Last updated: July 27, 2025

Introduction

Orphenadrine, a centrally acting muscle relaxant and anticholinergic agent, has maintained a niche in the management of muscular pain and spasms. Though its primary indication—relief from muscle pain associated with strains and injuries—remains consistent, recent shifts in pharmaceutical regulation, patent landscapes, and market dynamics warrant a comprehensive review. This analysis offers an in-depth understanding of current market conditions and projects future pricing trends for Orphenadrine, guiding stakeholders in investment and strategic planning.

Pharmacological Profile and Market Position

Orphenadrine’s mechanism involves central nervous system activity, reducing muscle spasm and pain, with off-label applications in treating restless leg syndrome and certain neurological conditions. Patent expiry in most markets has led to increased generic competition, significantly impacting pricing and profitability.

The drug’s licensing status is largely in the generic domain. Notably, in markets like the U.S. and Europe, Orphenadrine is available OTC or via prescription as a generic product, with minimal proprietary restrictions. Its therapeutic niche, coupled with its affordability, makes it a favored option in resource-limited settings and among practitioners seeking cost-effective muscle relaxants.

Market Dynamics and Demand Drivers

1. Regulatory Landscape

The expiration of patent protection and subsequent generic proliferation have introduced price pressure and widened market access. Regulatory approval processes for generics are straightforward in key jurisdictions, facilitating entry and expanding supply.

2. Patent and Exclusivity Status

With no active patents, market incumbents have limited control over pricing. The absence of patent exclusivity results in high market competition, suppressing prices.

3. Therapeutic Use Trends

The demand for muscle relaxants continues, driven by an aging population and increasing awareness of musculoskeletal conditions. However, the rise of newer agents with improved safety profiles or novel delivery forms may marginally influence Orphenadrine’s market share.

4. Competitive Landscape

Generic manufacturers, including Teva, Mylan, and Sandoz, dominate the market, maintaining aggressive pricing strategies. Brand-name companies, lacking proprietary rights, typically struggle to command premium prices.

5. Market Penetration and Regional Variations

Developing regions exhibit higher demand owing to affordability, whereas high-income markets see limited use due to the availability of newer therapies and regulatory preferences.

Current Market Size and Revenue Estimates

Global sales of Orphenadrine are modest, estimated at approximately $50-70 million annually, predominantly driven by generic sales. North America accounts for roughly 30-40% of sales, with Europe and Asia trailing.

The market is highly fragmented, with regional price variations influenced by local healthcare policies, reimbursement systems, and competitive density.

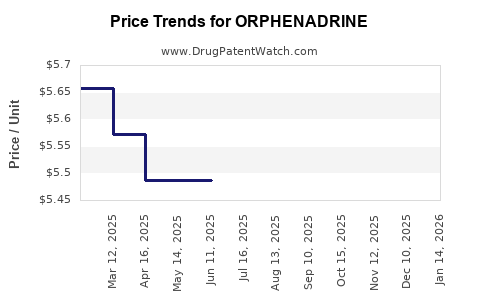

Price Analysis: Historical Trends and Current Pricing

Historically, Orphenadrine’s price has decreased following patent expiry, with per-unit costs dropping by approximately 50-70% over the past decade. The average retail price per tablet (100 mg) ranges from $0.05 to $0.20 depending on the region, manufacturer, and packaging.

In the U.S., the average gross wholesale price (GWP) for a 100 mg tablet hovers around $0.10, with retail prices often lower due to discounts. In European markets, similar drug formulations cost approximately €0.05–€0.15 per tablet.

Prices remain stable because of limited formulation variations, predominantly oral tablets. However, emerging markets with increased generics entry might experience further downward pressure.

Future Price Projections (Next 5-10 Years)

1. Market Saturation and Price Stability

Given the mature generic landscape, significant price reductions are unlikely. Instead, prices are expected to stabilize within the current range, barring regulatory or market disruptions.

