Share This Page

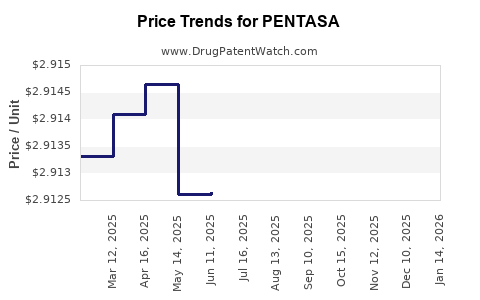

Drug Price Trends for PENTASA

✉ Email this page to a colleague

Average Pharmacy Cost for PENTASA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PENTASA 500 MG CAPSULE | 54092-0191-12 | 5.81732 | EACH | 2025-11-19 |

| PENTASA 250 MG CAPSULE | 54092-0189-81 | 2.91117 | EACH | 2025-11-19 |

| PENTASA 500 MG CAPSULE | 54092-0191-12 | 5.81483 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PENTASA (Mesalamine)

Introduction

PENTASA (mesalamine), a 5-aminosalicylic acid derivative, is a cornerstone therapy for inflammatory bowel diseases (IBD), specifically ulcerative colitis. Approved by the FDA in 1992, PENTASA’s distinctive formulation allows targeted rectal and intestinal delivery, optimizing therapeutic outcomes. As the global IBD market expands, understanding PENTASA’s market dynamics and pricing trajectory is vital for industry stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Therapeutic Landscape

Mesalamine remains a first-line agent for managing mild to moderate ulcerative colitis, with multiple formulations (oral, rectal) that cater to disease severity and location. The drug’s efficacy, favorable safety profile, and established position contribute to sustained demand. The broader IBD therapeutics market is increasingly competitive, with biologics (e.g., infliximab, adalimumab) capturing significant attention but remaining costly, thus positioning mesalamine-based therapies as cost-effective options.

Market Size and Growth

According to GlobalData and IQVIA, the global IBD therapeutics market reached approximately $12.5 billion in 2022, with mesalamine products representing a substantial share owing to their widespread use in ulcerative colitis management. The increasing prevalence of IBD—estimated at about 3 million Americans alone—predicts continued growth.

The IBD market is anticipated to expand at a compound annual growth rate (CAGR) of approximately 3-4% over the next five years. This growth stems from rising awareness, improved diagnostics, and expanding treatment indications.

Key Markets

- North America: Dominates the market due to high disease prevalence, advanced healthcare infrastructure, and reimbursement frameworks.

- Europe: Shows significant growth driven by increased diagnoses and adoption of novel formulations.

- Asia-Pacific: Rapid expansion driven by rising IBD incidence and healthcare infrastructure improvements.

Competitive Environment

PENTASA faces competition from generic mesalamine formulations, other branded products (e.g., Asacol, Lialda), and biologics reserved for refractory cases. The patent landscape, particularly the expiration of PENTASA’s primary patents, influences market positioning and pricing strategies.

Patent and Regulatory Status

PENTASA holds exclusivity until patent expirations, which vary by country. The key patent shielding PENTASA’s formulation expired in many jurisdictions around 2019-2021, leading to increased generic entry. The subsequent introduction of generics has exerted downward pressure on prices but preserved demand due to brand loyalty, formulary preferences, and slight formulation advantages.

Pricing Trends and Projections

Historical Pricing Data

- US Market: The average wholesale price (AWP) for a 60-capsule PENTASA prescription has historically ranged between $300 and $450 per cycle (30 days supply).

- Global Variations: Prices are lower in Europe and Asia due to regional pricing regulations and generic competition.

Impact of Generic Entry

Post-patent expiration, U.S. prices declined sharply, with generics reducing the retail price by approximately 50-70% within two years. Despite this, brand PENTASA maintains a niche due to physician preference and formulary placement.

Future Price Dynamics

- Core Drivers:

- Continued generic penetration will sustain downward pricing pressure.

