Share This Page

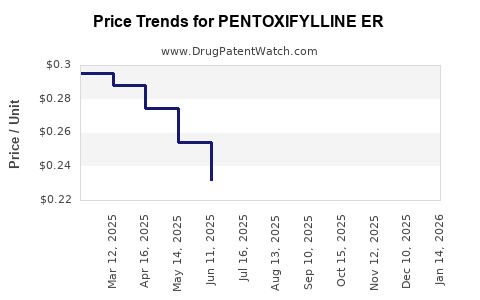

Drug Price Trends for PENTOXIFYLLINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PENTOXIFYLLINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PENTOXIFYLLINE ER 400 MG TAB | 60505-0033-06 | 0.22503 | EACH | 2025-12-17 |

| PENTOXIFYLLINE ER 400 MG TAB | 60505-0033-07 | 0.22503 | EACH | 2025-12-17 |

| PENTOXIFYLLINE ER 400 MG TAB | 16571-0856-50 | 0.22503 | EACH | 2025-12-17 |

| PENTOXIFYLLINE ER 400 MG TAB | 70954-0668-10 | 0.22503 | EACH | 2025-12-17 |

| PENTOXIFYLLINE ER 400 MG TAB | 00904-5448-61 | 0.22503 | EACH | 2025-12-17 |

| PENTOXIFYLLINE ER 400 MG TAB | 70954-0668-20 | 0.22503 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PENTOXIFYLLINE ER

Introduction

Pentoxifylline Extended Release (ER) is a methylxanthine derivative primarily used to improve blood flow and treat peripheral vascular diseases, intermittent claudication, and certain inflammatory conditions. The drug’s market outlook hinges on its clinical efficacy, regulatory status, competitive landscape, and evolving healthcare trends. This analysis provides an in-depth review of the current market dynamics and projective pricing strategies for Pentoxifylline ER.

Market Overview

Therapeutic Indications and Demand

Pentoxifylline ER's primary therapeutic application targets peripheral vascular diseases, where it enhances erythrocyte flexibility and decreases blood viscosity. According to recent epidemiological data, peripheral arterial disease (PAD) affects approximately 200 million people globally, with a significant proportion in North America, Europe, and Asia-Pacific regions [1]. The aging population and lifestyle-related risk factors such as diabetes mellitus and smoking further expand market potential.

In addition to vascular indications, recent off-label use and ongoing research suggest potential roles in managing inflammatory and fibrotic conditions, broadening its therapeutic scope. However, the primary driver remains vascular disease management.

Market Size and Growth

The global peripheral vascular disease therapeutics market was valued at around USD 2.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of approximately 5% through 2030 [2].

Pentoxifylline ER accounts for roughly 15-20% of this market segment, with its use concentrated in developed markets owing to approval status and clinical familiarity. The increasing prevalence of PAD, coupled with the growing adoption of generic formulations, supports steady market expansion.

Regulatory Status

Pentoxifylline ER is marketed under various brand names (e.g., Trental, Pentoxil) globally. In the United States, the drug is FDA-approved, primarily in immediate-release formulations, with extended-release versions available in select markets. Regulatory distinctions influence market penetration and pricing, with some regions experiencing off-label use due to clinical convenience or formulary preferences.

Competitive Landscape

Major Players and Generics

Key manufacturers include Sanofi (original patent holders), Mylan, Teva, and local generic producers. The patent expiry in many markets has led to a proliferation of generics, substantially reducing prices and increasing accessibility.

Competitive Factors

- Pricing and Reimbursement: Generics dominate due to cost advantages, pressuring branded prices.

- Formulation Innovations: ER formulations offer improved compliance, but their market share remains limited amidst generic competition.

- Clinical Evidence: Ongoing comparative studies influence prescribing patterns, notably in off-label contexts.

Price Dynamics and Projection

Current Pricing Landscape

In North America, branded Pentoxifylline ER costs approximately USD 50-70 for a 30-day supply (30 capsules, 400 mg each). Generics are available at approximately USD 10-20 for equivalent supplies, reflecting significant price erosion post-patents expiration.

In Europe and Asia, prices are generally lower, influenced by health system negotiations and local manufacturing costs. The global average retail price for generics hovers around USD 0.33-0.66 per capsule.

Factors Influencing Future Pricing

- Patent Status: Upcoming patent expirations or legal challenges may further lower prices.

