Last updated: July 28, 2025

Introduction

Pioglitazone Hydrochloride (HCl) is an oral antidiabetic medication primarily used for the management of type 2 diabetes mellitus. It belongs to the thiazolidinedione class, functioning as an insulin sensitizer by activating peroxisome proliferator-activated receptor gamma (PPAR-γ). As a well-established drug, Pioglitazone HCl maintains a significant role in diabetes management, but market dynamics are evolving due to generic competition, regulatory shifts, and emerging therapeutic alternatives.

This analysis explores the current market landscape, key factors influencing price trends, and future projections for Pioglitazone HCl.

Market Landscape Overview

Global Demand and Consumption Trends

The global prevalence of type 2 diabetes continues to rise, with the International Diabetes Federation (IDF) estimating upward of 537 million adults affected as of 2021, projected to reach 643 million by 2030 [1]. Pioglitazone HCl remains a vital treatment option, especially in combination therapies, with increased usage in countries with a high diabetes burden such as the US, India, and China.

Despite the advent of newer antidiabetic drugs like SGLT2 inhibitors and GLP-1 receptor agonists, Pioglitazone's affordability and established efficacy sustain its demand, particularly in emerging markets where cost considerations heavily influence prescribing patterns.

Market Players and Distribution

Multiple pharmaceutical companies manufacture Pioglitazone HCl, with leading generic manufacturers dominating the market since patent expiration. Notably, Mylan, Teva, Sun Pharmaceutical Industries, and Cipla are prominent suppliers supplying both branded and generic versions globally [2].

Distribution channels primarily include retail pharmacies, hospital formularies, and direct procurement by healthcare providers. In some markets, especially low-to-middle-income economies, Pioglitazone HCl is integrated into fixed-dose combination (FDC) products, further expanding its market reach.

Regulatory Landscape

Regulatory authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have reviewed Pioglitazone's safety profile, including concerns about potential links to bladder cancer and cardiovascular risks [3]. While these concerns prompted label warnings and monitoring recommendations, existing approvals continue, supporting ongoing market availability.

In some regions, regulatory restrictions have led to increased scrutiny and, occasionally, supply disruptions, influencing market stability and pricing.

Pricing Dynamics and Influencing Factors

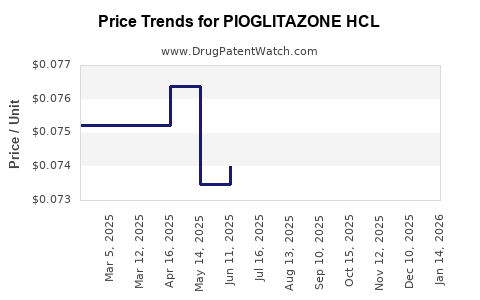

Historical Price Trends

Since patent expiration, Pioglitazone HCl's prices have markedly decreased, aligning with typical generic market behaviors. In the US, the average retail price for a standard 30-day supply of branded Pioglitazone (Actos) was approximately $150 in the early 2010s, which declined to roughly $30-50 for generic versions by 2022 [4].

Similarly, in India, the per-unit cost is significantly lower, often below $1, driven by local manufacturing and aggressive generic competition.

Factors Affecting Price Fluctuations

- Generic Competition: Market entry of multiple manufacturers has sustained downward pressure on prices, leading to high affordability in many markets.

- Regulatory Restrictions: Safety concerns and label updates can temporarily impact demand, influencing pricing strategies.

- Manufacturing Costs: Variations in raw material prices, manufacturing efficiencies, and scale of production can affect wholesale and retail prices.

- Supply Chain Dynamics: Disruptions due to geopolitical issues, pandemics, or regulatory hurdles can cause price volatility.

- Market Penetration and Prescribing Patterns: Increased adoption in tier-2 and tier-3 markets and inclusion in formularies bolster demand stability.

Future Pricing Trends

Given the intense competition among generics, prices are expected to stabilize at low levels, with marginal fluctuations driven by inflationary pressures, regulatory environment, and supply chain stability.

