Last updated: July 28, 2025

Introduction

PEGASYS (peginterferon alfa-2a) is an immunomodulatory drug developed by Hoffmann-La Roche, widely used in treating chronic hepatitis B and hepatitis C virus (HCV) infections. Since its approval in the early 2000s, PEGASYS has established a significant footprint in the antiviral therapeutic landscape. This analysis explores its current market dynamics, competitive environment, and future pricing trajectories, providing actionable insights for stakeholders.

Market Overview

1. Therapeutic Context and Market Demand

Hepatitis C remains a global health concern, with an estimated 58 million people infected worldwide [1]. PEGASYS has been a cornerstone in the standard of care, especially before direct-acting antivirals (DAAs) became predominant. While newer therapies such as ledipasvir/sofosbuvir (Harvoni) have largely displaced interferons, PEGASYS retains a niche role, particularly in resource-limited settings and special patient populations where DAAs are contraindicated or unavailable.

2. Disease Burden and Patient Population

The global HCV market's patient base has been shrinking progressively due to the high cure rates of DAAs and updated treatment guidelines. However, substantial populations, especially in low- and middle-income countries, still rely on interferon-based regimens, underpinning ongoing demand for PEGASYS. Furthermore, peginterferon applications in hepatitis B and certain malignancies contribute additional yet smaller demand segments.

Competitive Landscape

3. Existing Competitors and Market Share

The market for interferon-based therapies has diminished but remains operational. Key competitors include:

- Peginterferon Alfa-2b (e.g., Schering-Plough's PEG-Intron): Offers similar efficacy but has different pharmacokinetics.

- Other Biosimilars: Several biosimilars are entering emerging markets, potentially impacting PEGASYS's market position.

- Direct-Acting Antivirals (DAAs): Present the primary competition, with superior cure rates and shorter treatment courses.

Despite this, PEGASYS benefits from established clinician familiarity and broader regulatory approvals, particularly where licensing of other therapies is limited.

Pricing Dynamics and Projections

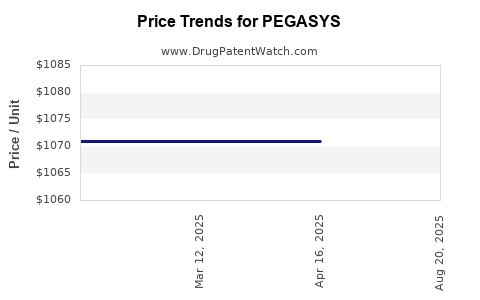

4. Current Pricing Landscape

In developed countries, PEGASYS’s treatment course cost fluctuates between $15,000 and $25,000, depending on dosage and treatment duration. For example:

- United States: Approximately $18,000–$22,000 per 48-week course [2].

- European markets: Slightly lower, often around €10,000–€15,000.

In low-income regions, prices are significantly reduced through tiered licensing and generic manufacturing, sometimes below $1,000.

5. Factors Influencing Price Trajectory

Multiple factors are poised to influence PEGASYS pricing over the next five years:

- Market Decline and Biosimilar Entry: Several biosimilars are in development or approved, especially in Asia and Europe, exerting downward pressure.

- Patent Status and Regulatory Approvals: Roche’s patent expiry for PEGASYS in key markets has occurred or is imminent, opening avenues for biosimilar entrants.

- Healthcare Policy and Reimbursement Trends: Governments and payers are prioritizing cost-effective treatments, favoring newer DAAs when available.

- Manufacturing and Distribution Costs: Advances in biopharmaceutical manufacturing could drive cost reductions, enabling more competitive pricing.

6. Price Projection Scenarios

- Baseline Scenario (Moderate Decline): As biosimilars gain market share, PEGASYS’s price may decline by 30-50% in developed markets over five years. For instance, a licensed course priced at $20,000 could fall to approximately $10,000–$14,000.

- Aggressive Biosimilar Penetration: If multiple biosimilars enter and capture significant market share, prices could decrease by up to 70%, potentially reducing a course to below $7,000.

- Niche Market Retention: In certain countries with limited biosimilar adoption, PEGASYS could retain relatively stable pricing, especially where brand loyalty endures.

