Last updated: July 27, 2025

Introduction

Phenylephrine, a selective alpha-1 adrenergic receptor agonist, is widely used as a decongestant in over-the-counter (OTC) medications and as a vasopressor in clinical settings. Its prominence in both retail consumer products and hospital formulations underscores a complex market landscape influenced by regulatory policies, manufacturing dynamics, and competitive pressures. This analysis delineates current market conditions, future price trajectories, and strategic considerations for stakeholders operating within the phenylephrine sphere.

Market Overview

Therapeutic and Commercial Applications

Phenylephrine's primary applications are in symptomatic relief of nasal congestion and in managing hypotension during anesthesia [1]. The OTC segment dominates the consumer market, with pharmaceutical companies incorporating phenylephrine into nasal sprays, oral decongestants, and combination products. In hospitals, it acts as a vasopressor for acute blood pressure support.

Regulatory Landscape

Recent regulatory debates have challenged phenylephrine’s efficacy as an oral decongestant. The U.S. Food and Drug Administration (FDA) indicates limited evidence supporting its systemic oral use due to bioavailability concerns, leading to considerations of reclassification or withdrawal from certain OTC formulations [2]. This regulatory scrutiny impacts market supply, pricing strategies, and future demand.

Manufacturing and Supply Chain Dynamics

Major players include industry giants such as Johnson & Johnson, Pfizer, and Teva Pharmaceuticals. The synthesis of phenylephrine involves complex chemical processes susceptible to raw material price fluctuations and patent constraints. Generic manufacturers leverage this to influence market pricing, while supply chain disruptions—exacerbated by geopolitical tensions or raw material shortages—pose risks to consistent production.

Market Size and Growth

Global decongestant market size was valued at approximately USD 8.2 billion in 2021, with phenylephrine accounting for a significant share [3]. The OTC segment has historically driven growth; however, recent regulatory discussions threaten continued expansion. Projections suggest a compound annual growth rate (CAGR) of around 2% through 2030, contingent on regulatory stability and consumer preferences.

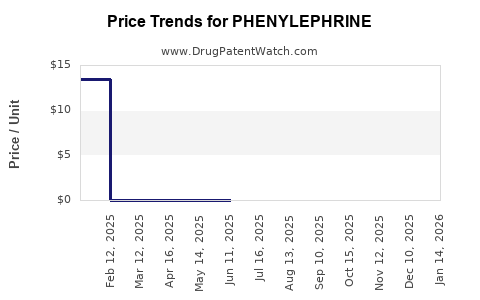

Current Price Landscape

Wholesale and Retail Pricing

As of 2023, wholesale prices for phenylephrine API range between USD 150–200 per kilogram, reflecting manufacturing complexities and raw material costs [4]. Retail prices for OTC products vary based on formulations, branding, and sales channels. A typical 30 mL nasal spray may retail at USD 5–8, while oral tablets containing phenylephrine are priced at USD 6–10 per package.

Pricing Factors

- Formulation Type: Liquid nasal sprays tend to command higher margins than oral tablets due to ease of formulation and consumer preference.

- Brand Versus Generic: Generics drive competitive pricing, often undercutting branded variants by 20–30%.

- Regulatory Status: Pending reclassification impacts pricing, with potential for increased costs if formulations require reformulation or packaging adjustments.

Price Projections and Market Dynamics

Short-term Outlook (1–3 Years)

The immediate landscape remains volatile, as regulatory agencies evaluate phenylephrine’s efficacy as an oral decongestant. Should the FDA impose restrictions or remove approval for oral formulations, manufacturers will pivot toward nasal sprays, which face less regulatory scrutiny. This shift could tighten supplies, elevate raw material demand, and potentially increase API prices by 5–10%. Retail prices for affected OTC products may also rise, reflecting increased manufacturing costs or reformulation expenses.

Conversely, persistent debates about efficacy may dampen consumer demand, leading to isotropic pricing pressures—particularly for oral formulations—if consumers lose confidence. Should regulatory authorities uphold current approvals, price stability or modest growth remains probable, supported by ongoing demand in clinical settings.

