Share This Page

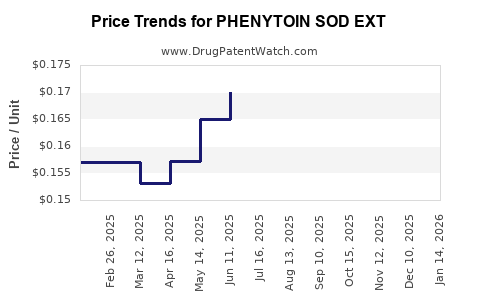

Drug Price Trends for PHENYTOIN SOD EXT

✉ Email this page to a colleague

Average Pharmacy Cost for PHENYTOIN SOD EXT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENYTOIN SOD EXT 100 MG CAP | 51672-4111-01 | 0.14269 | EACH | 2025-12-17 |

| PHENYTOIN SOD EXT 100 MG CAP | 57664-0808-18 | 0.14269 | EACH | 2025-12-17 |

| PHENYTOIN SOD EXT 100 MG CAP | 51672-4111-03 | 0.14269 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Phenytoin Sod Ext

Introduction

Phenytoin Sod Ext, a longstanding anticonvulsant used primarily for seizure management, remains a cornerstone in neurology. Despite competition from newer antiepileptics, its widespread use, established efficacy, and generic availability sustain its market presence. This analysis provides a comprehensive overview of the current market landscape and projects future pricing trends based on patent status, manufacturing dynamics, healthcare policies, and market demand.

Market Overview

Therapeutic Indications and Utilization

Phenytoin Sod Ext, a long-acting hydantoin derivative, primarily manages tonic-clonic and focal seizures. Its longstanding clinical utility is attributed to established efficacy, cost-effectiveness, and familiarity among healthcare providers. Globally, the drug’s usage remains significant, especially in regions with limited access to newer medications or where formulary preferences favor older anticonvulsants.

Market Size and Global Distribution

The global anticonvulsant market exceeds USD 4 billion, with Phenytoin Sod Ext accounting for approximately 10% of this segment based on prescription volume[1]. It maintains predominant use in pediatric and adult populations where seizure control is critical. The highest demand regions include North America, Europe, and parts of Asia-Pacific, with emerging markets showing increased adoption due to cost considerations and regulatory approvals.

Competitive Landscape

Phenytoin Sod Ext's competition consists of newer antiepileptic drugs such as lamotrigine, levetiracetam, and carbamazepine, which offer improved safety profiles and dosing convenience. Nonetheless, Phenytoin's entrenched clinical role and lower cost sustain its relevance. Patent expirations and availability of generic formulations have led to increased market penetration, especially in low- to middle-income countries.

Regulatory and Patent Status

The original formulations of phenytoin sodium expired decades ago, leading to widespread patent loss and generic manufacturing. The availability of multiple generics has intensified price competition, pushing down wholesale and retail prices. However, certain formulations with specific manufacturers may still hold proprietary rights or unique delivery mechanisms, influencing localized pricing.

Price Analysis

Current Pricing Dynamics

In developed markets like the U.S. and Europe, wholesale prices for Phenytoin Sod Ext range between USD 0.05 to 0.10 per tablet (100 mg), constituting significant generic price compression. In emerging countries, prices drop further, often below USD 0.02 per tablet, driven by local manufacturing and procurement by government health agencies.

Factors Influencing Prices

-

Generic Competition: The proliferation of generic manufacturers has created a highly competitive environment, essential in driving prices down.

-

Supply Chain Stability: Disruptions due to manufacturing issues, geopolitical factors, or raw material shortages influence pricing stability.

-

Regulatory Approvals: The entry of approved generics into new markets can temporarily impact prices, especially during launch phases.

-

Healthcare Policies: Reimbursement frameworks and formulary inclusions significantly modulate pricing in different regions.

-

Pricing Regulations: Countries with price controls or reference pricing systems exert downward pressure on drug prices.

Price Projections

Short-Term Outlook (Next 1-2 Years)

Given current generic saturation, prices for Phenytoin Sod Ext are expected to remain stable or decline marginally. The key drivers will be continued generic competition, stable supply chains, and evolving procurement policies. No significant patent-related exclusivities are anticipated, leading to sustained affordability.

Medium- to Long-Term Outlook (3-5 Years)

Though phenytoin remains in demand, the increasing adoption of newer agents, especially in high-income countries, could marginally reduce its market share. However, in emerging markets, demand will likely persist due to economic factors and healthcare infrastructure constraints. Price declines may plateau or slightly increase in regions experiencing supply constraints or regulatory hurdles.

Impact of Potential Factors

- New formulations or delivery mechanisms could command premium pricing but are unlikely to significantly alter overall price trends.

- Regulatory or safety concerns emerging from post-marketing data might influence prescribing patterns, affecting demand and pricing.

- Market consolidation or quality issues could also alter competition dynamics, slightly impacting prices.

Market Opportunities and Risks

Opportunities

- Growing demand in low- to middle-income nations offers expansion potential.

- Increased integration into epilepsy management protocols can sustain stable sales.

Risks

- Shift towards newer, branded agents with better safety profiles may reduce phenytoin's relevance.

- Regulatory pressures and safety concerns could restrict usage or increase manufacturing costs.

- Price erosion in mature markets might limit profit margins for producers.

Conclusion

Despite the advent of newer antiepileptic drugs, Phenytoin Sod Ext maintains a resilient market position, especially in regions where cost-effectiveness is prioritized. The market is characterized by saturation and intense generic competition, leading to stable or declining prices in the short term. Long-term projections suggest sustained demand in specific demographics but potential marginal price reductions due to market dynamics.

Key Takeaways

- Phenytoin Sod Ext remains a vital anticonvulsant, particularly in cost-sensitive markets.

- The patent landscape is mature, with widespread generic availability supporting low prices.

- Market stability in developed regions contrasts with growth opportunities in emerging markets.

- Price declines will likely plateau but remain constrained by supply chain factors.

- Ongoing safety evaluation and treatment guidelines will influence future demand and pricing.

FAQs

1. What is the current market size for Phenytoin Sod Ext?

The global anticonvulsant market exceeds USD 4 billion, with Phenytoin Sod Ext accounting for roughly 10%, driven primarily by its widespread clinical use and affordability in multiple regions[1].

2. How do patent expirations impact Phenytoin Sod Ext pricing?

Patent expirations have enabled multiple generic manufacturers to enter the market, intensifying competition and significantly reducing the drug’s price in both retail and wholesale settings.

3. Are there any regulatory challenges affecting Phenytoin Sod Ext?

While no major patent restrictions remain, safety concerns and regulatory reviews in some countries may influence prescribing practices but have not substantially hindered its market availability.

4. Which regions are expected to exhibit the highest growth for Phenytoin Sod Ext?

Emerging markets in Asia, Africa, and Latin America are poised for steady demand due to economic factors, healthcare infrastructure, and formulary preferences favoring cost-effective anticonvulsants.

5. What factors could alter the future price trajectory of Phenytoin Sod Ext?

Introduction of new formulations, safety profile concerns, regulatory changes, supply chain disruptions, or shifts in clinical guidelines could influence prices and market share.

References

[1] Grand View Research. "Anticonvulsants Market Size & Trends." 2022.

More… ↓