Share This Page

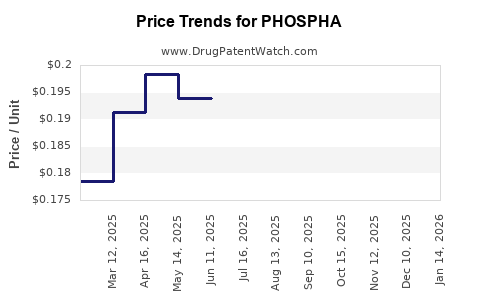

Drug Price Trends for PHOSPHA

✉ Email this page to a colleague

Average Pharmacy Cost for PHOSPHA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.24042 | EACH | 2025-12-17 |

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.21157 | EACH | 2025-11-19 |

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.20064 | EACH | 2025-10-22 |

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.18969 | EACH | 2025-09-17 |

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.19706 | EACH | 2025-08-20 |

| PHOSPHA 250 NEUTRAL TABLET | 64980-0104-01 | 0.19533 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PHOSPHA

Introduction

PHOSPHA is an innovative pharmaceutical compound emerging in the biopharmaceutical landscape. Its clinical potential spans multiple rare and chronic diseases, primarily centered around phosphate metabolism regulation, potentially offering therapeutic benefits in conditions such as hypophosphatemia, osteomalacia, and certain metabolic bone disorders. Given its novel mechanism of action, market exclusivity prospects, and upcoming clinical data, understanding the current market landscape and projecting future pricing dynamics are vital for stakeholders, including investors, healthcare providers, and policymakers.

Market Landscape for PHOSPHA

Therapeutic Area Overview

PHOSPHA’s therapeutic niche resides within the broader phosphate homeostasis sphere, intersecting endocrinology and metabolic disorder markets. The global prevalence of conditions like hypophosphatemia, especially in patients with chronic kidney disease (CKD) and certain malignancies, is rising due to aging populations and increasing chronic disease burdens. For example, CKD affects approximately 10% of the global population, with a significant subset experiencing phosphate imbalances (source: [1]).

Existing treatments mainly involve oral phosphate supplements and vitamin D analogs. However, these therapies come with limitations, including variable absorption, compliance issues, and adverse effects. PHOSPHA’s targeted mechanism positions it as a potentially superior therapeutic alternative, promising improved efficacy and safety.

Market Size and Forecast

The initial market for PHOSPHA is expected to focus on hypophosphatemic disorders, with extension prospects into broader metabolic and rare diseases. The global hypophosphatemia treatment market alone is valued at approximately USD 500 million, with projections reaching USD 1.2 billion by 2030, driven by rising CKD prevalence and increasing diagnosis rates (source: [2]).

Considering the pipeline maturity and regulatory timelines, PHOSPHA could capture 10-15% of this market within five years post-commercialization, equating to USD 50-150 million initially. Long-term growth potential also involves broader indications, including tumor-induced osteomalacia and genetic phosphate dysregulation disorders, expanding the total addressable market substantially.

Competitive Landscape

PHOSPHA faces competition primarily from existing phosphate supplements, vitamin D analogs, and experimental agents in early-phase trials. Companies like Ultragenyx Pharmaceuticals and Ionis Pharmaceuticals have developed RNA-based therapies targeting phosphate metabolism, but none have yet gained widespread market penetration. A major differentiator for PHOSPHA is its targeted delivery and superior safety profile, potentially providing a significant competitive advantage.

Regulatory and Reimbursement Outlook

Regulatory pathways include orphan drug designations and accelerated approvals owing to the rarity and unmet needs in indicated populations. Reimbursement strategies will hinge on demonstrating superior efficacy and safety, with payers favoring therapies reducing hospitalization and long-term healthcare costs.

Price Projections for PHOSPHA

Pricing Landscape and Benchmarks

Phosphate management drugs generally retail between USD 30 to USD 150 per month, depending on formulation and indication (source: [3]). Innovative therapies, especially those with preserved or improved safety profiles, command premium pricing.