Medium to Long-term Outlook (3–10 Years)

Over the medium term, the market is poised for gradual evolution. If phenylephrine faces regulatory bans or severe restrictions in key markets like the U.S. and EU, manufacturers may redirect R&D investments toward alternative decongestants such as oxymetazoline or pseudoephedrine derivatives. This transition could precipitate an API supply glut, Plummeting prices by up to 15–20% in the coming decade.

Conversely, persistent demand for phenylephrine in clinical settings—where its efficacy remains undisputed—supports steady or slightly appreciating prices in hospital formulary segments, especially amid shortages of competing vasopressors.

Furthermore, market consolidation, patent litigation, or emerging biosynthetic methods could influence pricing premiums. Notably, advancements in synthesis technologies may reduce production costs, exerting downward pressure on API prices.

Influence of Regulatory and Competitive Factors

The regulatory environment exerts the most significant influence on price trajectories:

- Efficacy Scrutiny: Diminished demand for oral formulations could lead to surplus API supply, reducing API prices.

- Market Reclassification: Restricting OTC availability would shift supply chain dynamics, possibly increasing costs associated with pharmaceutical reformulation and distribution.

- Emergence of Alternatives: New active ingredients or delivery methods may displace phenylephrine, depressing current market prices.

In a competitive landscape, price wars among generics, in combination with supply volatility, will determine retail pricing stability, with projections favoring moderate declines in API and product prices over the medium term.

Strategic Implications for Stakeholders

- Manufacturers: Solidify supply chains, monitor regulatory developments closely, and diversify product portfolios to mitigate risks associated with phenylephrine’s regulatory uncertainties.

- Investors: Focus on companies with diversified API portfolios or advanced manufacturing platforms capable of adapting to evolving regulations.

- Regulatory Bodies: Transparent communication regarding efficacy assessments influences market confidence and pricing stability.

- Developers: Innovate in alternative delivery systems or seek novel compounds with superior efficacy to buffer against phenylephrine’s market volatility.

Key Takeaways

- Phenylephrine’s market faces potential regulatory headwinds, chiefly questioning its efficacy as an oral decongestant.

- API prices are sensitive to raw material costs, supply chain stability, and regulatory shifts—currently around USD 150–200/kg.

- Retail prices for phenylephrine-containing products are approximately USD 5–10 per unit, with future trends leaning towards modest declines or stabilization depending on regulation.

- Long-term projections indicate possible price reduction due to increased competition, supplier adjustments, or technological innovations reducing manufacturing costs.

- Stakeholders should proactively adapt to regulatory changes, diversify manufacturing bases, and explore alternative formulations or compounds.

FAQs

1. How does regulatory scrutiny impact phenylephrine’s market price?

Regulatory reviews questioning phenylephrine’s efficacy can restrict or eliminate certain formulations, leading to supply constraints and potential API price increases. Conversely, bans or restrictions may reduce market demand, exerting downward pressure on retail prices.

2. What are the main drivers influencing phenylephrine’s manufacturing costs?

Raw material prices, complex synthesis processes, supply chain stability, and regulatory compliance costs are primary drivers impacting manufacturing expenses.

3. Can phenylephrine’s market price decline significantly in the coming years?

Yes. Increased regulation, the advent of effective alternatives, and technological innovations could reduce prices by up to 20% over the next decade.

4. Are hospital formulations of phenylephrine likely to be affected by regulatory changes?

Less likely. Phenylephrine remains effective as a vasopressor in clinical settings, so hospital formulations may experience scattered pricing effects compared to OTC products.

5. How should investors approach phenylephrine-related assets?

Investors should monitor regulatory developments, assess supply chain robustness, and consider diversification into alternative active ingredients and delivery technologies.

References

- PubChem Compound Summary for Phenylephrine. (2022). National Center for Biotechnology Information.

- U.S. Food and Drug Administration. (2022). Draft Guidance on OTC Decongestants.

- MarketsandMarkets. (2022). Decongestants Market Size and Growth Forecast.

- IQVIA Institute. (2023). Pharmaceutical Market Data Reports.