Share This Page

Drug Price Trends for PHENAZOPYRIDINE HCL

✉ Email this page to a colleague

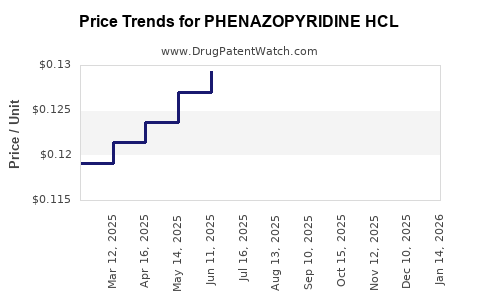

Average Pharmacy Cost for PHENAZOPYRIDINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PHENAZOPYRIDINE HCL 95 MG TAB | 00536-1411-07 | 0.12640 | EACH | 2025-12-17 |

| PHENAZOPYRIDINE HCL 95 MG TAB | 00536-1411-07 | 0.12642 | EACH | 2025-11-19 |

| PHENAZOPYRIDINE HCL 95 MG TAB | 00536-1411-07 | 0.12845 | EACH | 2025-10-22 |

| PHENAZOPYRIDINE HCL 95 MG TAB | 00536-1411-07 | 0.12899 | EACH | 2025-09-17 |

| PHENAZOPYRIDINE HCL 95 MG TAB | 00536-1411-07 | 0.12883 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Phenazopyridine HCl

Introduction

Phenazopyridine hydrochloride (HCl) is a widely used urinary analgesic, primarily prescribed to alleviate pain, burning, urgency, and discomfort associated with urinary tract infections (UTIs). While not an antibiotic, it provides symptomatic relief during antimicrobial therapy. The drug's market landscape is influenced by factors such as clinical demand, manufacturing dynamics, regulatory environment, competition, and global healthcare trends. This article offers a detailed analysis of the phenazopyridine HCl market, including current trends, supply chain considerations, regulatory hurdles, and forward-looking price projections.

Current Market Landscape

Global Demand and Market Size

Phenazopyridine HCl remains a staple in symptomatic UTI treatment in both developed and developing nations. Its widespread use in outpatient settings and over-the-counter (OTC) availability in certain regions contribute to consistent demand. According to market research, the global urinary analgesics market, which includes phenazopyridine, was valued at approximately $300 million in 2022 and is projected to grow at a CAGR of around 4–5% over the next five years[1].

The United States dominates the market due to high healthcare spending, with phenazopyridine available as both prescription and OTC formulations. Emerging markets in Asia-Pacific and Latin America are experiencing increased adoption driven by expanding healthcare coverage and rising UTI prevalence.

Key Market Players

Major manufacturing companies include:

- Akorn, Inc.

- Mylan (now part of Viatris)

- Glenmark Pharmaceuticals

- Sun Pharmaceutical Industries

- Aurobindo Pharma

- Generics and regional players also dominate local markets, with varying degrees of market share.

Patent protections are largely expired for phenazopyridine, shifting the market towards generic formulations, which influences price competition and manufacturing proliferation.

Regulatory Environment

In the US, phenazopyridine is approved by the FDA both as a prescription (Rx) and OTC drug. OTC availability has increased accessibility but has also intensified competition among generic manufacturers. Regulatory standards for manufacturing quality, especially after recent US FDA inspections and quality compliance measures, influence market entry and product quality dynamics.

In contrast, in some jurisdictions, phenazopyridine faces regulatory restrictions due to concerns over side effects, manufacturing quality, or lack of formal approval, limiting certain markets’ potential.

Supply Chain and Manufacturing Dynamics

Manufacturing Sources

Most phenazopyridine HCl is produced via chemical synthesis involving the diazotization of aniline derivatives. The process requires high-quality raw materials, and suppliers of aniline and other intermediates are concentrated mainly in Asia and Europe. The global supply chain experienced disruptions during COVID-19, leading to short-term shortages and price volatility.

Manufacturing Trends

Enhanced manufacturing standards, such as compliance with cGMP (current Good Manufacturing Practice), have become pivotal, particularly for export markets. Several regional producers are scaling up capacity, driven by generics proliferation, low entry barriers post-patent expiry, and increasing global demand.

Raw Material Costs

The cost of raw materials, especially aniline derivatives and stabilizers, influences manufacturing expenses. Fluctuations in crude oil prices and raw material availability can impact the cost structure and, ultimately, product pricing.

Competitive Dynamics and Market Drivers

Generic Competition

With patent expirations, the phenazopyridine market is highly genericized, leading to intense price competition. Multiple suppliers offering identical formulations lead to downward pressure on prices. Market differentiation occurs primarily through manufacturing quality, regulatory compliance, and supply reliability.

Clinical Demand Drivers

The growth in outpatient treatment for UTIs, increasing awareness of UTI management, and OTC availability in several markets sustain steady demand. The COVID-19 pandemic highlighted the importance of OTC medications, with phenazopyridine being a key symptomatic agent.

Regional Variations

Market penetration varies significantly:

- In the US, OTC access boosts volume but limits pricing power.

