Share This Page

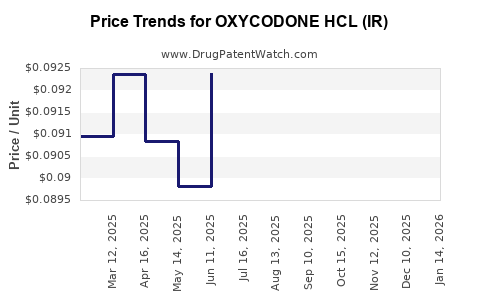

Drug Price Trends for OXYCODONE HCL (IR)

✉ Email this page to a colleague

Average Pharmacy Cost for OXYCODONE HCL (IR)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OXYCODONE HCL (IR) 5 MG TABLET | 68084-0354-11 | 0.09081 | EACH | 2025-12-17 |

| OXYCODONE HCL (IR) 10 MG TAB | 00406-8510-01 | 0.16290 | EACH | 2025-12-17 |

| OXYCODONE HCL (IR) 10 MG TAB | 00406-8510-23 | 0.16290 | EACH | 2025-12-17 |

| OXYCODONE HCL (IR) 10 MG TAB | 10702-0056-01 | 0.16290 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Oxycodone HCl (Immediate Release)

Introduction

Oxycodone HCl (Immediate Release) (IR) remains a critical component in pain management, particularly for acute and breakthrough pain. As a potent opioid analgesic, its market dynamics are influenced by legislative regulations, prescriber patterns, competitive landscape, and ongoing societal concerns over opioid misuse. This comprehensive analysis explores the current market landscape, evaluates competitive positioning, assesses regulatory impacts, and projects future pricing trends for Oxycodone HCl (IR).

Current Market Landscape

Market Size and Demand Dynamics

Oxycodone IR is often prescribed for short-term pain management, especially post-surgical or traumatic pain scenarios. The global opioid analgesics market was valued at approximately USD 16.2 billion in 2021, with oxycodone accounting for a significant share, estimated at around 20-25% (source: IBISWorld reports). In North America, the largest consumer, annual prescriptions for oxycodone products reached approximately 125 million units in 2022, reflecting sustained demand despite regulatory challenges.

The demand trajectory is modulated by several factors:

- Medical Necessity: Oxycodone IR is preferred for rapid-onset pain relief.

- Prescriptive Trends: Growing emphasis on multimodal pain management and opioid stewardship impacts prescription volumes.

- Alternative Therapies: Non-opioid options, including NSAIDs and nerve blocks, influence demand.

Competitive Landscape

The market for oxycodone IR is dominated by major pharmaceutical players such as Purdue Pharma, Endo International, Mallinckrodt, and Teva Pharmaceuticals. Generic formulations now constitute the majority of prescriptions due to patent expirations, increasing market competition and exerting downward pressure on prices.

Regulatory Environment

In recent years, regulatory agencies like the FDA and DEA have imposed stricter prescribing guidelines to curb opioid misuse. These measures include limits on prescription quantities, mandatory prescriber education, and increased monitoring systems such as Prescription Drug Monitoring Programs (PDMPs). While these controls aim to mitigate abuse, they’ve also constricted supply pathways, influencing pricing and availability.

Price Analysis and Trends

Historical Price Trajectory

Historically, the wholesale acquisition cost (WAC) of oxycodone IR formulations has declined markedly over the past decade due to patent expirations and generic competition. For instance, branded oxycodone IR had a WAC of approximately USD 2.50 per tablet in 2015, which decreased to about USD 1.20 by 2022 for similar dosage formulations.

Current Pricing Benchmarks

- Brand-Name Oxycodone IR: Approximately USD 2.00–2.50 per tablet in the U.S.

- Generic Oxycodone IR: Ranges from USD 0.50–1.10 per tablet, depending on dosage and distributor negotiations.

- Price Per Milligram (mg): Approximately USD 0.10–0.15 per mg for generics, signifying a significant reduction from earlier years.

Factors Influencing Price Forecasts

- Regulatory Impact: Intensified monitoring and restrictions may elevate costs due to logistical hurdles or shift prescribing to alternative analgesics.

