Share This Page

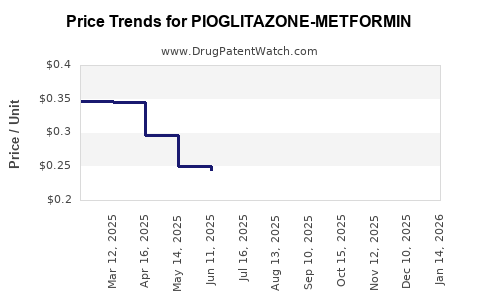

Drug Price Trends for PIOGLITAZONE-METFORMIN

✉ Email this page to a colleague

Average Pharmacy Cost for PIOGLITAZONE-METFORMIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PIOGLITAZONE-METFORMIN 15-850 | 65862-0526-60 | 0.29332 | EACH | 2025-12-17 |

| PIOGLITAZONE-METFORMIN 15-500 | 33342-0176-09 | 0.40968 | EACH | 2025-12-17 |

| PIOGLITAZONE-METFORMIN 15-500 | 33342-0176-57 | 0.40968 | EACH | 2025-12-17 |

| PIOGLITAZONE-METFORMIN 15-500 | 65862-0525-18 | 0.40968 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pioglitazone-Metformin

Introduction

Pioglitazone-Metformin, a fixed-dose combination (FDC) used primarily in managing type 2 diabetes mellitus (T2DM), continues to gain prominence amid the increasing global diabetes burden. This analysis explores the current market landscape, competitive dynamics, clinical positioning, regulatory considerations, and price projection forecasts for this combination therapy.

Market Overview

Global Diabetes Burden and Growth Drivers

The global prevalence of T2DM has surged dramatically over the past decade, with the International Diabetes Federation estimating approximately 537 million adults affected in 2021—projected to reach 643 million by 2030. Rising obesity rates, aging populations, sedentary lifestyles, and urbanization underpin this trend, fueling demand for effective oral antihyperglycemic agents.

Role of Pioglitazone-Metformin in T2DM Management

Pioglitazone and metformin are well-established oral drugs. Metformin, a cornerstone first-line agent, reduces hepatic glucose production, while pioglitazone, a thiazolidinedione, enhances insulin sensitivity. Combining these two offers synergistic glycemic control, improved patient adherence, and simplified dosing regimens.

The FDC leverages these advantages, targeting patients with suboptimal glycemic control despite monotherapy, and aligning with guidelines like ADA and EASD recommendations favoring combination therapies.

Current Market Penetration

While insulin and newer agents like SGLT2 inhibitors and GLP-1 receptor agonists command high margins, oral FDC drugs remain essential, especially in middle- and low-income countries. Existing pioglitazone-metformin formulations are marketed globally, with notable markets including North America, Europe, Asia-Pacific, and Latin America.

Competitive Landscape

Major Market Players

- Teva Pharmaceuticals: Offers branded and generic formulations.

- Macleods Pharmaceuticals: Known for affordable FDC options.

- Sun Pharmaceutical Industries

- Lupin Limited

- Cipla

Generic presence dominates in emerging markets, pressuring branded prices. Patent expiry of pioglitazone in many jurisdictions has increased biosimilar competition, further impacting pricing.

Regulatory and Patent Concerns

In 2011, the US FDA withdrew pioglitazone approval due to safety concerns, but approvals resumed after re-evaluation with updated safety data. Regulatory approvals for FDC formulations vary regionally, influencing market accessibility.

Pricing Dynamics

Factors Influencing Price

- Formulation cost: Manufacturing complexity and active pharmaceutical ingredient (API) sourcing.

- Regulatory status: Patents, exclusivity, and generic approvals.

- Market competition: Number of competitors and biosimilar availability.

- Distribution channels: Hospital-based, retail pharmacies, direct-to-consumer.

- Healthcare policies: Reimbursement landscape and pricing regulations.

Current Price Range

In mature markets, branded formulations typically range from $1.50 to $5.00 per tablet, whereas generics are priced lower, often under $1.00 per tablet in emerging markets. For instance, in India, the cost can be as low as INR 10-15 (~$0.13-$0.20) per tablet.

Market Trends Impacting Future Pricing

- Shift to Generics and Biosimilars: Patent expirations are increasing access to affordable generics, exerting downwards pressure on prices.

- Increased Adoption of Fixed-Dose Combinations: Driving volume sales and further reducing per-unit costs through manufacturing efficiencies.

