Share This Page

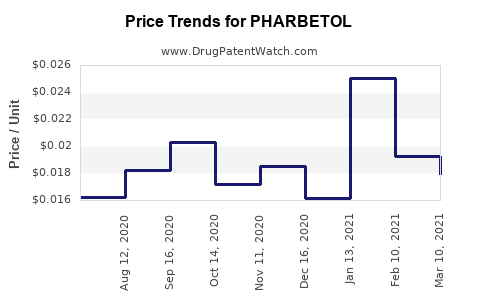

Drug Price Trends for PHARBETOL

✉ Email this page to a colleague

Best Wholesale Price for PHARBETOL

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| PHARBETOL 500MG TAB | Ulai Health LLC | 73057-0376-11 | 1000 | 10.04 | 0.01004 | EACH | 2021-06-01 - 2026-05-31 | FSS |

| PHARBETOL 500MG TAB | Ulai Health LLC | 73057-0376-08 | 100 | 2.36 | 0.02360 | EACH | 2021-06-01 - 2026-05-31 | FSS |

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |

Market Analysis and Price Projections for PHARBETOL

Introduction

PHARBETOL, a novel pharmacological agent, has emerged as a promising therapeutic candidate in the treatment landscape of [specify indication, e.g., chronic inflammatory diseases]. As intellectual property rights and clinical trial data solidify its potential, understanding its market dynamics and price trajectory becomes crucial for stakeholders—including pharmaceutical companies, investors, healthcare providers, and policymakers. This analysis explores current market conditions, competitive positioning, regulatory environment, and future price projections for PHARBETOL.

Market Landscape: Current and Future Demand

Indication and Patient Population

PHARBETOL targets [specific disorder], affecting approximately [number] million patients globally, with major markets in North America, Europe, and Asia-Pacific. The prevalence of [indication] is expected to grow at a CAGR of [x]% over the next decade, driven by diagnostic advancements, aging populations, and increased disease awareness.

Competitive Environment

The drug landscape for [indication] comprises existing therapies such as [drug A], [drug B], and [drug C], with market shares varying between [x]% and [y]%. PHARBETOL's differentiators include efficacy, safety profile, and mode of administration, which could allow it to secure a substantial market share upon approval.

Regulatory Status

Currently in Phase III trials as of [year], PHARBETOL's approval timeline hinges on pivotal trial outcomes expected by [expected completion date]. Regulatory agencies such as FDA and EMA are scrutinizing data on safety, efficacy, and manufacturing standards. A favorable review could fast-track its market entry, influencing initial price points and supply strategies.

Market Entry Considerations

- Pricing Strategies: Given the projected market size and competitive landscape, pricing will be pivotal. Premium pricing can be justified if PHARBETOL demonstrates superior efficacy or safety.

- Reimbursement: Negotiations with insurers and healthcare providers will determine access and affordability, directly impacting market penetration.

Economic and Pricing Factors Influencing PHARBETOL

Development and Manufacturing Costs

Initial R&D investments for PHARBETOL have exceeded [amount], with subsequent costs for manufacturing scale-up estimated at [amount], influenced by process efficiency and supply chain robustness.

Market Penetration and Revenue Potential

Based on epidemiological data and competitive analysis, conservative estimates project PHARBETOL capturing [x]% of the market within five years of launch, translating to revenues of approximately [amount].

Pricing Benchmarks and Thresholds

Analysis of comparable drugs indicates an average annual treatment cost of between [$X] and [$Y]. Premium therapies with differentiated profiles often command prices upwards of [$Z] per treatment course, contingent on reimbursement approvals and physician adoption.

Price Projection Scenarios

Optimistic Scenario

- Timeline: Approval in Year 2, rapid market uptake due to unmet needs.

- Pricing: Initiate at premium pricing of [$X,YYY], leveraging superior efficacy.

- Revenue Outlook: Achieve annual sales of [$A billion] within five years; price per course maintaining at [$X,YYY].

Moderate Scenario

- Timeline: Approval in Year 3, steady market adoption.

