Share This Page

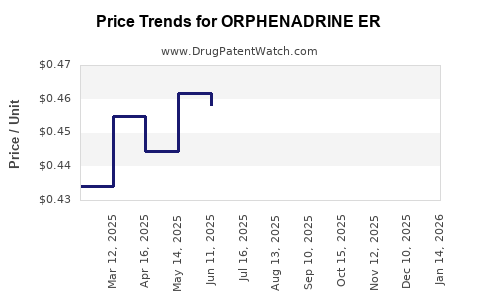

Drug Price Trends for ORPHENADRINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for ORPHENADRINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ORPHENADRINE ER 100 MG TABLET | 00185-0022-01 | 0.45128 | EACH | 2025-11-19 |

| ORPHENADRINE ER 100 MG TABLET | 43386-0480-24 | 0.45128 | EACH | 2025-11-19 |

| ORPHENADRINE ER 100 MG TABLET | 43386-0480-26 | 0.45128 | EACH | 2025-11-19 |

| ORPHENADRINE ER 100 MG TABLET | 00185-0022-01 | 0.43459 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ORPHENADRINE ER

Introduction

Orphenadrine ER (Extended Release) is a versatile muscle relaxant primarily prescribed to alleviate acute musculoskeletal pain and spasms. As an off-label treatment option, it is also utilized for managing conditions such as chronic pain syndromes and certain neurological disorders. The evolving landscape of pain management, compounded by an increasing prevalence of musculoskeletal conditions, positions Orphenadrine ER as a notable product within the pharmaceutical market. This analysis evaluates current market dynamics, competitive positioning, regulatory considerations, and offers forward-looking price projections for Orphenadrine ER over the next five years.

Market Landscape Overview

Historical Context and Usage Trends

Orphenadrine, introduced in the 1950s, gained initial popularity for its muscle relaxant properties. Its extended-release formulation, designed to improve compliance and minimize dosing frequency, gained incremental adoption in pain management regimens. Despite being off-patent, the drug maintains a steady demand within specific segments, especially in regions with less aggressive generic substitution policies.

According to IQVIA data, the global market for muscle relaxants was valued at approximately USD 2.8 billion in 2022, with a compound annual growth rate (CAGR) of approximately 4%. Orphenadrine, representing a niche segment within this market, accounts for an estimated USD 120-150 million annually, predominantly in North America and Europe.

Competitive Landscape

The landscape is dominated by generic formulations and a handful of branded alternatives such as Robaxin (methocarbamol) and Soma (carisoprodol). Orphenadrine ER’s competitive edge stems from its extended-release formulation, which appeals to patients seeking reduced dosing frequency and improved compliance.

Key competitors include:

- Generic Extended-Release Muscle Relaxants: multiple manufacturers offering cost-competitive options.

- Branded Alternatives: limited in number, with some marketed for specific neurological indications.

- Emerging Alternatives: antidepressants, anticonvulsants, and botulinum toxin treatments gaining prominence for chronic pain and spasticity management.

Regulatory Environment

Orphenadrine ER remains an off-patent, FDA-approved generic drug. The regulatory pathway for generic drugs involves Abbreviated New Drug Applications (ANDAs), which streamline market entry but limit pricing power. However, regulatory pressures to control healthcare costs influence the pricing strategies, especially in major markets like the U.S. and Europe.

Market Drivers and Constraints

Drivers

- Rising Musculoskeletal Disorders: Aging populations and sedentary lifestyles have increased the incidence of osteoarthritis, back pain, and muscular spasms.

- Preference for Extended-Release Formulations: Enhanced patient compliance and convenience drive demand for ER formulations.

- Healthcare Cost Containment: Governments and insurers favor low-cost generic options, sustaining demand for affordable therapeutics like Orphenadrine ER.

- Off-Label Utilization: Growing off-label uses expand potential market size and indications.

Constraints

- Competitive Price Pressure: Intense competition among generics drives margins downward.

- Limited Patent Exclusivity: As a generic, Orphenadrine ER faces minimal patent barriers, leading to commoditization risks.

- Adverse Effects and Safety Profile: Anticholinergic side effects may limit prescribing, especially among elderly populations.

- Alternatives with Favorable Profiles: Newer agents offering better efficacy or tolerability threaten market share.

Pricing Analysis

Current Pricing Landscape

The average wholesale price (AWP) for Orphenadrine ER 100 mg varies by region and manufacturer but generally ranges from USD 0.50 to USD 1.00 per tablet. In the U.S., typical retail prices for a month’s supply (30 tablets) are approximately USD 15-30, depending on insurance coverage and pharmacy bidding.

