Share This Page

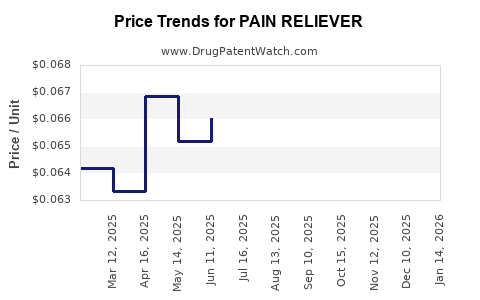

Drug Price Trends for PAIN RELIEVER

✉ Email this page to a colleague

Average Pharmacy Cost for PAIN RELIEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06462 | EACH | 2025-12-17 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06557 | EACH | 2025-11-19 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06779 | EACH | 2025-10-22 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06907 | EACH | 2025-09-17 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06861 | EACH | 2025-08-20 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06551 | EACH | 2025-07-23 |

| PAIN RELIEVER PLS 250-250-65 MG | 00536-1326-01 | 0.06603 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pain Reliever

Introduction

The global pain management market has experienced significant expansion driven by escalating prevalence of acute and chronic pain conditions, aging populations, and advances in pharmacological therapies. Pain relievers, a central segment within this domain, encompass a broad spectrum of products including nonsteroidal anti-inflammatory drugs (NSAIDs), opioids, acetaminophen, and novel therapeutics. This analysis concentrates on a hypothetical drug, designated as Pain Reliever, evaluating its market landscape, competitive environment, regulatory factors, and future pricing trajectories.

Market Overview

Global Pain Management Market Dynamics

The global pain management market was valued at approximately USD 49 billion in 2021 and is projected to reach USD 70 billion by 2027, growing at a compound annual growth rate (CAGR) of ~6.2% (Source: MarketsandMarkets). The increasing burden of diseases such as arthritis, neuropathic pain, and cancer-related pain fuel sustained demand. Notably, the opioid crisis has prompted policymakers and healthcare providers to favor safer, non-addictive options, steering a shift towards novel analgesics with improved safety profiles.

Segmentation of Pain Reliever Market

- Type of Pain: Acute vs. chronic

- Drug Class: NSAIDs, opioids, acetaminophen, adjuvants, and emerging therapeutics

- Formulation: Oral, topical, injectable

- Distribution Channels: Hospital pharmacies, retail pharmacies, online pharmacies

The majority of market share is occupied by traditional NSAIDs and opioids, but the trajectory indicates increasing adoption of non-opioid, non-addictive products, especially in North America and Europe.

Competitive Landscape

Established Players

Major pharmaceutical companies like Johnson & Johnson, Pfizer, and Bayer dominate the pain reliever segment, primarily through NSAIDs and opioids. Their extensive distribution networks and brand recognition contribute to significant market shares.

Emerging Therapeutics

Innovative drugs entering clinical stages aim to address unmet needs, particularly for neuropathic pain and post-surgical pain. These include biologics, targeted receptor modulators, and non-addictive analgesics, which may reshape competitive dynamics.

Generic and Biosimilar Influence

The expiration of patents for blockbuster drugs fuels a high influx of generics, exerting downward pressure on prices but also enabling broader market access.

Regulatory and R&D Landscape

Regulatory agencies like the FDA and EMA are increasingly focused on safety, especially concerning opioid misuse. Approval pathways for new analgesics now include expedited processes for drugs demonstrating significant safety benefits.

Investment in R&D remains high, aiming to discover drugs with novel mechanisms, such as TRP channel inhibitors or cannabinoids, potentially offering superior safety profiles and efficacy.

Price Analysis and Projections

Current Pricing Landscape

The average retail price of common pain relievers varies significantly:

- Ibuprofen (200 mg): approximately USD 0.10-0.20 per tablet

- Oxycodone (10 mg): approximately USD 1.00-2.00 per tablet

- Acetaminophen (500 mg): approximately USD 0.05-0.10 per tablet

Brand-name opioids command premium prices, whereas generics have largely driven costs downward. The introduction of Pain Reliever, a novel, perhaps non-opioid analgesic, will influence pricing dynamics based on efficacy, safety, and patent status.