- Regulatory Reforms: Price control measures in countries like India, China, and select European nations constrain maximum allowable prices.

- Emergence of Digital Health and Monitoring: May influence prescribing patterns and medication adherence, indirectly impacting demand and pricing.

Price Projection Outlook (2023-2030)

Baseline Scenario

- Emerging Markets: Continued decline in prices due to ramped-up generic competition and price regulation, forecasts suggest an annual decrease of 3-5% in unit prices for branded formulations.

- Developed Markets: Stabilization of prices with slight upward adjustments attributable to inflation and enhanced formulation features (e.g., improved bioavailability, combination patches). However, the dominance of generics caps significant price hikes.

High-Scenario

- In markets where biosimilar or innovative formulations achieve approval, prices could stabilize, or marginally increase (~2%) due to quality differentiation, regulatory exclusivity, or brand loyalty.

Low-Scenario

- Stringent pricing controls, patent challenges, or barriers to approval inhibiting new entrants might elevate prices marginally, but overall, prices are expected to trend downward over the next decade.

| Year | Estimated Price Range (per tablet) | Trend |

|---|---|---|

| 2023 | $0.50 - $1.00 (generics) | Stable/slight decrease |

| 2025 | $0.45 - $0.95 | Gradual decline |

| 2028 | $0.40 - $0.85 | Continued reduction |

| 2030 | <$0.40 | Market saturation, price stabilization |

Regulatory and Competitive Outlook

Regulatory agencies' evolving policies emphasizing affordable access will likely sustain low-price environments, especially in emerging economies. Concurrently, innovations such as fixed-dose formulations with extended-release profiles and digital integration could introduce premium options, slightly elevating prices.

Furthermore, approval of biosimilars and generics in key markets will continue to drive down prices, reducing profit margins for branded firms and potentially leading to consolidations or exit strategies.

Implications for Stakeholders

- Manufacturers: Must balance between maintaining profitability and competitive pricing, emphasizing cost reductions and operational efficiencies.

- Healthcare Providers: Favor affordable options; pricing dynamics influence prescribing patterns.

- Patients: Benefit from lower prices, increasing adherence and health outcomes.

- Regulators: Will influence market prices through policy and patent law adjustments.

Key Takeaways

- The global market for pioglitazone-metformin FDCs is expected to grow, driven by increasing diabetes prevalence.

- Competitive dynamics favor generics and biosimilars, exerting downward pressure on prices, especially in emerging markets.

- Innovative formulations and digital health integrations may mitigate some price declines, offering premium offerings.

- Regulatory policies emphasizing affordability will shape future price trajectories, with significant regional variation.

- Over the next decade, prices are projected to steadily decline, reaching below current generics' prices, promoting broader access.

Frequently Asked Questions

1. How does patent expiration influence pioglitazone-metformin pricing?

Patent expiration typically leads to a surge in generic entries, increasing competition and significantly reducing prices. In markets where patents are still active, branded formulations maintain higher price points.

2. What factors could disrupt the projected downward trend in prices?

Introduction of innovative formulations with enhanced features, supply chain disruptions, or regulatory barriers for generics may temporarily stabilize or increase prices.

3. Are biosimilars applicable to pioglitazone-metformin?

No, biosimilars pertain to biologics; pioglitazone-metformin is a small-molecule oral medication, so biosimilar designation is not applicable. However, generic formulations act as cost-effective alternatives.

4. How do regional regulations affect pricing strategies?

Countries with strict price control policies (e.g., India, China) enforce maximum retail prices, limiting variability and downward pressure, whereas markets with less regulation may see more competitive pricing.

5. What is the outlook for new combination formulations?

Future developments may include extended-release formulations, fixed-dose single tablets, or digital monitoring integrations, offering premium pricing opportunities but not fundamentally altering baseline price decline trends.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 10th Ed. 2021.

[2] American Diabetes Association. Standards of Medical Care in Diabetes—2022.

[3] MarketWatch. Global Oral Antidiabetic Drug Market Trends, 2022.

[4] IMS Health. Price Trends in Generic Diabetes Medications, 2021.

[5] European Medicines Agency. Pioglitazone Summary of Product Characteristics, 2019.

This comprehensive analysis offers a strategic view for stakeholders seeking to navigate the evolving market landscape of pioglitazone-metformin, emphasizing affordability, regulatory impact, and competitive positioning to inform informed decision-making.

More… ↓