- Manufacturing Costs: Advances in production, especially in low-cost countries, will sustain low pricing.

- Reimbursement Policies: Government and insurance coverage determines patient out-of-pocket costs, influencing demand.

- Formulation Premium: ER formulations could command a premium over immediate-release forms if clinical advantages are substantiated.

- Market Penetration: Increased uptake in emerging markets driven by affordability enhances volume sales.

Projected Price Trends (2023-2030)

| Year | Estimated Brand Price (USD) | Estimated Generic Price (USD) | Key Influencing Factors |

|---|---|---|---|

| 2023 | 50-70 | 10-20 | Patent expiry, cost pressures |

| 2025 | 45-65 | 8-18 | Increased generic competition |

| 2027 | 40-60 | 6-15 | Market saturation, price compression |

| 2030 | 35-55 | 5-12 | Sustained patent expiries, global volume growth |

It is expected that the premium for ER formulations will decline relative to immediate-release in competitive markets, but may retain an edge where convenience and adherence are prioritized.

Regional Analysis

North America

High awareness, advanced healthcare infrastructure, and stringent pricing pressures have led to aggressive generic pricing. Despite this, branded drugs hold a niche due to established prescribing habits.

Europe

Pricing variability exists across countries, with some nations practicing aggressive negotiation (e.g., Germany, UK), further lowering drug prices. Pharmacoeconomic assessments influence formulary inclusion.

Asia-Pacific

Emerging markets display lower prices driven by local manufacturers and government-led procurement. Market growth is robust due to expanding healthcare coverage.

Latin America and Africa

Limited penetration exists, but growth potential remains; prices are substantially lower, aligned with regional affordability.

Regulatory and Market Entry Considerations

Changes in regulatory policies, incentivizing biosimilar and generic entries, will exert downward pressure on prices. Conversely, new formulations with demonstrated clinical benefits could command premium pricing. Market entry strategies must consider patent status, local regulations, and reimbursement landscape.

Key Drivers and Challenges

- Drivers: Demographic shifts, increasing PAD prevalence, generic availability, clinical adoption of ER forms.

- Challenges: Price erosion, competition from emerging therapies, off-label use regulations, and evidence-based assessments.

Conclusion

Pentoxifylline ER's market remains influenced by patent cycles, generic proliferation, and regional healthcare policies. While current prices are dictated mainly by generic competition, strategic positioning around formulation advantages and regional market development can sustain profitability. Price projections indicate a continued decline aligned with increasing generics, but opportunities persist in expanding indications and regions.

Key Takeaways

- The global Pentoxifylline ER market is projected to grow modestly, driven by PAD prevalence and generic release.

- Current prices are predominantly dictated by generic competition, with significant downward pressure expected over the next decade.

- Premium ER formulations may sustain higher prices temporarily, especially with clinical evidence supporting improved adherence.

- Regional disparities significantly influence pricing strategies; emerging markets offer growth potential at lower prices.

- Stakeholders should monitor patent expiries, regulatory reforms, and pipeline developments to optimize market positioning.

FAQs

1. How will patent expirations affect Pentoxifylline ER pricing?

Patent expirations are likely to lead to substantial price reductions due to increased generic competition, impacting both retail and reimbursement rates.

2. Are there promising new formulations of Pentoxifylline ER on the horizon?

While several ER formulations exist, innovations aiming to improve bioavailability and adherence without significantly increasing costs are under clinical evaluation, possibly sustaining premium pricing in select markets.

3. What factors influence regional variations in Pentoxifylline ER prices?

Pricing differences stem from regulatory policies, healthcare system structures, procurement strategies, economic conditions, and the degree of generic market penetration.

4. What is the outlook for off-label use of Pentoxifylline ER?

Off-label use remains influenced by emerging clinical evidence. If validated, it could expand demand, impacting the market dynamics and potentially stabilizing prices in some regions.

5. How does the competitive landscape affect the profitability of branded Pentoxifylline ER?

Intense generic competition exerts pressure on prices and margins. Branded products need to emphasize clinical differentiation, formulation advantages, or niche indications to maintain profitability.

Sources

[1] Global Peripheral Vascular Disease Market Analysis and Forecast, 2022.

[2] Healthcare Market Insights, 2022.

[3] Regulatory Agency Publications and Market Reports (FDA, EMA).

More… ↓