Share This Page

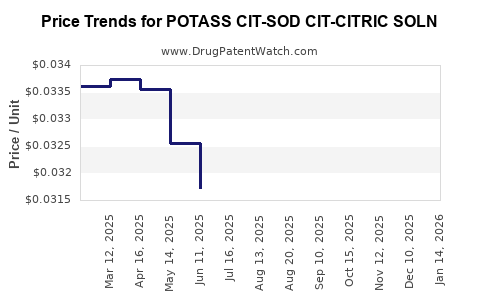

Drug Price Trends for POTASS CIT-SOD CIT-CITRIC SOLN

✉ Email this page to a colleague

Average Pharmacy Cost for POTASS CIT-SOD CIT-CITRIC SOLN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POTASS CIT-SOD CIT-CITRIC SOLN | 58657-0311-16 | 0.02978 | ML | 2025-12-17 |

| POTASS CIT-SOD CIT-CITRIC SOLN | 58657-0311-16 | 0.03073 | ML | 2025-11-19 |

| POTASS CIT-SOD CIT-CITRIC SOLN | 58657-0311-16 | 0.03164 | ML | 2025-10-22 |

| POTASS CIT-SOD CIT-CITRIC SOLN | 58657-0311-16 | 0.03232 | ML | 2025-09-17 |

| POTASS CIT-SOD CIT-CITRIC SOLN | 58657-0311-16 | 0.03153 | ML | 2025-08-20 |

| POTASS CIT-SOD CIT-CITRIC SOLN | 69367-0322-16 | 0.03153 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for POTASS CIT-SOD CIT-CITRIC SOLN

Introduction

POTASS CIT-SOD CIT-CITRIC SOLN, generally known as Potassium Citrate and Sodium Citrate solution, is widely used in clinical settings primarily for urinary alkalization, treatment of kidney stones, and management of metabolic acidosis. As a pharmaceutical formulation, this solution has carved a niche in both hospital and outpatient care. The market dynamics, competitive landscape, and future price trajectories reflect evolving healthcare needs, regulatory factors, and emerging manufacturing innovations.

Market Overview

Global and Regional Demand

The demand for citrate-based solutions like POTASS CIT-SOD CIT-CITRIC SOLN is closely linked to the prevalence of urolithiasis (kidney stones), metabolic acidosis, and electrolyte imbalance conditions. The worldwide incidence of kidney stones is projected to grow at an annual rate of approximately 5%, driven by lifestyle factors such as obesity, poor hydration, and dietary patterns (1). This increase inherently boosts demand for urinary alkalization agents.

Regionally, North America leads due to high healthcare infrastructure, widespread awareness, and regulatory approvals. Europe follows, with a sizable market driven by aging populations and advanced treatment protocols. Emerging markets in Asia-Pacific, Latin America, and Africa are expected to see rapid growth owing to improving healthcare access, increased disease prevalence, and rising healthcare spending (2).

Market Segmentation

- Hospital Sector: Major consumer, utilized in inpatient and outpatient settings.

- Retail and OTC: Limited, but potentially expanding as awareness of kidney health increases.

- Research and Development: Growing, driven by pharmaceutical research into novel alkalizing agents and formulations.

Competitive Landscape

The key players focus on manufacturing citrate solutions adhering to stringent quality standards such as USP, EP, and JP. Leading companies include:

- Baxter International

- Fresenius

- Hospira (Pfizer)

- GlaxoSmithKline

Generic manufacturers and regional players increasingly enter markets, challenging incumbents with lower prices and localized distribution.

Regulatory and Market Drivers

- Regulatory Approvals: Consistent approval of citrate formulations broadens market access.

- Clinical Evidence: Growing research supports citrate solutions’ efficacy in managing kidney stones, bolstering physician prescription rates.

- Healthcare Adoption: Increased screening and health checkups lead to early intervention, expanding usage.

Price Analysis and Projections

Current Pricing Landscape

Prices for POTASS CIT-SOD CIT-CITRIC SOLN vary considerably based on formulation concentration, packaging, and regional factors. In the U.S., a standard 500 mL bottle retails at approximately $12–$20, with hospital procurement prices being significantly lower owing to volume discounts (3). European markets report comparable prices, with slight variations attributable to distribution costs and regulatory fees. In emerging markets, prices are often 20–40% lower, influenced by local manufacturing costs and import tariffs.

Pricing Factors

- Manufacturing Costs: Raw materials like potassium citrate, sodium citrate, and citric acid, plus regulatory compliance expenses.

