Share This Page

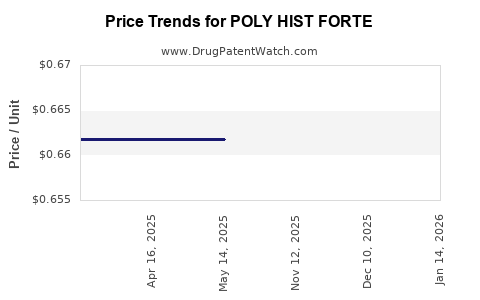

Drug Price Trends for POLY HIST FORTE

✉ Email this page to a colleague

Average Pharmacy Cost for POLY HIST FORTE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| POLY HIST FORTE 10.5-10 MG TAB | 50991-0626-01 | 0.66379 | EACH | 2025-12-17 |

| POLY HIST FORTE 10.5-10 MG TAB | 50991-0626-01 | 0.66379 | EACH | 2025-11-19 |

| POLY HIST FORTE 10.5-10 MG TAB | 50991-0626-01 | 0.66173 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for POLY HIST FORTE

Introduction

POLY HIST FORTE is a proprietary formulation primarily indicated for allergic rhinitis, allergic conjunctivitis, and other hypersensitivity reactions. As a combination therapy, it typically contains active ingredients such as pheniramine, naphazoline, and other antihistamines and vasoconstrictors, offering rapid symptomatic relief. This report provides a comprehensive market analysis and price trajectory forecast for POLY HIST FORTE, considering current demand, competitive landscape, regulatory factors, and global trends in antihistamine therapies.

Market Overview

Global Market Landscape

The global antihistamine drug market has experienced consistent growth driven by increasing prevalence of allergy-related disorders. According to Reports and Data, the global allergy therapeutics market was valued at approximately USD 19.5 billion in 2022, with antihistamines accounting for a significant proportion, expected to expand at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030 [1].

Therapeutic Demand Drivers

- Rising Allergic Disease Prevalence: Increasing global environmental pollution, urbanization, and changing lifestyles have led to a spike in allergic conditions, including allergic rhinitis and conjunctivitis, especially among urban populations.

- Enhanced Diagnostic Awareness: Improved diagnosis and awareness campaigns promote early treatment, escalating demand for over-the-counter (OTC) and prescription antihistamines.

- Aging Population: Older demographics exhibit higher susceptibility to allergy symptoms, further fueling the market.

Regional Dynamics

- North America: The largest market, driven by high healthcare spending and robust OTC drug sales.

- Europe: Second in market size; strengthened by regulatory support and adoption of combination therapies.

- Asia-Pacific: Fastest growth rate, owing to rising allergies, urbanization, and increasing healthcare access.

Competitive Landscape

POLY HIST FORTE faces competition from both branded and generic antihistamines, including:

- Oral antihistamines: Loratadine, cetirizine, fexofenadine.

- Nasal sprays: Fluticasone, azelastine.

- Topical formulations: Cromolyn sodium.

Key players include Sanofi, Allergan, and Teva, who dominate the antihistamine market [2]. POLY HIST FORTE's unique positioning hinges on its combination formulation, providing rapid relief with fewer dosing requirements compared to monotherapies.

Market Penetration and Adoption Factors

The growth trajectory of POLY HIST FORTE hinges on multiple factors:

- Efficacy and Safety Profile: Demonstrated rapid symptomatic relief with minimal adverse effects enhances prescriber acceptance.

- Formulation and Delivery: Availability in combination forms suitable for OTC sale increases accessibility.

- Regulatory Environment: Approval in major markets like India, Southeast Asia, and Latin America influences market penetration.

- Consumer Preference: Preference for combination nasal sprays over systemic antihistamines for local symptom relief.

Price Dynamics and Projections

Historical Pricing Trends

Historically, POLY HIST FORTE has positioned as an affordable combination therapy in many developing markets, often priced below branded monotherapies. The average retail price has ranged between USD 0.15 to USD 0.30 per spray/dose, depending on geographic region and market conditions [3].

