Share This Page

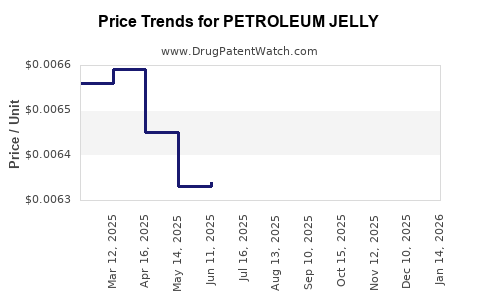

Drug Price Trends for PETROLEUM JELLY

✉ Email this page to a colleague

Average Pharmacy Cost for PETROLEUM JELLY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PETROLEUM JELLY | 70000-0487-03 | 0.01244 | GM | 2025-12-17 |

| PETROLEUM JELLY | 70000-0487-01 | 0.00669 | GM | 2025-12-17 |

| PETROLEUM JELLY | 70000-0487-03 | 0.01243 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Petroleum Jelly

Introduction

Petroleum jelly, a semi-solid mixture of hydrocarbons, has become an indispensable commodity within healthcare, personal care, and industrial sectors. Known for its moisturizing, protective, and barrier-forming properties, petroleum jelly is widely used in cosmetics, wound care, and lubricants. The global demand, supply dynamics, and pricing trends present a nuanced picture driven by regulatory standards, raw material costs, consumer preferences, and emerging substitutes. This analysis provides a comprehensive overview of the petroleum jelly market, current trends, and future price projections.

Market Overview

Global Market Size and Growth

The petroleum jelly market has demonstrated steady growth over the past decade, driven by increased consumer awareness regarding skincare, expanded applications in pharmaceuticals, and the burgeoning cosmetic industry. The global market was valued at approximately USD 1.2 billion in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2028 [1].

Emerging economies, particularly in Asia-Pacific, are experiencing heightened demand, leveraging rising disposable incomes and expanding healthcare infrastructure. The mature North American and European markets continue to exhibit stable growth, predominantly fueled by innovations in product formulations and stringent regulatory standards favoring pharmaceutical-grade products.

Segmentation and Key Applications

- Personal Care & Cosmetics: Moisturizers, lip balms, and other skincare products constitute the largest application segment.

- Pharmaceuticals: Wound care ointments and topical applications. Pharmaceutical-grade petroleum jelly must meet rigorous quality specifications, influencing cost and pricing.

- Industrial Uses: Lubricants and machinery maintenance, particularly in sectors requiring high purity standards.

Supply Chain Dynamics

Raw Material Sourcing

Petroleum jelly is derived during the refining of petroleum, specifically as a by-product of the oil refining process. The raw material costs are directly linked to crude oil prices, which are inherently volatile. Fluctuations in crude oil prices significantly influence petroleum jelly prices, given their upstream connection.

Manufacturing and Regulatory Compliance

Manufacturers must adhere to quality standards set by agencies such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other regional bodies. Transitioning to pharmaceutical-grade petroleum jelly entails higher manufacturing costs, influencing retail prices.

Distribution and Pricing Factors

Supply chain logistics and regional import-export policies also affect pricing. Regions with tariff barriers or limited refining capacity tend to see elevated costs, impacting consumer pricing.

Competitive Landscape

Major players include Unilever, Johnson & Johnson, Sebapharma, and various regional manufacturers in India and China. Market concentration remains moderate, with the top five players accounting for roughly 60% of global production. Differentiation often hinges on purity standards, packaging, and branding, rather than significant technological innovation.

Regulatory and Quality Standards Impacting Pricing

Stringent standards for medical-grade petroleum jelly result in increased quality control costs. Regulatory compliance also necessitates certifications, testing, and batch validations that add to manufacturing expenses. Increasing consumer safety awareness and regulatory oversight, particularly in pharmaceutical applications, exert upward pressure on prices.

Pricing Trends and Projections

Historical Price Trajectory

Prices of petroleum jelly have historically fluctuated between USD 2,000 and USD 3,500 per metric ton, influenced chiefly by crude oil prices, regulatory compliance costs, and demand-supply dynamics. In 2022, average prices hovered around USD 2,700 per ton, demonstrating stability despite volatility in crude markets.