- New formulations (extended-release, combination therapies) may command premium pricing.

- Market consolidation and negotiated payor discounts will influence net prices.

- Projection:

- Short-term (1-2 years): Prices are expected to stabilize or decline marginally (by 10-20%) due to intense generic competition.

- Mid-term (3-5 years): Further reductions possible, especially as new generics enter, but with potential price resilience if formulary exclusivity is regained through novel delivery mechanisms or combination products.

- Long-term (5+ years): Prices may plateau, stabilized by manufacturing efficiencies and volume-based growth.

Pricing in Emerging Markets

In regions like Asia-Pacific and Latin America, prices are generally lower due to regulatory price caps and healthcare spending constraints. However, increasing demand may lead to gradual price increases correlating with market maturation.

Market Drivers and Challenges

Drivers

- Rising prevalence and incidence of ulcerative colitis.

- Increased awareness and diagnosis.

- Preference for cost-effective, non-biologic therapies.

- Expansion of healthcare infrastructure facilitating access.

Challenges

- Expiration of patents leading to generic competition.

- Swelling of the biosimilar landscape affecting biologic treatments’ market share.

- Stringent reimbursement policies in various regions.

- Emergence of novel therapies, including selective JAK inhibitors and other small molecules, potentially diminishing mesalamine’s relevance in refractory cases.

Opportunities and Outlook

Market opportunities hinge on formulation innovations—such as once-daily dosing and targeted delivery systems—that could enable premium pricing despite generic competition. Collaborations with payers for formulary placement and patient adherence programs can bolster revenue streams.

The increasing focus on personalized medicine and combination therapies may also carve new niches for PENTASA, particularly if clinical research demonstrates superior outcomes.

Key Takeaways

- Market Growth: The global IBD therapeutics market, particularly mesalamine-based drugs like PENTASA, is poised for steady growth driven by rising disease prevalence.

- Pricing Trends: Post-patent expiration, prices have declined substantially in the U.S. and globally, with future reductions likely to continue due to generic competition.

- Strategic Positioning: Maintaining market share will depend on product differentiation, formulation innovation, and formulary access.

- Regional Variations: Pricing strategies must adapt to regional healthcare economics, with emerging markets offering growth potential at lower prices.

- Future Outlook: While downward price pressures persist, opportunities exist through product innovation and strategic market positioning to sustain profitability.

FAQs

1. How has the patent expiration impacted PENTASA’s pricing?

Patent expiration led to increased generic competition, resulting in significant price reductions—up to 70%—which eroded brand market share but increased overall volume sales. The brand maintains some market share through physician loyalty and formulary preferences.

2. What is the current market outlook for PENTASA?

The outlook remains cautiously optimistic, with steady demand due to its efficacy and safety. However, price pressures from generics and emerging competitors necessitate strategic innovation and cost management.

3. Are there upcoming formulations or delivery systems for PENTASA?

Research is ongoing into extended-release formulations and combination therapies that may command higher prices and improve patient adherence, representing future growth opportunities.

4. How does regional pricing affect PENTASA’s global sales?

Pricing varies considerably, with higher prices in North America and Europe, and lower prices in Asia-Pacific and Latin America. Regional regulations, reimbursement policies, and market maturity heavily influence these differences.

5. How do biologics influence PENTASA’s market?

Biologics serve refractory cases and have a different target patient profile. While biologics are more expensive, their rising use is more likely to shift patient management strategies rather than diminish PENTASA’s role in initial or mild-to-moderate UC.

Sources:

[1] GlobalData, "IBD Market Forecast," 2022.

[2] IQVIA, "Pharmaceutical Market Analysis," 2022.

[3] FDA, "PENTASA (Mesalamine) Product Label," 1992.

[4] MarketWatch, "Generic Drug Pricing Trends," 2023.

[5] European Medicines Agency, "Mesalamine Formulations," 2022.

More… ↓