Last updated: July 27, 2025

Introduction

Potassium chloride (KCl) is a critical pharmaceutical and industrial chemical, predominantly used in medical IV solutions, agriculture as a fertilizer, and various industrial applications. Its widespread application underscores its significance in global markets. This analysis provides an in-depth assessment of the current market dynamics, supply-demand trends, key players, regulatory landscape, and future price projections for potassium chloride.

Market Overview

The global potassium chloride market was valued at approximately USD 15 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 3-4% through 2030. The growth is driven by increased fertilizer demand to support global food security, expanding pharmaceutical needs, and industrial applications.

Segmentation:

- Agricultural Segment: Accounts for roughly 80% of total KCl consumption. The growing need for crop productivity sustains high demand.

- Pharmaceutical Segment: Represents a smaller but critical proportion, especially in IV infusion solutions for electrolyte replenishment.

- Industrial Segment: Encompasses uses in chemical manufacturing, melting agents, and other industrial processes.

Supply-Demand Dynamics

Supply Chain Overview:

Major producers include Canada (notably the potash-rich Saskatchewan region), Russia, Belarus, China, and Israel. Canada is the predominant supplier, holding over 40% of global production capacity.

Market Drivers:

- Agricultural Growth: The global population's increase necessitates higher agricultural productivity, thereby elevating fertilizer consumption and KCl demand.

- Regulatory and Environmental Factors: Restrictions on mining in certain regions may influence supply side constraints.

- Geopolitical Tensions: Political conflicts, particularly involving Russia and Belarus—the second and third-largest producers—pose risks to supply stability, influencing market prices.

Recent Trends:

- Supply Constraints: Reduced output due to regulatory hurdles and weather-related disruptions in key mining regions.

- Rising Costs: Energy prices, especially natural gas, significantly influence production costs, given the energy-intensive nature of potash mining.

- Environmental Considerations: Increasing environmental scrutiny imposes operational restrictions, influencing supply availability.

Market Players and Competitive Landscape

Key Players:

- Nutrien Ltd.: The world's largest potassium fertilizer producer, with significant capacity in Canada.

- The Mosaic Company: Major US-based producer supplying both agricultural and industrial KCl.

- Community and government-owned mines: Such as Belaruskali and Uralkali, which account for substantial global supply.

Market competitiveness is influenced by:

- Production costs

- Logistics capabilities

- Geopolitical stability

- Technological advancements in mining and processing

Regulatory and Environmental Factors

Regulatory frameworks in key producing regions shape market supply:

- Canada's strict environmental regulations impact expansion and operational costs.

- Sanctions and trade restrictions concerning Russia and Belarus affect their export volumes, thereby impacting global supply.

Environmental concerns focus on sustainable mining practices and minimizing ecological footprint, with some countries imposing stricter standards that can limit production or raise compliance costs.

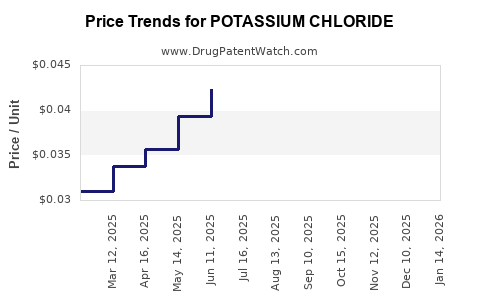

Price Dynamics and Trends

Historically, KCl prices have shown volatility influenced by supply disruptions, energy prices, and demand fluctuations.

Current Pricing (2023):

- FOB Contract prices range from USD 350 to USD 450 per ton, depending on quality, grade, and contractual terms.

- Spot market prices display volatility due to geopolitical uncertainties and logistical constraints.

Price Drivers:

- Fertilizer Demand: As the primary growth engine, fluctuations in global crop production estimates influence fertilizer prices.

- Energy Costs: Elevated natural gas and electricity prices increase mining and processing expenses, leading to potential price hikes.

- Supply Disruptions: Geopolitical conflicts and weather-related issues compromise supply stability, catalyzing price surges.

Future Price Projections

Forecast Outlook (2024-2030):

Based on current market trends, supply-demand analysis, and macroeconomic factors, the following projections are estimated:

- Average Price Range: USD 370 to USD 470 per ton in the short term (2024), with gradual escalation aligned with inflation and input costs.

- Medium to Long Term (2025-2030): Prices could trend upward, reaching USD 500+ per ton, particularly if supply disruptions persist or environmental regulations tighten.

Key Influencing Factors:

- Supply Constraints: Persistent geopolitical risks may cause periodic price spikes.

- Demand Elasticity: The agricultural sector's responsiveness to fertilizer price increases may temper price acceleration.

- Technological & Regulatory Changes: Advances in mining efficiency or stricter environmental standards could affect supply dynamics and costs, respectively.

Implications for Industry Stakeholders

- Manufacturers: Should invest in supply chain diversification and technological innovation to mitigate risks and control costs.

- Investors: Monitoring geopolitical developments and energy markets is crucial for projecting long-term price trends.

- Regulators: Balancing environmental policies with supply stability will be central to maintaining market equilibrium.

Conclusion

The potassium chloride market exhibits a balanced but complex interplay of supply-side constraints and robust demand, primarily from agriculture. While prices face upward pressure due to geopolitical tensions and environmental regulations, supply-side innovations and diversification can moderate volatility. Stakeholders must maintain agility and strategic foresight to navigate this evolving landscape.

Key Takeaways

- Market Size & Growth: The global KCl market exceeded USD 15 billion in 2022, with steady growth driven by fertilizer demand and industry needs.

- Supply Risks: Concentration among key producers, especially in politically sensitive regions, poses supply stability challenges.

- Price Trends: Short-term prices hover around USD 350-450/ton, with potential upward movement to USD 500+ by 2030.

- Major Influencers: Geopolitical developments, energy costs, environmental policies, and technological advances are critical determinants.

- Strategic Recommendations: Stakeholders should diversify supply sources, explore technological efficiencies, and hedge against volatility.

FAQs

1. What are the primary uses of potassium chloride?

Potassium chloride is chiefly used in fertilizers (~80% of demand), as a salt substitute and food additive, in pharmaceutical electrolytes, and in industrial applications such as chemical manufacturing.

2. How do geopolitical tensions impact the potassium chloride market?

Conflicts involving major producers like Russia and Belarus can restrict exports, reduce supply, and trigger price spikes, underscoring the importance of diversified sourcing.

3. What factors influence the cost of potassium chloride production?

Key factors include energy prices (natural gas and electricity), mining and processing efficiencies, environmental compliance costs, and logistical expenses.

4. What are the environmental concerns associated with potassium chloride mining?

Mining operations can cause land degradation, water contamination, and ecological disturbance, prompting stricter regulations that may increase operational costs.

5. How might technological innovation influence future pricing?

Advancements such as more efficient mining methods or recycling technologies could reduce costs, alleviating potential price increases and improving supply stability.

References

[1] Research and Markets. "Global Potassium Chloride Market Analysis." 2022.

[2] U.S. Geological Survey. "Mineral Commodity Summaries." 2023.

[3] MarketsandMarkets. "Fertilizer Chemicals Market by Type." 2023.

[4] Canadian Mining Association. "Mining Industry Overview." 2022.

[5] International Fertilizer Industry Association. "Global Fertilizer Outlook." 2022.