- In emerging economies, prescription-based demand is higher, with local manufacturing increasing prices due to supply chain constraints.

Regulatory and Patent Landscape

While phenazopyridine's patents have long expired, regulatory barriers around quality standards, import restrictions, and label requirements continue to influence market dynamics.

Price Projections (2023-2028)

Current Price Benchmarks

- Wholesale acquisition cost (WAC): Approx. $0.05 to $0.10 per tablet for generic phenazopyridine.

- Consumer retail prices: Vary depending on formulation, packaging, and regional taxes, generally ranging from $0.20 to $0.50 per tablet OTC.

Factors Influencing Future Pricing

- Market Saturation: Increased vendor saturation causes price reduction.

- Raw Material Dynamics: Stable supplies and raw material costs support price stability; disruptions could cause volatility.

- Regulatory Changes: Tightened manufacturing standards or new approvals may raise costs temporarily.

- Demand Trends: Growing global demand in emerging markets might stabilize prices but will likely be offset by increasing competition.

Projection Overview

- 2023–2025: Prices will trend downward modestly due to intense competition, with a projected average price decline of 3–5% annually.

- 2026–2028: As supply chains stabilize and demand growth in emerging markets persists, prices are expected to plateau or slightly increase, with overall prices stabilizing around $0.07–$0.09 per tablet in wholesale terms.

Pricing Outlook in Different Markets

- United States: OTC sales pressure will keep prices low; significant discounts on bulk generic purchases are expected.

- Emerging Markets: Higher prices may persist due to regulation, import tariffs, and limited local manufacturing, potentially stabilizing around $0.10–$0.15 per tablet.

- European Union: Stringent quality standards could marginally increase manufacturing costs, leading to slightly higher prices compared to North America.

Regulatory and Economic Considerations

The regulatory environment profoundly impacts pricing. Stricter standards, such as increased quality control or licensing costs, might result in marginal price increases. Conversely, regulatory simplifications and patent expirations continue to foster price erosion through generic competition.

Additionally, economic factors like inflation, currency fluctuations, and raw material costs influence production expenses and, consequently, retail prices across regions.

Key Market Opportunities and Challenges

Opportunities

- Expansion into OTC markets in developing economies continues to be a growth vector.

- Capacity expansion and increased manufacturing efficiency may reduce costs.

- Strategic partnerships with regional distributors can enhance accessibility.

Challenges

- Price erosion due to proliferation of generics.

- Regulatory hurdles in certain countries may delay market entry.

- Fluctuations in raw material costs and supply chain vulnerabilities.

Conclusion and Strategic Insights

The phenazopyridine HCl market remains mature and highly competitive, with ongoing price declines driven by generic proliferation. The global demand will sustain moderate growth, especially in emerging markets where OTC availability expands. Manufacturers should focus on quality compliance, supply chain resilience, and regulatory navigation to maintain market share and cost efficiency.

In light of these dynamics, industry stakeholders should anticipate:

- Continued downward pressure on wholesale prices;

- Opportunities for growth in developing markets;

- Necessity for investments in manufacturing quality and supply chain robustness.

Future price stabilization appears probable beyond 2025, with wholesale prices per tablet averaging in the range of $0.07–$0.09. Strategic positioning and regulatory compliance will be vital for market participants to optimize profitability amidst evolving demand and competitive landscapes.

Key Takeaways

- Phenazopyridine HCl is a vital symptomatic treatment with stable global demand, especially in OTC markets.

- The market is dominated by generics, resulting in consistent price erosion since patent expiration.

- Supply chain resilience and regulatory standards are critical factors influencing manufacturing costs and pricing.

- Price projections indicate a gradual decline in wholesale prices through 2025, stabilizing thereafter.

- Emerging markets offer growth avenues, but local regulatory environments and market competition remain challenges.

FAQs

Q1: What factors are driving the price decline of phenazopyridine HCl?

A: The primary drivers include patent expiry leading to generic competition, increased manufacturing capacity, and market saturation. Regulatory standardization and supply chain efficiencies further contribute to downward price pressures.

Q2: How does OTC availability affect phenazopyridine pricing?

A: OTC availability increases accessibility and volume but often limits pricing power, resulting in lower retail and wholesale prices compared to prescription-only formulations.

Q3: What regional differences influence phenazopyridine market prices?

A: Developed markets like North America and Europe benefit from stricter regulations and higher demand, leading to relatively stable prices. Emerging markets face supply chain constraints and regulatory hurdles, which can elevate costs.

Q4: Are there any upcoming regulatory changes that could impact phenazopyridine pricing?

A: Potential changes include stricter manufacturing quality standards and labeling requirements in certain regions, possibly increasing compliance costs and product prices temporarily.

Q5: What opportunities exist for new entrants in the phenazopyridine market?

A: New entrants can capitalize on expanding demand in emerging markets, invest in manufacturing quality and supply chain robustness, and explore formulation innovations to differentiate their offerings.

Sources:

[1] Market Research Future, “Global Urinary Analytics Market,” 2022.

More… ↓