Last updated: July 27, 2025

Introduction

Pain relief medications form a vital segment within the global pharmaceutical landscape, driven by rising prevalence of acute and chronic pain conditions worldwide. The sector encompasses a spectrum of drug classes including opioids, NSAIDs, anticonvulsants, antidepressants, and novel analgesics. This analysis offers a comprehensive view of the current market dynamics, future growth projections, and pricing trends for pain relief drugs, equipping stakeholders with strategic insights essential for investment, development, or competitive positioning.

Current Market Landscape

Market Size and Growth Trajectory

The global pain management market was valued at approximately USD 70 billion in 2022. Projections indicate a compound annual growth rate (CAGR) of 4-6% through 2030, reaching over USD 110 billion. Factors underpinning this growth include surging incidences of osteoarthritis, back pain, neuropathy, and cancer-related pain, alongside expanding awareness and healthcare access globally.

Key segments

- Opioids: Nonetheless dominant, opioids accounted for about 40% of the market share in 2022. The ongoing opioid crisis, particularly in North America, prompts regulatory constraints and diminishes growth potential.

- NSAIDs and Coxibs: These non-steroidal anti-inflammatory drugs comprise roughly 25%, widely prescribed for arthritis and musculoskeletal conditions.

- Adjuvant Analgesics: Including anticonvulsants (gabapentin, pregabalin) and antidepressants (amitriptyline, duloxetine), rapidly gaining share due to their efficacy in chronic neuropathic pain.

- Emerging/Novel Analgesics: Biologic agents, monoclonal antibodies targeting nerve growth factors, and non-opioid formulations reflect a promising growth frontier.

Geographical Dynamics

North America dominates the market, benefiting from high healthcare spending and a prevalence of chronic pain conditions. However, Asia-Pacific exhibits the fastest growth (projected CAGR of over 6%) driven by expanding healthcare infrastructure, aging populations, and rising awareness.

Market Drivers and Challenges

Drivers

- Increasing prevalence of chronic pain in aging populations.

- Rising adoption of minimally invasive procedures demanding effective analgesia.

- Development of novel, non-addictive pain medications.

- Regulatory incentives for research into non-opioid analgesics.

Challenges

- Stringent regulatory environment, especially concerning opioids.

- Rising scrutiny over opioid misuse and addiction.

- Cost pressures and reimbursement fluctuations impacting drug pricing.

- Patent expirations leading to generic competition and downward pricing.

Pricing Trends and Projections

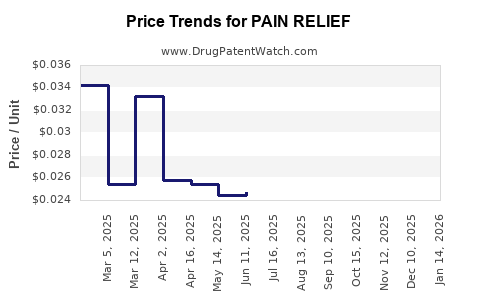

Current Pricing Landscape

- Opioids: Prices vary; oxycodone 10 mg tablet averages around USD 0.10–0.20 per dose, with generic availability exerting downward pressure.

- NSAIDs: Over-the-counter NSAIDs like ibuprofen are priced around USD 0.02–0.05 per tablet; prescription NSAIDs generally range slightly higher.

- Novel Analgesics: Monoclonal antibodies such as tanezumab (NGF inhibitor) are anticipated to be priced between USD 1,000–2,000 per dose, reflecting their biological complexity and R&D costs.

Future Price Dynamics

- Genericization: As patents expire, increasing generic penetration is projected to reduce drug prices by 30-50% within 3-5 years, intensifying market competition.

- Innovative Therapies: Expect incremental pricing, often justified by superior efficacy and reduced side effects; biologics could command prices upwards of USD 10,000 annually.

- Regulatory Impact: Policies favoring non-addictive pain medications could incentivize premium pricing strategies for breakthrough drugs.

Market Outlook and Price Projection Framework

| Year |

Estimated Market Size (USD Billion) |

Key Pricing Trends |

Notable Market Shifts |

| 2023 |

70 |

Prices stabilizing; generic growth continues |

Increased focus on non-opioid therapies |

| 2025 |

85 |

Prices for biologics stable or rising |

Launch of novel biologic agents |

| 2027 |

100 |

Potential price reductions for generics |

Regulatory emphasis on safety |

| 2030 |

110+ |

Strategic pricing for premium therapies |

Expansion in Asia-Pacific markets |

Implications for Stakeholders

- Pharmaceutical Companies: Invest in R&D for non-addictive, tailored analgesics; position for patent expiries with cost-effective generics.

- Investors: Focus on biotech firms developing biologic pain treatments offering high-margin opportunities.

- Healthcare Providers: Emphasize opioid-sparing protocols and multimodal pain management approaches.

- Policymakers: Support regulation that balances access and safety, fostering sustainable pricing models.

Conclusion

The pain relief drug market exhibits robust growth driven by demographic shifts and advances in therapeutics. Price projections indicate ongoing downward pressure on traditional drugs due to generics, while innovative biologic therapies and non-addictive formulations hold potential for premium pricing. Strategic positioning in R&D, regulatory alignment, and market access will be critical for stakeholders aiming to capitalize on future opportunities.

Key Takeaways

- The global pain management market is poised for steady growth, reaching over USD 110 billion by 2030.

- Generics will significantly suppress prices, but biologic and novel therapies will command premium pricing.

- Asia-Pacific constitutes a rapidly expanding market, offering lucrative opportunities.

- Regulatory changes, especially concerning opioids, will influence drug availability and pricing strategies.

- Innovation in non-addictive, targeted pain treatments will be a key differentiator and revenue driver.

FAQs

Q1: How will patent expirations influence the pricing of pain relief drugs?

Patent expirations typically lead to increased generic competition, driving prices down by 30-50% over 3-5 years, impacting revenue streams for innovator companies but expanding access.

Q2: Are non-opioid alternatives expected to replace traditional opioids?

While non-opioid therapies are gaining prominence due to safety concerns, opioids will continue to play a role in severe pain management, complemented by safer alternatives.

Q3: What innovative therapies are on the horizon for pain management?

Biologics targeting nerve growth factors, gene therapies, and non-pharmacologic modalities like neuromodulation are emerging, with potential for premium pricing.

Q4: How do regulatory policies impact pricing strategies?

Stricter regulations on opioids and emphasis on safety foster growth in non-addictive therapies, influencing market entry timing and premium pricing opportunities for novel drugs.

Q5: Which regions are most promising for market expansion?

Asia-Pacific's demographic shifts, infrastructural development, and increasing healthcare spending make it the most promising region for future growth and diversified pricing strategies.

Sources:

[1] MarketResearch.com, "Global Pain Management Market 2023-2030."

[2] IQVIA, "Pharmaceutical Price Trends 2023."

[3] Deloitte Insights, "Emerging Trends in Pain Management."