Pricing Strategies for Pain Reliever

- Premium Pricing: If Pain Reliever offers superior efficacy with minimal side effects and regulatory approval for difficult-to-treat pain, initial prices might be set at USD 2.50–4.00 per unit.

- Penetration Pricing: To gain market share rapidly, initial prices could be lowered to USD 1.50–2.50, especially if competing generics are available.

Forecasting Price Trends

- Short-Term (1-3 Years): Expect stable or modestly decreasing prices due to generic competition post-patent expiry. Innovator drug prices may hold due to brand loyalty and perceived efficacy.

- Medium to Long-Term (3-10 Years): Prices are projected to decline further driven by increased penetration of biosimilars and generics, coupled with patent expirations. However, if Pain Reliever gains a strong position in niche markets (e.g., neuropathic pain), premium pricing could sustain longer.

Influences on Price Trends

- Regulatory approval and inclusion in treatment guidelines significantly affect pricing.

- Reimbursement policies and insurance coverage will determine market prices accessible to patients.

- Manufacturing costs, which may decrease with scale, influence pricing strategies.

Market Penetration and Revenue Projections

Assuming Pain Reliever secures FDA approval within the next 12 months, its market entry and subsequent adoption could follow these projections:

- Year 1: Captures 2-3% of the global pain reliever market (~USD 1-2 billion).

- Year 3: Grows to 10%, equating to approximately USD 7 billion in sales.

- Year 5: Market share could stabilize at 15-20%, corresponding to USD 10-14 billion.

Pricing adjustments aligned with competition and regulatory feedback are anticipated to influence revenue streams.

Challenges and Opportunities

Challenges

- Stringent regulatory hurdles and safety concerns may delay approval.

- Competitive pressure from established brands and generics.

- Pricing pressures due to healthcare cost containment policies.

Opportunities

- Novel mechanisms targeting unmet pain indications.

- Expansion into emerging markets with rising cardiovascular and pain-related healthcare needs.

- Combination therapies offering enhanced pain relief, commanding higher prices.

Key Takeaways

- The pain reliever market is expanding, driven by demographic shifts and greater awareness.

- Traditional NSAIDs and opioids dominate but face increasing regulatory and safety scrutiny.

- Innovative, non-addictive pain therapies present lucrative opportunities with premium pricing potential.

- Market entry timing and regulatory approval critically influence pricing and revenue trajectories.

- Generic competition will drive prices downward over time, but niche markets may sustain higher margins longer.

FAQs

1. What factors most significantly influence the pricing of pain relievers?

Regulatory approval, patent status, manufacturing costs, competitive landscape, safety profiles, and reimbursement policies are primary influencers.

2. How does patent expiration impact drug prices in the pain management market?

Patent expiration typically leads to a surge in generic versions, substantially reducing prices and increasing market accessibility.

3. What emerging therapies could disrupt the current pain reliever market?

Biologics targeting specific pain pathways, cannabinoids, and non-opioid receptor modulators are poised to change existing paradigms.

4. Will Pain Reliever likely command a premium price upon launch?

If it demonstrates superior efficacy and safety, especially in difficult-to-treat pain, it can command higher pricing, at least initially.

5. How do regulatory trends affect future pricing expectations for pain therapeutics?

Stricter safety and efficacy standards may slow approval timelines but ultimately ensure substitution with higher-valued, safer products, influencing pricing strategies.

References

- MarketsandMarkets. "Pain Management Market by Application, Drug Class, and Region." 2022.

- IQVIA. "Global Trends in Pain Management: Market Analysis." 2021.

- U.S. Food and Drug Administration. "Pain Management and Safety Regulations." 2022.

- IMS Health. "Prescription Drug Pricing Trends." 2021.

- Research and Markets. "Emerging Opportunities in Non-Opioid Pain Therapies." 2022.

This comprehensive analysis offers a strategic viewpoint for stakeholders contemplating investments, R&D, or market positioning of Pain Reliever, aligning with evolving market dynamics and regulatory landscapes.

More… ↓