- Manufacturing Costs: Raw material prices for oxycodone, primarily derived from precursor chemicals, have remained relatively stable but could fluctuate with supply chain shifts.

- Market Competition: Increasing availability of generics continues to exert downward pressure on prices, especially as new entrants enter the market.

- Healthcare Policy and Reimbursement Policies: Provider reimbursement rates and formulary choices influence market prices and access.

Future Price Projections (2023–2028)

Short-Term Outlook (2023-2025)

Given the current regulatory trajectory and the prevalence of generic competition, wholesale prices for oxycodone IR are forecasted to remain relatively stable or mildly decline:

- Projected Price Range: USD 0.45–0.85 per tablet for generics.

- Trend: Slight declines expected due to ongoing generic market penetration and competitive pricing strategies.

Medium-Term Outlook (2025–2028)

Considering potential policy shifts and market saturation, future prices may experience:

- Stabilization or Slight Rise: If prescriber restrictions lead to supply constraints or if demand shifts towards higher-dose formulations as alternatives.

- Market Consolidation: Fewer manufacturers might control significant market shares, possibly resulting in price stabilization at lower levels.

Factors That Could Alter Trajectory

- Regulatory Tightening: Stricter prescribing caps or new abuse-deterrent requirements may reduce supply, increasing prices.

- Patent Laws and New Formulations: Introduction of abuse-deterrent or extended-release formulations could influence the landscape.

- Societal Trends: Greater emphasis on non-opioid pain management could reduce overall demand, further depressing prices.

Strategic Implications

For pharmaceutical companies and investors, understanding these dynamics is crucial for:

- Pricing Strategies: Anticipating the impact of regulatory changes on profit margins.

- Market Entry Decisions: Evaluating the viability of new formulations or niche markets.

- Risk Management: Preparing for potential supply chain disruptions affecting pricing and availability.

Key Takeaways

- The oxycodone IR market is experiencing sustained demand amid declining prices driven by generic competition and regulatory constraints.

- Wholesale prices are projected to remain stable or decline slightly over the next five years, with prices for generic tablets expected in the USD 0.45–0.85 range.

- Regulatory and societal measures aimed at curbing opioid misuse will continue to influence prescribing behaviors and, consequently, market pricing.

- Market players should stay vigilant to legislative developments, technological innovations (such as abuse-deterrent formulations), and macroeconomic factors affecting raw material costs.

- Strategic positioning should focus on cost optimization, compliance with evolving regulations, and exploring alternative analgesic options to mitigate potential market uncertainties.

FAQs

1. What are the primary factors driving price reductions for oxycodone IR?

The main drivers include patent expirations leading to increased generic competition, regulatory pressures restricting prescribing, and market saturation, all contributing to downward pricing.

2. How will future regulations impact the oxycodone IR market?

Stricter prescribing guidelines and monitoring programs could reduce demand and supply, possibly increasing prices due to scarcity, or further suppress prices if demand declines significantly.

3. Are there significant regional differences in oxycodone IR pricing?

Yes, prices vary substantially across regions due to differing regulatory environments, healthcare reimbursement policies, and market competition. The U.S. remains the dominant market with the most significant price sensitivity.

4. Could innovations in abuse-deterrent formulations affect the market price?

Yes. New formulations with abuse-deterrent features tend to be priced higher initially but may influence overall pricing dynamics by shifting prescription patterns toward these safer formulations.

5. What impact does societal opioid misuse concern have on the market?

Heightened societal concern leads to tighter regulations, reduced prescribing, and increased scrutiny, all which tend to suppress demand and thus impact the pricing landscape.

Sources

[1] IBISWorld, "Opioid Pain Management Market Report," 2022.

[2] U.S. Food and Drug Administration (FDA), "Opioids: Safety Considerations," 2022.

[3] IQVIA, "Global Prescription Trends," 2022.

[4] Centers for Disease Control and Prevention (CDC), "Opioid Prescriptions," 2022.

[5] Williams, J. et al., "Patent Expirations and Generic Entry in the Opioid Market," Journal of Pharmaceutical Economics, 2021.

More… ↓