Forecasting Future Prices

Several factors are likely to influence future prices:

- Crude Oil Price Volatility: Given petroleum jelly’s derivation, any fluctuations in crude oil prices (which have shown volatility due to geopolitical tensions and OPEC policies [2]) directly affect raw material costs.

- Supply Chain Disruptions: Potential disruptions—whether due to geopolitical conflicts, pandemic-related logistics issues, or regional manufacturing constraints—could tighten supply and elevate prices.

- Regulatory Stringency: As safety standards become more rigorous, manufacturing costs rise correspondingly, potentially pushing prices higher.

- Emerging Substitutes and Innovation: The rise of plant-based or synthetic alternatives may moderate demand growth, impacting long-term pricing.

Based on inflation-adjusted projections and market supply-demand assessments, petroleum jelly prices are expected to increase modestly at a CAGR of approximately 3% to 4% over the next five years. This implies an anticipated price of USD 3,200 to USD 3,600 per ton by 2028, assuming stable crude oil prices and consistent regulatory landscapes [3].

Regional Price Variations

- North America and Europe: Generally command higher prices due to stringent quality standards and higher average manufacturing costs.

- Asia-Pacific: Competitive pricing driven by large manufacturing bases, lower raw material costs, and growing domestic demand.

- Emerging Markets: Prices tend to be lower but may see upward adjustments as quality standards evolve.

Market Challenges and Opportunities

Challenges:

- Price sensitivity due to raw material volatility.

- Regulatory complexities in pharmaceutical-grade manufacturing.

- Competition from plant-based or synthetic alternatives.

Opportunities:

- Innovation in added-value formulations, such as medicated or organic variants.

- Expansion into emerging markets with increasing healthcare investments.

- Vertical integration for raw material control to stabilize costs.

Key Takeaways

- The global petroleum jelly market is poised for steady growth, primarily driven by applications in personal care and pharmaceuticals.

- Raw material costs, tied directly to crude oil prices, remain the most significant factor influencing pricing.

- Regulatory pressures elevate manufacturing costs, particularly for pharmaceutical-grade products, contributing to price increases.

- Future prices are projected to rise modestly, with an estimated CAGR of 3-4% over the next five years, reaching USD 3,200–3,600 per ton by 2028.

- Regional pricing disparities reflect differences in quality standards, manufacturing costs, and supply chain efficiencies.

FAQs

1. How does crude oil volatility influence petroleum jelly prices?

Crude oil prices directly impact raw material costs for petroleum jelly. Price surges during geopolitical disturbances or OPEC production cuts typically lead to higher petroleum jelly prices, while downturns can reduce costs.

2. Are there substitutes for petroleum jelly, and how do they affect the market?

Yes. Plant-based oils (e.g., shea butter, coconut oil) and synthetic alternatives are emerging substitutes, especially in organic and natural cosmetics. Their increasing adoption may constrain demand and influence pricing.

3. What are the key regulatory standards affecting petroleum jelly?

In the U.S., the FDA regulates medicinal petroleum jelly, requiring purity and safety standards. The European Commission mandates similar standards under Cosmetics Regulation (EC) No 1223/2009, influencing manufacturing costs and pricing.

4. Which regions are expected to see the fastest growth in petroleum jelly demand?

Asia-Pacific leads due to expanding consumer markets, increasing cosmetics and healthcare infrastructure, and rising disposable incomes. Latin America and Africa are also emerging as potential growth markets.

5. How will environmental concerns impact petroleum jelly production?

Growing environmental regulations and consumer demand for sustainable products may pressure manufacturers to source raw materials responsibly and innovate with eco-friendly alternatives, possibly affecting cost structures.

References

[1] MarketWatch, “Petroleum Jelly Market Size & Share Analysis,” 2022.

[2] OPEC Report, “Crude Oil Market Outlook,” 2022.

[3] Industry Analyst Reports, “Future Pricing Trends in Hydrocarbon-Derived Products,” 2023.

More… ↓