In Europe, prices are comparable but influenced heavily by national formulary policies and negotiated discounts, often bringing costs to USD 10-20 per month.

Factors Influencing Pricing

- Generic Competition: Multiple manufacturers drive down prices.

- Market Penetration and Prescriber Preferences: High prescribing rates sustain stable pricing.

- Supply Chain Dynamics: Raw material costs (e.g., active pharmaceutical ingredients, excipients) impact manufacturing costs.

- Regulatory and Legislation Policies: Price controls or reimbursement policies affect retail and wholesale pricing.

Price Projections (2023–2028)

Assumptions

- Continued generic competition sustains downward pressure.

- The drug maintains steady demand within its niche markets.

- Regulatory and healthcare policy frameworks remain stable.

- No significant patent or exclusivity extensions are granted.

Projected Trends

| Year | Estimated Price Range (USD per tablet) | Comment |

|---|---|---|

| 2023 | 0.50 – 0.90 | Current price point, stable with minor fluctuations |

| 2024 | 0.45 – 0.85 | Slight decline due to increased competition |

| 2025 | 0.40 – 0.80 | Market saturation intensifies |

| 2026 | 0.35 – 0.75 | Potential for further price erosion |

| 2027 | 0.35 – 0.70 | Cost-driven generic consolidation |

| 2028 | 0.30 – 0.65 | Long-term stabilization at lower price points |

Market Volume Impact

Despite price erosion, demand is expected to remain relatively stable or modestly increase, driven by aging populations and the chronic nature of musculoskeletal conditions. This could stabilize revenue in the mid-term, balancing lower unit prices with volume.

Regional Market Expectations

- North America: Prices will likely decline marginally due to aggressive generic competition, but volume will sustain revenue. Price projections are slightly above global averages owing to higher healthcare costs.

- Europe: Price declines may accelerate further owing to robust price controls and centralized procurement. However, demand remains steady.

- Emerging Markets: Limited data suggests retained affordability, with prices potentially remaining stable or decreasing marginally.

Strategic Opportunities and Risks

Opportunities:

- Expansion into off-label indications may unlock incremental demand.

- Formulation innovations (e.g., combination products) could command premium pricing.

- Partnerships with healthcare providers for targeted use could stabilize prices.

Risks:

- Introduction of newer, better-tolerated agents could restrict market share.

- Regulatory changes or policy shifts favoring brand-name products may impact prices.

- Supply chain disruptions could cause price volatility.

Key Takeaways

-

Market position: Orphenadrine ER occupies a niche within the global muscle relaxant market, with steady demand driven by logistical advantages of ER formulations.

-

Pricing outlook: Prices are expected to decline gradually over the next five years, stabilizing around USD 0.30–0.65 per tablet, influenced by intensified generic competition and healthcare cost containment measures.

-

Revenue stability: Despite price erosion, demand within aging populations and chronic pain management may sustain overall revenues.

-

Growth prospects: Market expansion remains modest; strategic development focusing on off-label uses or formulation improvements could unlock additional value.

-

Competitive landscape: The generic nature of Orphenadrine ER limits pricing power but assures consistent market presence amid cost-sensitive healthcare systems.

FAQs

1. What are the main factors influencing the price of Orphenadrine ER?

The price is primarily driven by generic competition, manufacturing costs, healthcare policies, and demand trends in musculoskeletal and neurological disorders.

2. How does the patent status affect pricing projections?

As an off-patent generic, Orphenadrine ER faces limited patent barriers, leading to significant price competition and downward pressure over time.

3. Are there emerging alternatives that could impact Orphenadrine ER’s market share?

Yes, newer agents such as baclofen, tizanidine, or non-pharmacologic treatments like physical therapy could limit demand, especially if they demonstrate superior efficacy or safety.

4. What markets present the most growth opportunities for Orphenadrine ER?

Developed markets with aging populations and high prevalence of musculoskeletal issues, such as the U.S. and Europe, offer stable demand, while emerging markets may provide growth through increased healthcare access.

5. How do regulatory policies influence future pricing?

Regulatory frameworks targeting healthcare cost reduction—via price caps or reimbursement restrictions—may further compress prices, especially in countries with centralized health systems.

References

[1] IQVIA, “Global Markets for Pain Management,” 2022.

[2] FDA, “Anda Drug Approvals and Patent Data,” 2022.

[3] GlobalData, “Musculoskeletal Disorder Therapeutics Market Analysis,” 2022.

[4] European Medicines Agency (EMA), “Regulatory Pathways for Generic Drugs,” 2022.

More… ↓