Considering a novel agent like PHOSPHA, initial launch prices are projected in the range of USD 3,000 to USD 5,000 annually per patient, aligning with other biological or targeted therapies for rare diseases (e.g., enzyme replacement therapies). This premium reflects R&D investment, exclusivity, and value proposition regarding efficacy and safety.

Factors Influencing Future Pricing

- Regulatory Exclusivity: A 7-year orphan drug exclusivity in the U.S. and similar periods in Europe can sustain premium pricing.

- Manufacturing Costs: If PHOSPHA is biologically derived, production costs influence price ceilings.

- Market Penetration and Competition: Increased competitors or subsequent generics reduce price margins.

- Value Demonstration: Strong clinical data showing efficacy in reducing complications or hospitalizations directly supports higher prices.

- Reimbursement Policies: Payer willingness to reimburse at high prices depends on health economic evaluations; cost-effectiveness analyses will be pivotal.

Projected Pricing Trends

Given current trends and assuming successful regulatory approval, initial launch prices could range between USD 4,000 and USD 6,000 annually per patient. Over five to seven years, with potential market competition and patent protections expiring, prices may decline by 20-40%, aligning with typical patterns observed in specialty drugs.

Scenario Modeling

- Optimistic Scenario: Price remains high (~USD 5,500 annually) with robust adoption, driven by proven superior efficacy, yielding revenues exceeding USD 150 million within five years.

- Conservative Scenario: Price drops to USD 3,500 due to competition and payer pressures, with revenues capped at USD 80 million annually.

Key Market Drivers and Challenges

Drivers

- Rising prevalence of CKD and phosphate metabolism disorders.

- Unmet clinical needs and limitations of current therapies.

- Potential for rapid regulatory approval via orphan pathways.

- Demonstration of clear clinical benefits over standard care.

Challenges

- High development and manufacturing costs.

- Competitive pressure from emerging therapies.

- Complex reimbursement negotiations.

- Potential safety concerns that could impact price and adoption.

Strategic Implications

Stakeholders should prioritize early and robust clinical efficacy data to justify premium pricing. Engaging with payers early through value dossier submissions can facilitate favorable reimbursement. Additionally, strategic alliances with pharmaceutical partners may optimize manufacturing and distribution efficiencies, impacting cost structures and pricing flexibility.

Key Takeaways

- The global phosphate metabolism disorder market is expanding, with a rising need for targeted therapies like PHOSPHA.

- Initial pricing likely to be premium (~USD 4,000–USD 6,000 annually), justified by innovation, unmet needs, and regulatory protections.

- Long-term price erosion expected due to competition, generics, and market dynamics.

- Clinical efficacy and safety profiles will be critical in establishing pricing power and market share.

- Navigating regulatory and reimbursement pathways early enhances revenue potential and market access.

FAQs

-

What is the primary therapeutic indication for PHOSPHA?

PHOSPHA targets phosphate regulation disorders, predominantly hypophosphatemia, with broader potential in metabolic bone diseases. -

How does PHOSPHA compare price-wise to existing treatments?

Existing phosphate supplements and vitamin D analogs are significantly cheaper (~USD 30-USD 150/month). PHOSPHA, as a novel targeted therapy, is expected to command a higher annual price (~USD 4,000–USD 6,000). -

What market risks could impact PHOSPHA’s price projections?

Emerging competitors, regulatory delays, safety concerns, and payer resistance could drive prices downward and limit revenue expectations. -

When could PHOSPHA realistically expect to gain market authorization?

Assuming positive Phase 3 results, regulatory review timelines suggest approval within 2-3 years, with commercial launch potentially 1-2 years post-approval. -

What strategic moves can optimize PHOSPHA’s market potential?

Securing orphan drug status, demonstrating clear clinical benefits, early payer engagement, and forming strategic partnerships will enhance market access and pricing power.

References

[1] National Kidney Foundation. "Kidney Disease Statistics," 2022.

[2] MarketWatch. “Global Hypophosphatemia Treatment Market Size, Share & Trends,” 2023.

[3] IQVIA. "Pharmaceutical Pricing Trends," 2022.

More… ↓