Market and Revenue Forecasts

Given the anticipated decline in global HCV prevalence and increasing reliance on DAAs, PEGASYS’s overall revenue trajectory is expected to trend downward. In 2022, Roche's HCV franchise, including PEGASYS, contributed approximately $400 million worldwide. This figure could diminish by 40-60% over five years barring new indications or formulations.

In substrategies tailored to hepatitis B or oncology, PEGASYS may sustain niche revenues, but these are unlikely to offset declines from hepatitis C applications.

Regulatory and Policy Impact

Regulatory bodies are increasingly advocating for cost-effective therapies. The EU and several Asian markets have authorized biosimilar interferons, pressuring originator prices. Additionally, healthcare systems in emerging markets are adopting generic alternatives, accelerating price compression.

Furthermore, ongoing patent expirations in major markets such as the EU (expected around 2024) will facilitate biosimilar entry, further constraining pricing.

Implications for Stakeholders

-

Pharmaceutical Companies: Opportunities exist for biosimilar entrants to capture market share; originator companies like Roche must strategize around patent expiration and competitive differentiation.

-

Healthcare Providers and Payers: Cost pressures will steer formulary decisions towards lower-cost biosimilars and newer DAAs, impacting the demand for PEGASYS.

-

Investors: Long-term revenue prospects for PEGASYS are limited. Portfolio diversification into newer antiviral therapeutics and biosimilars offers strategic advantages.

Concluding Remarks

PEGASYS's future in the global antiviral market appears constrained by evolving treatment standards, patent expirations, and biosimilar competition. Price projections indicate a marked decline over the next five years, with potential reductions exceeding 50% in mature markets. The drug’s role may pivot toward niche indications or early treatment settings where DAAs are less accessible.

Key Takeaways

- The global shift towards direct-acting antivirals has reduced PEGASYS’s market share; however, demand persists in resource-limited settings.

- Patent expirations and biosimilar market entry will pressure prices downward, with reductions potentially exceeding 50% in five years.

- Pharmacoeconomic considerations favor newer, shorter-duration therapies; PEGASYS’s pricing will need to adapt to survive in competitive landscapes.

- Strategic planning for originator companies should include diversification into biosimilars and markets where PEGASYS retains relevance.

- Policymakers’ emphasis on cost-effective treatment options will influence reimbursement landscapes, further impacting PEGASYS’s pricing and utilization.

FAQs

1. What are the primary drivers behind the declining price of PEGASYS?

Market competition from biosimilars, patent expirations, shifts in treatment standards favoring DAAs, and increased emphasis on cost-effectiveness drive price reductions.

2. How does PEGASYS compare to newer hepatitis C treatments in terms of cost?

DAAs generally cost between $20,000 and $30,000 per course, but their higher cure rates and shorter durations make them more cost-effective overall, reducing the market for interferon-based therapies.

3. Are there regions where PEGASYS remains a preferred treatment?

Yes, especially in low- and middle-income countries with limited access to DAAs, where PEGASYS is still used due to affordability and availability.

4. What is the outlook for biosimilar interferons competing with PEGASYS?

Biosimilar interferons are poised to significantly reduce prices and could capture substantial market share, especially after patent expirations, impacting PEGASYS’s revenue.

5. Will PEGASYS be viable outside hepatitis C treatment?

Potentially, in indications such as hepatitis B and some oncology applications, but overall demand remains limited compared to initial hepatitis C launches.

References

[1] World Health Organization. (2022). Hepatitis C. Global health sector strategy on viral hepatitis 2022–2030.

[2] GoodRx. (2023). Cost of PEGASYS (Peginterferon Alfa-2a) treatment course.

[3] IQVIA. (2022). Global Market Insights on Hepatitis C Treatments.

[4] FDA. (2019). Approved Biosimilars and Patent Expirations.

[5] Statista. (2022). Hepatitis C treatment costs in different regions.

Disclaimer: Market conditions are subject to rapid change based on regulatory, technological, and geopolitical developments. This analysis provides a forward-looking perspective based on current data and trends.