Share This Page

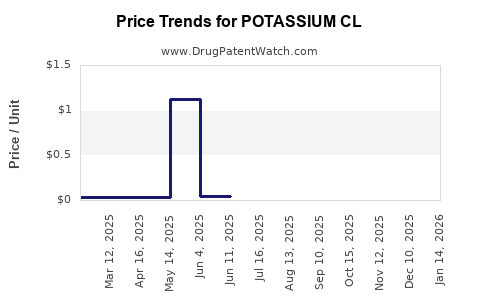

Drug Price Trends for POTASSIUM CL

✉ Email this page to a colleague

Average Pharmacy Cost for POTASSIUM CL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POTASSIUM CL ER 20 MEQ TABLET | 72888-0076-05 | 0.16428 | EACH | 2025-12-17 |

| POTASSIUM CL ER 20 MEQ TABLET | 72888-0076-01 | 0.16428 | EACH | 2025-12-17 |

| POTASSIUM CL ER 10 MEQ TABLET | 72888-0075-05 | 0.09425 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Potassium Chloride (KCl)

Introduction

Potassium chloride (KCl) is a vital electrolyte and mineral supplement with extensive applications across the healthcare, agricultural, and industrial sectors. It is primarily used for treating hypokalemia, as a fertilizer, and in various industrial processes. Given its multifaceted utility, the market for KCl is shaped by healthcare demand, agricultural requirements, and geopolitical factors influencing raw material supply chains. This analysis explores the current market landscape, demand drivers, supply dynamics, and provides an informed projection of pricing trends over the next five years.

Overview of Potassium Chloride Market

Potassium chloride is the second most common potassium fertilizer globally, accounting for approximately 70% of the total potassium fertilizer production. The global market size for KCl was valued at USD 19 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4% from 2023 to 2028.

The demand for KCl in healthcare, particularly for intravenous electrolytes and dietary supplements, accounts for roughly 20% of total consumption, with the remaining from agriculture and industrial applications. The latter sectors are more sensitive to geopolitical and macroeconomic factors, influencing overall market stability and pricing.

Market Drivers

Healthcare Demand

The medical sector’s reliance on potassium chloride for managing electrolyte imbalances ensures a consistent demand, especially amidst rising chronic diseases like cardiovascular conditions that necessitate electrolyte management. The COVID-19 pandemic increased healthcare resource allocation, including electrolyte solutions, slightly boosting KCl demand.

Agricultural Sector

Demand from the fertilizer industry justifies over 70% of total KCl consumption. Global food security initiatives and rising fertilizer application rates in emerging economies, particularly in Asia and Africa, contribute to sustained demand growth.

Industrial Applications

KCl is used in manufacturing various products such as de-icing agents, plastics, and pharmaceuticals. Growth in these sectors, particularly in regions with expanding infrastructure, contributes to demand stability.

Supply Chain Factors

The primary producers are countries like Canada, Belarus, Russia, and Germany, which collectively supply approximately 80% of global KCl. Political sanctions, trade tariffs, and geopolitical tensions, especially concerning Russian and Belarusian exports, impact prices and availability. The recent geopolitical tensions have led to fluctuations in supply, influencing market volatility.

Competitive Landscape

Major players include Nutrien Ltd., The Mosaic Company, Belaruskali, EuroChem, and Yara International. These organizations control a significant share of the global production capacity, influencing pricing strategies through capacity adjustments and production management. The industry sees moderate consolidation, with emerging regional producers attempting to capture niche markets.

Pricing Trends and Forecasting

Historical Price Movements

Between 2018 and 2022, KCl prices experienced fluctuations driven by supply constraints and global demand surges, with prices ranging from USD 250 to USD 400 per ton FOB. Notably, the 2020 pandemic outbreak caused initial price dips, followed by a sharp rebound in 2021 as supply chain disruptions persisted.

Current Market Conditions

As of early 2023, FOB prices hover around USD 370-390 per ton, with some regional variations. North American markets remain relatively stable due to abundant capacity, while European and Asian markets face volatility linked to import tariffs and logistics.