2. Impact of Market Entry and Competition

Further patent expirations and new generics entering the market will sustain competitive pressure. Price erosion may continue at an annual rate of 3-5%, aligning with typical generic market behaviors.

3. Potential for Formulation and Delivery Innovations

Limited scope for innovative delivery (e.g., sustained-release formulations) constrains pricing upside. Nonetheless, slight premium pricing may occur if new formulations demonstrate efficacy benefits.

4. Regulatory and Economic Factors

Global economic shifts, regulatory reforms in drug pricing, and reimbursement policies could influence prices. For example, stricter cost-containment measures in publicly funded systems might push prices lower.

5. Emerging Markets Outlook

In developing countries, pricing could decline further owing to increased competition, or conversely, could stabilize if supply chain constraints emerge.

Projected Price Range (2024–2030):

Average wholesale price per tablet: $0.05–$0.12.

Retail price per prescription (30 tablets): approximately $1.50–$3.60.

Market Opportunities and Risks

Opportunities

- Expanding Indications: Incorporation into combination therapies or off-label uses could elevate demand.

- Formulation Diversification: Developing different delivery methods might command higher prices temporarily.

- Emerging Markets: Growing healthcare infrastructure offers untapped demand, potentially increasing sales volume even at lower prices.

Risks

- Patent Challenges: Although patents have expired, potential patent litigations or exclusivity claims on new formulations could create temporary price advantages.

- Market Substitution: Preference for newer agents or alternative therapies could erode demand.

- Regulatory Restrictions: Stricter regulations or changes in OTC policies could impact accessibility and pricing.

Conclusion

Orphenadrine remains a low-cost, broadly accessible muscle relaxant with a stable market environment characterized by intense generic competition. Prices are expected to remain within a narrow range over the coming decade, with slight downward pressure due to ongoing generic entry. Strategic stakeholders should consider opportunities for formulation innovation and market expansion in emerging economies, while maintaining awareness of potential regulatory and competitive risks.

Key Takeaways

- The global market for Orphenadrine is mature, highly competitive, and predominantly driven by generic manufacturers.

- Current wholesale prices hover around $0.05–$0.10 per tablet, with minimal fluctuation anticipated owing to market saturation.

- Future pricing is expected to decline gradually at a rate of 3–5% annually, consistent with similar generics.

- Opportunities exist in expanding indications and formulations; however, risks include substitution by newer agents and regulatory shifts.

- Stakeholders should prioritize market expansion in developing regions and monitor patent and regulatory developments to optimize positioning.

FAQs

1. What are the primary factors influencing Orphenadrine’s market price?

Patent expiry, generic competition, manufacturing costs, regional regulations, and demand-supply dynamics primarily influence its price.

2. How does the global demand for Orphenadrine compare to other muscle relaxants?

Demand for Orphenadrine remains moderate, with competition from newer agents like cyclobenzaprine and tizanidine, which may cannibalize some segments.

3. Are there prospects for patent protection or exclusivity for Orphenadrine?

Given its patent expiry and multiple generic manufacturers, new patent protections are unlikely unless reformulations or delivery systems are introduced.

4. How might regional policies impact future pricing trends?

Stringent cost-containment measures and reimbursement policies in developed markets could suppress prices further, while developing countries may see price stabilization due to less regulation.

5. What strategic moves can manufacturers consider to maximize profit?

Focusing on emerging markets, developing alternative formulations, and establishing partnerships for exclusive distribution rights can optimize profitability despite low per-unit prices.

References:

[1] Statistical data on global drug sales volumes from IQVIA Reports, 2022.

[2] Price trend analyses from the International Drug Price Indicator Guide, WHO, 2022.

[3] Regulatory updates from the European Medicines Agency, 2023.

[4] Patent and exclusivity information from U.S. Patent and Trademark Office, 2023.

[5] Market demand forecasts from GlobalData Healthcare, 2022.