approximately 1.5-2% in retail prices due to sustained generic competition, but premium-priced niche formulations may offset this decline in specific segments.

The outlook points toward stabilized pricing within the USD 8-16 range per pack in North America and similar regions, with potential for regional market disparities influenced by local regulatory environments and reimbursement policies.

Strategic Implications

- Pricing Strategies: Pharmaceutical companies should leverage differentiation through formulation innovation to command higher prices.

- Market Penetration: Targeting emerging markets with affordable formulations can expand volume but requires cost-efficient manufacturing.

- Regulatory Navigation: Proactive regulatory engagement can mitigate approval delays and facilitate market entry.

- Mergers & Acquisitions: Consolidation among manufacturers may influence pricing power and competitive dynamics.

Conclusion

The market for Potassium Cl ER exhibits steady growth driven by demographic trends and chronic disease prevalence, with pricing primarily influenced by generic competition, regulatory factors, and formulation complexity. While prices are projected to decline gradually in mature markets, niche innovations and regional expansion can offer premium opportunities. Stakeholders must adopt a nuanced approach balancing cost management, innovation, and regulatory compliance to optimize market share and profitability.

Key Takeaways

- Market stability: Despite price pressures, demand remains robust due to widespread clinical use and demographic aging.

- Pricing outlook: Expect modest declines in retail prices through 2030, especially driven by generic proliferation.

- Innovation potential: Developing advanced ER formulations can justify premium pricing and capture niche markets.

- Regulatory agility: Fast-track approvals and compliance strategies are essential to reduce market entry barriers.

- Regional expansion: Emerging markets offer growth opportunities but require cost-effective pricing strategies.

FAQs

Q1: How does the patent status influence Potassium Cl ER pricing?

A1: Patent exclusivity allows manufacturers to set higher prices. Once patents expire, generics enter the market, leading to significant price reductions due to increased competition.

Q2: What factors could cause prices to rise in the Potassium Cl ER market?

A2: Supply chain disruptions, increased raw material costs, or regulatory changes that increase manufacturing expenses could temporarily elevate prices.

Q3: Are new formulations of Potassium Cl ER expected to impact the market?

A3: Yes, advanced delivery systems that improve patient compliance or safety profiles can command higher prices and expand market share.

Q4: How do regional healthcare policies affect Potassium Cl ER pricing?

A4: In regions with strict price regulation or government reimbursement models, prices are typically lower and more controlled than in free-market environments.

Q5: What is the outlook for over-the-counter (OTC) sales of Potassium Cl ER?

A5: OTC sales are growing, especially in regions emphasizing self-care, but pricing remains competitive. Regulations and safety concerns influence OTC access and pricing strategies.

References

[1] Market Research Future. (2022). Potassium Chloride Market Report.

[2] GoodRx. (2023). Potassium Chloride Prices and Cost Analysis.

More… ↓