Last updated: July 28, 2025

Introduction

Phendimetrazine, a sympathomimetic amine classified as an anorectic agent, is primarily prescribed for weight management in obese patients. Recognized for its appetite-suppressant properties, it is marketed in various formulations, including tablets and extended-release capsules. The drug's market dynamics are evolving amid increasing obesity rates, regulatory environments, and emerging competition from alternative therapies. This analysis provides a comprehensive overview of the current market landscape and offers price projections for Phendimetrazine over the next five years.

Market Overview

Global Market Size and Trends

The global obesity epidemic has bolstered demand for pharmacological weight management solutions. According to the World Health Organization (WHO), worldwide obesity rates have nearly tripled since 1975, with over 650 million adults classified as obese in 2016.[1] This surge has spurred growth in the appetite-suppressant drug market, including Phendimetrazine.

Phendimetrazine remains a niche, though historically popular, anti-obesity agent, primarily prescribed in the United States and some European countries. The drug is often utilized as a short-term adjunct to lifestyle modifications. Its market share is, however, influenced by regulatory controls and shifting preferences towards newer pharmacotherapies with improved safety profiles.

Regulatory and Regulatory Developments

Phendimetrazine's prescribing status is influenced by its schedule classification, typically as a controlled substance (e.g., Schedule III in the US). Regulatory agencies emphasize mitigating abuse potential, impacting formulary inclusion, prescription rates, and overall accessibility.

Recent regulatory scrutiny has led to tighter controls, especially due to concerns over stimulant-like side effects and dependence potential. The Food and Drug Administration (FDA) has historically issued warnings, which influence prescriber confidence and patient adoption.

Competitive Landscape

Phendimetrazine faces stiff competition from other weight-loss agents, including:

- Phentermine: A structurally similar anorectic with broader availability.

- Orlistat: A lipase inhibitor, favored for its safety.

- Liraglutide: A GLP-1 receptor agonist, increasingly prescribed.

- Semaglutide: Recently approved for weight management, offering significant efficacy.

The rise of these alternatives impacts Phendimetrazine's market share, especially as healthcare providers seek agents with proven safety and efficacy profiles.

Market Drivers and Challenges

Drivers

- Increasing Obesity Prevalence: Sustained growth in obesity correlates with higher demand for weight management drugs.

- Limited Pharmacotherapies: The dearth of effective short-term appetite suppressants supports continued use of agents like Phendimetrazine.

- Physician Familiarity: Long-standing use in clinical practice promotes ongoing prescribing, particularly where newer agents are cost-prohibitive.

Challenges

- Regulatory Restrictions: Stringent controls limit prescription flexibility.

- Safety Concerns: Risks of abuse and dependence curb widespread adoption.

- Emerging Competition: Novel therapies with better safety profiles are replacing older agents.

- Generic Status: As a generic, price competition among suppliers is intense, constraining profit margins.

Price Analysis and Projections

Current Pricing Landscape

Phendimetrazine is primarily available as a generic medication, which influences pricing:

- Average wholesale price (AWP): Approximate $10–$15 per 30-count tablet (50 mg strength) in the US.

- Patient out-of-pocket costs: Typically $5–$20 per prescription, depending on insurance coverage.

- Market price trends: Due to generic status, prices are relatively stable but susceptible to minor fluctuations driven by manufacturing costs and distribution logistics.

Factors Influencing Future Pricing

- Regulatory Policies: Stricter regulations could reduce prescription volumes, marginally impacting price stability.

- Manufacturing Costs: Raw material availability and regulatory compliance may influence production costs, thus affecting pricing.

- Market Competition: Entry of newer, branded agents may depress prices of existing generics as market shares shift.

- Supply Chain Dynamics: Wholesale and pharmacy supply chain efficiency contributes to price stability or volatility.

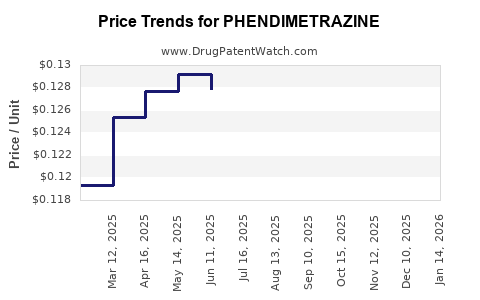

Price Projection (2023–2028)

Given current parameters, the pricing outlook suggests:

- Short-Term (2023–2025): Stable prices with minor fluctuations within a narrow range (~$10–$15 per 30-tablet pack).

- Medium-Term (2025–2028): Slight downward pressure anticipated due to increasing competition. Prices could decline by approximately 10–15%, reaching about $8–$13 per pack.

- Impact of New Therapies: If newer medications with superior safety profiles dominate the market, demand for Phendimetrazine may decline, exerting further downward pressure on prices.

Note: In niche markets, price dynamics are heavily influenced by regional regulations and healthcare policies, implying regional variations around these projections.

Future Market Outlook

Despite challenges, Phendimetrazine retains a foothold in specific clinical contexts due to its cost-effectiveness and familiarity among physicians. However, its long-term market viability is contingent upon regulatory leniency, safety profile improvements, and the evolution of obesity pharmacotherapy landscapes.

The entry of newer agents like semaglutide, which are demonstrating superior efficacy, signals a potential decline in demand. Consequently, pricing will likely trend downward, especially as generic competition intensifies.

Key Takeaways

- The global market for Phendimetrazine is driven predominantly by the increasing prevalence of obesity and limited alternatives for short-term appetite suppression.

- Regulatory constraints and safety concerns limit broader market penetration, maintaining its niche status.

- Current pricing is stable due to generic availability, with minor regional and provider-influenced variations.

- Price projections anticipate marginal declines over the next five years, aligning with increased competition and evolving therapeutic options.

- Stakeholders should monitor regulatory shifts, emerging pharmacotherapies, and patent/legal developments influencing market dynamics and pricing strategies.

FAQs

1. Is Phendimetrazine still a commonly prescribed weight-loss medication?

While historically used, its prescription rates have declined due to safety concerns and competition from newer agents like semaglutide. It remains prescribed in specific clinical contexts but is not a frontline therapy in many regions.

2. What factors could significantly alter the price of Phendimetrazine?

Major regulatory changes, patent expirations, manufacturing cost shifts, and the introduction of highly effective new treatments could all impact its market price.

3. Are there any notable safety concerns with Phendimetrazine?

Yes, due to its stimulant-like properties, concerns over dependence, abuse, and cardiovascular side effects have historically limited its use under strict regulatory control.

4. How does the regulatory environment affect Phendimetrazine's market?

Stringent scheduling and prescribing restrictions limit access, which constrains both demand and pricing flexibility.

5. Will Phendimetrazine gain renewed market interest?

Unlikely in the near term, as newer drugs with better safety and efficacy profiles tend to overshadow older appetite suppressants, although niche applications may persist.

References

[1] World Health Organization. "Obesity and Overweight." WHO Fact Sheet, 2020.