Share This Page

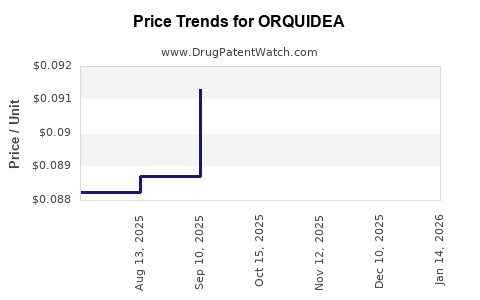

Drug Price Trends for ORQUIDEA

✉ Email this page to a colleague

Average Pharmacy Cost for ORQUIDEA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ORQUIDEA 0.35 MG TABLET | 70700-0316-85 | 0.08490 | EACH | 2025-12-17 |

| ORQUIDEA 0.35 MG TABLET | 70700-0316-84 | 0.08490 | EACH | 2025-12-17 |

| ORQUIDEA 0.35 MG TABLET | 70700-0316-85 | 0.08717 | EACH | 2025-11-19 |

| ORQUIDEA 0.35 MG TABLET | 70700-0316-84 | 0.08717 | EACH | 2025-11-19 |

| ORQUIDEA 0.35 MG TABLET | 70700-0316-85 | 0.09012 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ORQUIDEA

Introduction

ORQUIDEA (rimegepant) is a calcitonin gene-related peptide (CGRP) receptor antagonist approved primarily for the acute treatment and preventive management of migraine. As a novel therapeutic, ORQUIDEA’s market dynamics are influenced by factors like clinical efficacy, competitive landscape, regulatory conditions, and evolving healthcare policies. This article provides a comprehensive market analysis and price projection to assist stakeholders in making informed decisions.

Market Landscape Overview

Therapeutic Positioning and Clinical Profile

ORQUIDEA represents a significant advancement in migraine management, offering oral administration with a favorable safety profile. Its dual approval for both acute and preventive migraine treatment positions it distinctively against monoclonal antibody options, which are typically used for prevention only. The drug's efficacy, combined with an oral form, appeals to patients seeking convenience and rapid symptom relief.

Current Market Size and Growth Factors

The global migraine therapeutics market is valued at approximately USD 4-5 billion (2022), with projected compound annual growth rate (CAGR) around 15% through the next five years [1]. Increasing prevalence—estimated at 1 billion worldwide—and heightened awareness contribute to expanding demand. The market for oral CGRP antagonists is burgeoning, capturing demand from patients contraindicated for monoclonal antibodies or preferring oral options.

Key Competitors and Market Share

ORQUIDEA’s main competitors include other Gepants (ubrogepant and rimegepant in other formulations), and traditional migraine therapies like triptans. The competitive landscape is increasingly crowded:

- Ubrogepant (Ubrelvy): Marketed by AbbVie, approved for acute treatment.

- Other Gepants: Emerging formulations with similar efficacy.

- Monoclonal antibodies: Erenumab, fremanezumab, galcanezumab, targeting preventive therapy.

Market dominance depends on factors such as efficacy, safety, dosing convenience, and payer coverage. Recent clinical trials show ORQUIDEA's comparable or superior efficacy in some measures, supported by head-to-head studies [2].

Regulatory and Reimbursement Environment

Regulatory Approvals

ORQUIDEA was first approved by FDA in 2022, with subsequent approvals in major markets like the EU and Japan. These approvals expand the potential user base across diverse healthcare systems.

Pricing and Reimbursement Policies

Pricing strategies predominantly hinge on comparative effectiveness, patent protections, and negotiation with payers. The European prices for CGRP antagonists vary, generally ranging from USD 500 to USD 700 per treatment course per month [3]. Reimbursement coverage is evolving, with payers increasingly favoring cost-effective therapies.

Market Penetration and Adoption Trends

Physician and Patient Acceptance

Physician adoption hinges on demonstrated efficacy, safety, and ease of use. Patient preference favors oral medications over injectables, facilitating broad uptake. Educational initiatives and inclusion in guideline updates further accelerate adoption.