Current Pricing Factors

- Manufacturing Costs: Raw material prices for active pharmaceutical ingredients (APIs) have seen volatility, impacting costs.

- Regulatory Charges: Patent status, regional approval costs, and reformulation costs influence pricing strategies.

- Competitive Pricing: Entry or expansion of generic competition tends to drive prices downward.

Price Projection for 2023-2028

Based on current trends, regulatory developments, and market adoption patterns, the following projections are outlined:

- Short Term (2023-2024): Slight price stabilization or minor reductions (~3-5%) as generic competition intensifies.

- Medium Term (2025-2026): Potential price reductions of 8-12% driven by increased market saturation and creation of generic equivalents.

- Long Term (2027-2028): Stabilization at lower price points, potentially USD 0.10-0.20 per dose, driven by manufacturing efficiencies and competitive pressures.

An anticipated increase in demand, particularly from emerging markets, might counterbalance price declines to some extent, ensuring revenue stability for patent-holders and manufacturers.

Regulatory and Market Entry Considerations

POLY HIST FORTE's market success depends heavily on regulatory approval pathways across different regions:

- India and Southeast Asia: Streamlined approval processes for existing formulations favor rapid market expansion.

- Latin America: Regulatory harmonization efforts and OTC licensing support wider availability.

- Regulatory barriers: Stringent safety evaluations or patent litigations could impact pricing and availability.

Importantly, patent expiry or the introduction of bioequivalent generics will likely weaken pricing power over time, encouraging market competition.

Future Market Opportunities

- Formulation Innovations: Development of higher-dose, sustained-release, or preservative-free formulations.

- Digital and OTC Channels: Leveraging e-pharmacies and telehealth platforms for broader reach.

- Expanding Indications: Exploring adjunct uses in conjunctivitis or other allergic manifestations could increase market size.

Key Challenges

- Price Erosion: As generics penetrate markets, wholesale and retail prices decline.

- Market Saturation: Mature markets may show slow growth, limiting revenues.

- Regulatory Hurdles: Delays or rejections impact time-to-market and potentially inflate development costs.

Key Takeaways

- The global antihistamine market, including POLY HIST FORTE, is poised for robust growth driven by increasing allergy prevalence and regional epidemiological shifts.

- Pricing for POLY HIST FORTE is expected to trend downward, with an approximate 8-12% decline over the next three years, influenced by generic competition and manufacturing efficiencies.

- Market success relies heavily on regulatory approvals, formulation advantages, and strategic positioning within emerging markets.

- Companies should monitor regional regulatory changes and technological innovations to optimize pricing strategies and market penetration.

- Diversification into new formulations and indications can sustain revenue streams amidst fierce competition.

FAQs

-

What are the primary active ingredients in POLY HIST FORTE?

POLY HIST FORTE typically contains pheniramine and naphazoline, combining antihistaminic and vasoconstrictive effects for rapid symptom relief. -

How does the pricing of POLY HIST FORTE compare globally?

Prices are generally lower in emerging markets, ranging from USD 0.10 to 0.30 per dose, with premium pricing in developed markets due to regulatory and branding factors. -

What factors influence the future price of POLY HIST FORTE?

Regulatory approvals, patent expirations, competitive generic entries, manufacturing costs, and regional demand influence future pricing trends. -

What are the main markets for POLY HIST FORTE?

India, Southeast Asia, Latin America, and parts of Africa constitute major markets due to high allergy prevalence and regulatory pathways for combination nasal sprays. -

What growth opportunities exist for POLY HIST FORTE?

Formulation innovations, expansion into new allergy-related indications, digital sales channels, and targeted marketing in burgeoning markets present growth avenues.

References

[1] Reports and Data, "Global Allergy Therapeutics Market," 2022.

[2] Grand View Research, "Antihistamine Market Size & Share."

[3] IQVIA, "Pharmaceutical Pricing & Market Data Reports," 2022.

More… ↓