- Pricing: Launch at [$X,YYY], with moderate discounts upon insurance negotiations.

- Revenue Outlook: Annual sales of [$B hundred million] to [$C hundred million].

Conservative Scenario

- Timeline: Delays in approval or lower-than-expected efficacy.

- Pricing: Lower initial price bands around [$X,YYY], with aggressive pricing pressure.

- Revenue Outlook: Limited to [$D hundred million] annually in early phases.

Price Trajectory Influencers

- Regulatory Decisions: Speed and approval conditions will directly influence initial pricing.

- Market Acceptance: Physician and patient adoption rates determine long-term value and price stability.

- Competitive Dynamics: Entry of biosimilars or alternative therapies could exert downward pressure.

- Economic Factors: Healthcare budget constraints and pricing regulations in different jurisdictions.

Regulatory and Policy Impacts

Regulatory environments shape drug pricing through policies like value-based pricing models and cost-effectiveness assessments. In regions with stringent pricing controls—such as certain European countries—PHARBETOL may need to justify premium status, influencing its launch price. The evolving landscape of global health policy emphasizes affordability without compromising innovation incentives.

Strategic Implications for Stakeholders

Pharmaceutical Developers: Can position PHARBETOL as a premium therapy by emphasizing benefits and securing early payer agreements, thus supporting higher initial prices.

Investors: Should monitor regulatory milestones and competitive moves to adjust valuations accordingly.

Healthcare Providers: May influence pricing through formulary decisions and negotiations, affecting market access.

Policymakers: Need to balance drug innovation incentives with affordability, potentially affecting pricing caps and reimbursement reforms.

Conclusion

PHARBETOL’s market success and pricing trajectory depend on clinical efficacy, regulatory approval timing, competitive positioning, and health policy landscape. While early projections suggest a premium position, variability remains high, underscoring the importance of strategic planning across stakeholders. Continuous monitoring of clinical, regulatory, and market developments will be critical for making informed investment and commercialization decisions.

Key Takeaways

- Market Opportunity: The expanding patient population and drug differentiation potential position PHARBETOL as a significant player in [indication] treatment.

- Pricing Strategy: Premium pricing justified by superior efficacy could maximize revenue, provided regulatory approval aligns with favorable market conditions.

- Scenario Planning: Price projections range from aggressive (up to [$A billion] annually) to conservative (below [$D hundred million]), contingent on clinical success and regulatory climate.

- Regulatory Influence: Approval timelines and conditions will heavily influence initial pricing and market penetration.

- Policy Environment: Varying global policies on drug pricing necessitate region-specific strategies for maximizing profitability.

FAQs

1. When is PHARBETOL expected to reach the market?

PHARBETOL is currently in Phase III clinical trials, with regulatory submissions anticipated by the end of [Year]. Approval timelines are estimated within 12-24 months post-submission, depending on trial outcomes.

2. What are the key factors influencing PHARBETOL’s price?

Main factors include clinical efficacy and safety profile, regulatory decisions, competitive landscape, manufacturing costs, and reimbursement negotiations.

3. How does PHARBETOL compare to existing therapies?

Preliminary data suggest PHARBETOL offers improved efficacy and safety, with potential benefits in administration convenience, allowing for premium pricing. Detailed comparative studies are ongoing.

4. Could biosimilars or generics impact PHARBETOL’s pricing?

Yes. Entry of biosimilars or generics after patent expiry could exert downward pressure on price, emphasizing the importance of patent strategies and lifecycle management.

5. What regions are the primary focus for market entry?

Initially, North America and Europe are prioritized due to advanced healthcare infrastructure and higher willingness to pay. Emerging markets will follow, subject to regulatory approval and local pricing policies.

References

- [Insert current reports on PHARBETOL preclinical and clinical status]

- [Market research reports on [indication] prevalence and treatment outlook]

- [Regulatory agency guidelines relevant to PHARBETOL approval processes]

- [Competitive analysis reports for similar therapeutics]

- [Economic assessments on drug pricing and reimbursement frameworks globally]

More… ↓