In developed markets, with insurance coverage and formulary inclusion, retail prices for branded Pioglitazone are likely to remain higher but with limited growth. Conversely, in emerging economies, low manufacturing costs and high volumes will sustain low-price points.

Projections for 2023-2030

Short-term Projections (2023-2025)

- Market Size Stability: The global Pioglitazone HCl market will largely stabilize, with incremental growth driven by increasing diabetes prevalence.

- Pricing Stability: Wholesale and retail prices are forecasted to remain low, with minor adjustments for inflation and regulatory impacts.

- Supply Chain Resilience: Minimal disruptions anticipated; however, geopolitical factors may introduce localized price variability.

Mid to Long-term Outlook (2026-2030)

- Market Resilience: Sustained demand driven by diabetes management in emerging markets.

- Price Trends: Continued price compression, with generics maintaining dominant market share.

- Potential Influences: Introduction of biosimilar molecules or new chemical entities could marginally shift market share, but Pioglitazone's role is expected to consolidate due to cost advantages.

Key Drivers and Barriers

Drivers

- Increasing global diabetes burden.

- Cost-effectiveness of generic Pioglitazone HCl.

- Inclusion in treatment guidelines for certain patient populations.

- Growing healthcare infrastructure in developing nations.

Barriers

- Safety concerns leading to regulatory restrictions.

- Competition from newer, preferred antidiabetic agents.

- Perception of side effect profile limiting prescribing.

Strategic Implications for Stakeholders

- Manufacturers: Focus on cost-efficient production to sustain profitability amidst price erosion.

- Healthcare Providers: Balance treatment efficacy and safety, especially considering the regulatory environment.

- Regulators: Continue monitoring safety data to inform policies that stabilize the market and protect patients.

- Investors: Anticipate limited growth in pricing but sustained revenue due to continuing demand; explore regional market expansions.

Key Takeaways

- Market stability: The Pioglitazone HCl market is characterized by high generic competition, leading to low and stable prices globally.

- Demand drivers: The persistent rise in type 2 diabetes prevalence sustains a steady demand, especially in emerging markets.

- Pricing outlook: Prices are expected to remain low through 2030, with marginal fluctuations due to supply chain, regulatory, and market factors.

- Strategic focus: Stakeholders should prioritize cost optimization, regulatory compliance, and regional market expansion to maximize profitability.

- Competitive landscape: The dominance of generics ensures that innovation has limited impact, emphasizing efficiency and regulatory agility.

FAQs

1. Will Pioglitazone HCl's price increase due to future regulatory restrictions?

Unlikely. Regulatory concerns have historically led to cautious prescribing rather than significant price hikes. Price increases are more driven by supply constraints than regulatory actions.

2. How does the safety profile affect the market outlook for Pioglitazone HCl?

Safety concerns, such as potential links to bladder cancer, have resulted in label warnings. This may limit prescribing in certain regions but has not eliminated demand, especially where alternative therapies are cost-prohibitive.

3. Are there opportunities for premium pricing in developed markets?

Limited. The presence of low-cost generics constrains premium pricing unless new formulations or combination therapies offering added benefits are introduced.

4. How does the rise of new antidiabetic drugs influence Pioglitazone's market share?

Newer agents with improved safety profiles and additional benefits are gradually replacing Pioglitazone in some markets. However, cost and accessibility keep Pioglitazone relevant, particularly in lower-income regions.

5. What regional factors most influence Pioglitazone HCl prices?

Local regulatory frameworks, market penetration of generics, healthcare infrastructure, and prevalence of diabetes are key regional determinants affecting pricing.

References

[1] IDF Diabetes Atlas, 9th Edition. International Diabetes Federation, 2021.

[2] IQVIA, Global Market Intelligence Reports, 2022.

[3] FDA Drug Safety Communication, 2016.

[4] GoodRx, Price Trends for Pioglitazone, 2022.