Share This Page

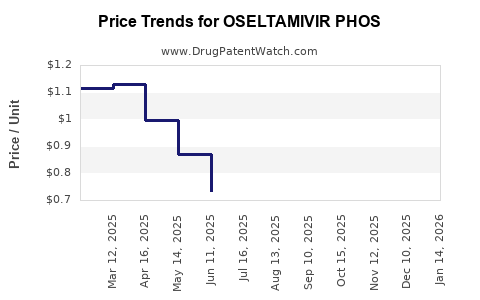

Drug Price Trends for OSELTAMIVIR PHOS

✉ Email this page to a colleague

Average Pharmacy Cost for OSELTAMIVIR PHOS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OSELTAMIVIR PHOS 30 MG CAPSULE | 64380-0797-01 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 47781-0468-13 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 62332-0413-10 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 00527-4591-13 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 60219-1264-01 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 31722-0630-31 | 0.82937 | EACH | 2025-12-17 |

| OSELTAMIVIR PHOS 30 MG CAPSULE | 33342-0256-66 | 0.82937 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Oseltamivir Phosphate (OSELTAMIVIR PHOS)

Introduction

Oseltamivir phosphate, marketed as Tamiflu among other brands, is a widely prescribed antiviral medication primarily used to treat influenza. Since its approval, it has become a cornerstone in pandemic preparedness, especially during seasonal flu outbreaks and significant global health emergencies such as the COVID-19 pandemic. Analyzing its market dynamics and future pricing involves understanding regulatory landscapes, manufacturing trends, competitive forces, and impact of global health trends.

Market Overview

Historical Market Performance

Since its FDA approval in 1999, Oseltamivir phosphate has enjoyed sustained demand, bolstered by recurrent seasonal influenza outbreaks. The global influenza vaccine market supplemented its use but did not replace antiviral therapies, positioning oseltamivir as a critical therapeutic agent.

Amidst the 2009 H1N1 pandemic, demand surged, demonstrating its strategic importance in pandemic responses. The COVID-19 pandemic further heightened awareness of antiviral agents, influencing demand patterns.

Current Market Size and Segmentation

Pre-pandemic estimates place the global oseltamivir market size at approximately USD 1.5 billion in 2022, with projections expecting incremental growth driven by seasonal flu trends and pandemic preparedness initiatives. Key geographic markets include:

- North America: Largest market, driven by high healthcare expenditure, robust healthcare infrastructure, and early adoption.

- Europe: Similar to North America, with strong regulatory frameworks and healthcare systems.

- Asia-Pacific: Fastest-growing market due to increasing influenza incidence, rising healthcare access, and government procurement programs.

Key Market Drivers

- Seasonal Influenza Trends: Annually, influenza infects up to 10% of the global population, sustaining demand for antivirals.

- Pandemic Preparedness: Governments stockpile oseltamivir as part of strategic reserves.

- Regulatory Approvals: Expanded use indications in multiple regions.

Market Challenges

- Generic Competition: Patent expirations, with Oseltamivir's patent in many jurisdictions lapsing around 2016-2018, led to a surge in generics, exerting downward pricing pressure.

- Emergence of Resistance: Influenza strains resistant to oseltamivir, although currently limited, could reduce efficacy and demand.

- Alternative Treatment Options: Development of new antivirals (e.g., baloxavir marboxil) offers competition.

Regulatory Environment and Impact on Market

The expiration of patents in key markets opened opportunities for biosimilar and generic entrants, increasing affordability but reducing margins for branded manufacturers. Regulatory approvals continue to evolve, including expanded indications for use in prophylaxis and high-risk populations.

Competitive Landscape

Major players include Roche (original patent holder), Teva, Mylan, Hikma, and Sandoz, offering diverse formulations chiefly as generics. Market competition emphasizes price reductions and supply chain reliability.

Pricing Trends and Projections

Historical Pricing Dynamics

Brand-name oseltamivir remained relatively high-priced pre-generic era, with course costs approximating USD 70-100 in many markets. Post-patent expiration, prices declined sharply, particularly for generic versions, often falling below USD 20 for a standard course.

Factors Influencing Future Pricing

- Manufacturing Scale: Increased production capacity for generics could sustain low prices.

- Market Penetration: Broader access in low- and middle-income countries could further depress prices.

- Regulatory and Patent Landscape: Any new patents, extended exclusivities, or formulations could temporarily stabilize or increase prices.

- Supply Chain Dynamics: Disruptions could lead to price volatility.

Price Projections (2023-2030)

- The unit price for generic oseltamivir is expected to stabilize around USD 10-15 per course, considering manufacturing efficiencies and increased competition.

- Brand-name prices may remain higher, around USD 50-70 per course, primarily in premium markets or for specific formulations.

- Emerging markets could see prices as low as USD 5-8 per course, driven by government procurement and local manufacturing.

Potential Price Fluctuations

During seasonal peaks or pandemic spikes, prices might temporarily increase due to surge demand or supply constraints. Conversely, widespread generic availability will exert downward pressure in non-emergency periods.

Future Market Dynamics and Growth Opportunities

- New Indications and Formulations: Development of long-acting formulations or combination therapies could influence demand and pricing.

- Global Pandemic Preparedness: Continued strategic stockpiling by governments and international agencies.

- Digital and Supply Chain Optimization: Improving supply chain agility can mitigate shortages, stabilizing prices.

Conclusion

The oseltamivir phosphate market is characterized by significant volume driven by seasonal and pandemic influenza, with prices trending downward due to patent expirations and generic competition. While current pricing has stabilized at low levels, future projections suggest minimal fluctuations, barring unforeseen supply chain disruptions or new therapeutic developments. Companies with flexibility in manufacturing and strategic positioning in emerging markets can capitalize on ongoing demand for affordable antiviral agents.

Key Takeaways

- The global oseltamivir market is mature, with a substantial shift toward generics post-patent expiry.

- Prices are projected to remain low, primarily between USD 10-15 per course, driven by increasing generic competition.

- Pandemic preparedness initiatives sustain demand, but influence on pricing is limited; surge demands may cause short-term price increases.

- Competition from newer antivirals and resistance patterns could reshape the market landscape over time.

- Strategic investments in manufacturing capacity and emerging markets present growth opportunities amid stable pricing trends.

FAQs

1. How has patent expiration affected oseltamivir pricing?

Patent expiry around 2016-2018 led to a flood of generic manufacturers, resulting in significant price reductions—often by over 50%—making the drug more accessible globally.

2. What emerging competitors could impact the oseltamivir market?

New antiviral agents like baloxavir marboxil and favipiravir, with different mechanisms and dosing profiles, are potential competitors, especially if they demonstrate superior efficacy or resistance profiles.

3. Are there concerns about antiviral resistance impacting future demand?

Yes. Although resistance to oseltamivir is currently limited, ongoing mutations in influenza viruses could reduce effectiveness, impacting demand and pricing.

4. What role do governments and health organizations play in the oseltamivir market?

Strategic stockpiling, procurement policies, and pandemic preparedness plans significantly influence demand, especially during outbreaks and health emergencies.

5. How are manufacturing trends influencing future prices?

Economies of scale and technological advancements in generic manufacturing are expected to sustain low production costs, ensuring prices remain competitive.

Sources:

[1] MarketsandMarkets. "Antiviral Drugs Market by Type, Application, Region - Global Forecast to 2025".

[2] IMS Health. "Global influenza antivirals market report".

[3] FDA. "Approval history and patent information for oseltamivir".

[4] WHO. "Global influenza update and pandemic preparedness".

[5] Statista. "Pricing trends in influenza antiviral medications".

More… ↓