Projection Assumptions

Key assumptions influencing price projections include:

- Steady demand in agricultural applications due to global food security initiatives.

- Moderate increase in healthcare utilization driven by aging populations.

- Supply constraints continue due to geopolitical tensions with Russia and Belarus.

- Recovery in global logistics post-pandemic supports smoother trade flows.

Forecasted Price Trends (2023-2028)

Based on supply-demand dynamics, geopolitical considerations, and macroeconomic trends, KCl prices are projected to increase modestly at a CAGR of 3-4%, reaching USD 480-520 per ton FOB by 2028.

Expected drivers of price increases include:

- Persistent supply tightness due to sanctions and trade restrictions.

- Rising raw material costs, including energy prices impacting production costs.

- Increasing demand in emerging markets for both agriculture and health sectors.

- Environmental policies prompting cleaner and more efficient mining practices, potentially raising operational costs.

Conversely, potential oversupply from new capacity additions in North America and Australia could temper price increases, emphasizing the need for continuous market monitoring.

Regional Analysis

North America

The U.S. and Canadian markets benefit from abundant production capacity and advanced logistics networks. Prices here are relatively stable but could face downward pressure with new capacity launches.

Europe

Highly dependent on imports from Russia and Belarus, European prices tend to be more volatile, potentially rising amid sanctions or trade disruptions.

Asia-Pacific

As the fastest-growing agricultural region, Asia-Pacific’s demand for KCl is surging. Prices are expected to continue upward trends, especially as India and China seek to secure fertilizer supplies.

Emerging Markets

Africa and Latin America present growing markets for KCl, driven by modernization efforts and infrastructural investments. By 2028, these regions will represent significant incremental demand.

Regulatory and Environmental Considerations

Environmental regulations concerning mining practices and emissions may impact operational costs. Additionally, increasing scrutiny on mining sustainability could lead to higher compliance costs, affecting bottom lines and influencing price strategies.

Conclusion

The potassium chloride market is poised for steady growth, primarily driven by agriculture and healthcare demands. Supply chain disruptions and geopolitical tensions, especially relating to Russia and Belarus, are significant factors influencing prices. The projected modest price escalation through 2028 underscores the importance of strategic sourcing and inventory management for industry players.

Investors and corporate stakeholders should monitor geopolitical developments, supply chain trends, and demand patterns to adjust strategies accordingly.

Key Takeaways

- Global KCl demand is expected to grow at 4% CAGR through 2028, driven largely by agriculture and healthcare sectors.

- Prices are forecasted to rise gradually, reaching USD 480–520 per ton FOB by 2028, influenced by supply constraints and raw material costs.

- Major geopolitical tensions with Russia and Belarus remain critical factors impacting global supply and pricing stability.

- North American markets offer relatively stable pricing due to ample capacity, while Asian markets will see increased demand and upward price pressure.

- Environmental regulations and sustainability initiatives may increase operational costs, affecting market prices over the medium term.

FAQs

1. What are the primary applications of potassium chloride?

Potassium chloride is mainly used in agriculture as a fertilizer, in healthcare as an electrolyte supplement, and in industrial processes such as manufacturing plastics, de-icing agents, and pharmaceuticals.

2. How has geopolitics influenced KCl prices recently?

Sanctions and trade restrictions on Russia and Belarus have significantly impacted supply chains, causing fluctuations in global prices and creating market volatility.

3. What is the long-term price outlook for potassium chloride?

Prices are projected to increase modestly at a CAGR of approximately 3-4% until 2028, driven by demand growth and supply constraints.

4. Which regions are the major producers of KCl?

Canada, Belarus, Russia, and Germany are the leading producers, accounting for about 80% of global supply.

5. What factors could disrupt the projected market growth?

Potential disruptions include new supply capacities, technological innovations reducing demand, stricter environmental regulations, and geopolitical tensions disrupting trade flows.

More… ↓