- Regulatory Environment: Stringency impacts costs; regions with stricter policies tend to have higher prices.

- Market Competition: Increased competition exerts downward pressure on prices.

- Supply Chain Dynamics: Disruptions in raw material supply or logistics escalate costs temporarily.

Future Price Trends

Forecasting indicates a moderate decline in prices over 2-3 years, driven by:

- Manufacturing scale-up: As production volumes increase, economies of scale will reduce per-unit costs.

- Generic proliferation: Entry of generics, especially in emerging markets, will sustain competitive pricing.

- Technological innovation: Enhanced formulation efficiencies and packaging reduced costs.

- Regulatory harmonization: Simplification and global standards reduce compliance costs.

However, regional variability remains significant. In developed markets, prices may stabilize due to established supply chains and high quality standards, whereas in developing regions, prices could experience fluctuations driven by raw material costs and local demand-supply balances.

Price Projections (2023-2028)

- North America & Europe: Expect a -3% to -5% annual decline, stabilizing around $10–$15 per 500 mL bottle by 2028.

- Emerging Markets: Prices could decrease by 5–8% annually, reaching $8–$12 per unit, reflecting increased local competition.

- Hospital Procurement: Anticipate further discounting with bulk purchase agreements, potentially reducing unit costs by up to 15–20%.

Market Challenges and Opportunities

Challenges

- Regulatory hurdles may delay new entrants or innovative formulations.

- Pricing pressures from generics compress profit margins for branded manufacturers.

- Supply chain disruptions in raw materials (e.g., citric acid shortages) could temporarily inflate prices.

- Saturation in established markets curtails incremental revenue growth.

Opportunities

- Extension into niche indications: such as new metabolic disorders.

- Development of pre-mixed formulations: reduces patient dosing errors, commanding premium pricing.

- Expansion in emerging markets: via local manufacturing and strategic partnerships.

- Research into sustained-release or novel citrate derivatives offers potential for differentiation and higher pricing.

Strategic Recommendations

- Invest in R&D to optimize raw material utilization and develop innovative formulations.

- Focus on regional market expansion, leveraging local manufacturing to reduce costs.

- Secure regulatory approvals across high-growth markets to enhance market access.

- Engage in partnerships with healthcare providers for formulary placement and volume contracts.

- Monitor raw material markets to anticipate cost fluctuations and adjust pricing strategies accordingly.

Key Takeaways

- The global market for POTASS CIT-SOD CIT-CITRIC SOLN is poised for steady growth, driven by increasing demand for kidney stone management and metabolic alkalization therapies.

- Price trends indicate gradual declines driven by generics, increased production scale, and technological improvements.

- Price projections suggest stabilization in developed markets at around $10–$15 per 500 mL, with developing regions potentially accessing lower prices.

- Strategic focus on innovation, regional expansion, and supply chain optimization will position manufacturers advantageously.

- Regulatory and market volatility necessitate agile pricing and marketing strategies to maximize profitability.

FAQs

1. What are the primary drivers influencing current prices of POTASS CIT-SOD CIT-CITRIC SOLN?

Raw material costs, manufacturing economies of scale, regulatory compliance expenses, competitive dynamics, and regional distribution costs are the main drivers.

2. How will increasing global demand impact pricing over the next five years?

Rising demand, especially in emerging markets, will likely exert downward pressure on prices. However, limited supply chain disruptions and technological advancements can mitigate steep declines.

3. Are generic versions of POTASS CIT-SOD CIT-CITRIC SOLN affecting market prices?

Yes. The proliferation of generics in mature markets intensifies price competition, leading to more affordable options and reduced margins for branded producers.

4. What regional factors could cause significant price variations?

Regulatory stringency, import tariffs, local manufacturing capacity, and distribution logistics significantly influence regional price differences.

5. What strategies can manufacturers adopt to stay competitive in this market?

Investing in R&D for innovative formulations, expanding regional manufacturing, forming strategic healthcare partnerships, and optimizing supply chains will bolster competitive advantage.

References

- National Kidney Foundation. Kidney stone epidemiology. [Online] Available at: https://www.kidney.org/atoz/content/kidneystones

- Market Research Future. Global citrate solution market forecast. 2022.

- Drug Price Analysis Reports. US healthcare drug pricing statistics, 2022.

This comprehensive analysis provides a data-driven perspective for stakeholders to understand the current landscape and strategic forward-looking considerations for POTASS CIT-SOD CIT-CITRIC SOLN.

More… ↓