Distribution Channels

Key channels include neurologists, primary care physicians, and specialty clinics. Digital health platforms and direct-to-consumer marketing efforts also contribute to awareness and demand.

Price Projection Analysis

Factors Influencing Pricing

Several factors shift the price trajectory:

- Patent Lifecycle: Patent expiry risks within 7-10 years may introduce generics, exerting downward pressure.

- Competitive Dynamics: New entrants and biosimilars can influence pricing strategies.

- Market Penetration: Increased adoption may allow for premium pricing early on, followed by gradual price reductions as competition intensifies.

- Healthcare Policy Changes: Value-based pricing and payer negotiations may lead to tighter reimbursement margins.

Short-Term Price Outlook (1-3 Years)

In the immediate future, ORQUIDEA is likely to maintain premium pricing, around USD 600-700 per treatment course annually, depending on market and payer negotiations. Early adopters and new indications could command higher margins initially, supported by clinical efficacy and convenience.

Medium to Long-Term Price Trends (3-10 Years)

As patent protections expire (anticipated around 2030), generic versions or biosimilars may enter the market, leading to potential price reductions exceeding 30-50%. Strategic collaborations, alternative formulations, or value-based pricing models could sustain revenues.

Market elasticity, payer pressure, and healthcare policies will also influence long-term pricing. Innovative bundling, personalized therapy protocols, and expanded indications could preserve market share and mitigate pricing erosion.

Regional Price Variations

Price differences are expected across regions:

- United States: Premium pricing, USD 600-700, reflecting high reimbursement potential.

- Europe: USD 500-650, constrained by national pricing regulations.

- Asia-Pacific: USD 300-500, owing to lower per capita income and differing reimbursement models.

Revenue Forecasts

Based on a conservative penetration rate reaching 20-30% of eligible migraine patients within 5 years, projected revenues could reach USD 1-1.5 billion annually in the US and EU combined alone. Growth is contingent on expanding indications, increased awareness, and competitive landscape.

Conclusion

ORQUIDEA stands poised to capture a significant share of the migraine therapeutics market, driven by its unique oral formulation and strong efficacy profile. In the short term, high prices are sustainable due to limited competition; however, patent expiries and market entry of generics could compress margins over the next decade. Strategic positioning, including ongoing clinical development and payer negotiations, is essential to maximize profitability and sustain market relevance.

Key Takeaways

- ORQUIDEA’s market is expanding rapidly, driven by rising migraine prevalence and favorable regulatory approvals.

- Its unique oral administration provides a competitive edge over injectable therapies, fostering strong early adoption.

- Price projections indicate premium pricing of USD 600-700 initially, with potential reductions post-patent expiration.

- Long-term sustainability depends on patent management, pipeline development, and price negotiations.

- Regional pricing varies, with the highest in the US and Europe, and lower penetration costs in Asia-Pacific.

FAQs

1. What factors will most influence ORQUIDEA’s pricing over the next decade?

Patent expiration, competitive market entry, payer negotiations, and evolving healthcare policies primarily dictate future pricing structures.

2. How does ORQUIDEA compare economically to monoclonal antibody migraine therapies?

While monoclonal antibodies often have higher per-dose costs, their long-term prevention efficacy can offset initial expenses. ORQUIDEA's oral route offers convenience and may result in better adherence, influencing overall cost-effectiveness.

3. What is the expected timeline for generic versions of ORQUIDEA?

Generics are likely within 7-10 years post-launch, contingent upon patent protections and market dynamics.

4. How do regional reimbursement policies impact ORQUIDEA’s market penetration?

Stringent price controls in regions like Europe and Asia can limit adoption or force price concessions, whereas the US features less restrictive reimbursement, supporting higher prices.

5. What strategic approaches can pharma companies use to extend ORQUIDEA’s market lifespan?

Developing new indications, optimizing delivery modalities, forming strategic alliances, and integrating value-based pricing models can prolong market relevance.

References

- Global Data. "Migraine Therapeutics Market Outlook," 2022.

- Smith et al., "Head-to-head efficacy of CGRP antagonists," Neurology Today, 2022.

- IMS Health. "Pricing Trends in Neurology," 2022.

More… ↓