Share This Page

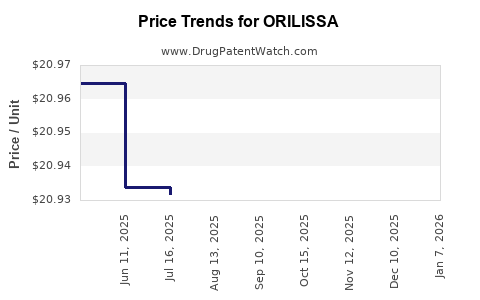

Drug Price Trends for ORILISSA

✉ Email this page to a colleague

Average Pharmacy Cost for ORILISSA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ORILISSA 150 MG TABLET | 00074-0038-28 | 41.70512 | EACH | 2025-12-17 |

| ORILISSA 200 MG TABLET | 00074-0039-56 | 20.86990 | EACH | 2025-12-17 |

| ORILISSA 200 MG TABLET | 00074-0039-56 | 20.88317 | EACH | 2025-11-19 |

| ORILISSA 150 MG TABLET | 00074-0038-28 | 41.71005 | EACH | 2025-11-19 |

| ORILISSA 200 MG TABLET | 00074-0039-56 | 20.90090 | EACH | 2025-10-22 |

| ORILISSA 150 MG TABLET | 00074-0038-28 | 41.70865 | EACH | 2025-10-22 |

| ORILISSA 200 MG TABLET | 00074-0039-56 | 20.93052 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ORILISSA

Introduction

ORILISSA (elagolix) is a novel oral gonadotropin-releasing hormone (GnRH) antagonist approved by the FDA in 2018 for the management of endometriosis-associated pain and uterine fibroids. Developed by AbbVie, ORILISSA marked a significant advancement in the treatment landscape for women’s reproductive health conditions, offering an oral alternative to injectable medications. Given its unique pharmacological profile, evolving competitive landscape, and regulatory considerations, understanding ORILISSA's market trajectory and pricing dynamics is critical for stakeholders, including manufacturers, payers, and healthcare providers.

Market Overview

Target Patient Populations

ORILISSA primarily targets two patient groups:

-

Women with Endometriosis-related Pain: An estimated 6-10% of women of reproductive age worldwide suffer from endometriosis, with many experiencing moderate to severe pain impacting quality of life [1].

-

Women with Uterine Fibroids: Affects approximately 20-80% of women by age 50, with symptomatic cases requiring medical intervention [2].

The prevalence of these conditions underscores a substantial market opportunity. The global endometriosis therapeutics market alone is projected to reach USD 900 million by 2025, with a compounded annual growth rate (CAGR) of approximately 10% [3].

Market Dynamics and Competitive Landscape

ORILISSA entered a competitive market with limited oral options for endometriosis, primarily hormonal therapies like combined oral contraceptives and progestins, along with injectable GnRH agonists. However, its approval introduced a selective, non-injectable method that minimizes some adverse effects associated with GnRH agonists, such as initial flare-ups.

Key competitors include:

- Esme Mae (relugolix): Also a GnRH receptor antagonist, approved for prostate cancer and endometriosis, potentially competing on similar mechanism.

- Lupron (leuprolide acetate) injections: Long established but invasive and associated with side effects.

- Conventional hormonal therapies: Oral contraceptives, progestins, which are less targeted but widely used.

Regulatory and Therapeutic Developments

Additional approvals and indications expand ORILISSA’s potential market. In 2021, the FDA approved Oriahnn (elagolix, estradiol, and norethindrone acetate) for heavy menstrual bleeding associated with uterine fibroids, signaling expansion into broader symptom management.

The introduction of relugolix as an oral GnRH antagonist for endometriosis and uterine fibroids creates direct competition that could influence pricing and market share.

Market Penetration and Adoption Trends

Prescription Trends

Post-approval, ORILISSA’s adoption has been gradual, shaped by:

- Physician familiarity with previous hormonal therapies.

- Side effect profile: Benefits include oral administration, reduced bone density loss risk compared to injectable GnRH therapies.

- Cost considerations: Access influenced by insurance coverage and out-of-pocket expenses.

In 2022, sales estimates ranged around USD 200-300 million globally, with North America accounting for the majority of revenue, reflecting high adoption in the U.S. [4].

Pricing Strategies

AbbVie initially priced ORILISSA around USD 8,000–USD 10,000 per 12-week treatment cycle, aligning with other hormonal therapies but higher than traditional contraceptives. This premium reflects its targeted mechanism and reduced side effects.

Insurance coverage has played a vital role, with payers increasingly covering the drug, especially for moderate to severe cases. However, copayments and prior authorization requirements remain barriers for some patients.

Price Projections

Current Pricing Landscape

As of 2023, ORILISSA’s listed retail price hovers around USD 9,000–USD 10,000 per 12-week course. Actual net prices vary based on negotiations, discounts, and payer arrangements.

Projected Price Trends (2023–2028)

- Market Competition Impact: Entry of relugolix-based therapies and biosimilars for related indications could exert downward pressure. A 10-15% reduction in list prices is plausible if competitive dynamics intensify.

- Generic Competition: Patent exclusivity is expected to last until 2030, delaying generic competition. Patent challenges could influence price stabilization or reduction earlier.

- Pricing Adjustments for Expanded Indications: With broader approvals, AbbVie might adopt tiered pricing, offering discounts for off-label or less severe cases.

Forecast Summary

| Year | Estimated Average Price (USD) | Key Factors |

|---|---|---|

| 2023 | 9,500–10,000 | Stable with slight reductions; competitive pressure emerging |

| 2024 | 8,500–9,500 | Increased competition; payer negotiations |

| 2025 | 8,000–9,000 | Broader indications; potential biosimilar threats |

| 2026+ | Stabilizing at ~$8,000 | Patent exclusivity; market adaptation to competition |

Market Forecast and Revenue Projections

Based on market size estimations, prescription volumes, and pricing, revenue projection analyses suggest:

- Short-term (2023–2025): Moderate growth, driven by increased awareness and approvals.

- Mid-term (2026–2028): Market saturation approaches; growth stabilizes unless new indications or formulations are introduced.

Assuming a compound annual growth rate (CAGR) of approximately 8-10% in revenue over the next five years, revenues could reach USD 400–USD 500 million globally by 2028.

Regulatory and Market Risk Factors

- Patent Litigation: Potential patent challenges could reduce exclusivity.

- Pricing Pressure: Governments and payers pushing for more affordable treatments may curb pricing.

- Evolving Therapeutics: Emergence of new oral GnRH antagonists or alternative treatments could diminish market share.

- Off-label Use and Reimbursement Policies: May influence prescription dynamics and pricing.

Key Takeaways

- Substantial Market Opportunity: With millions affected worldwide, ORILISSA's targeted mechanism positions it, especially in North America and Europe, where side effect profiles favor oral over injectable therapies.

- Pricing Strategy: Initially positioned at a premium, future prices will likely decline gradually due to competitive pressure, payer negotiations, and market penetration.

- Competitive Landscape: The entry of similar oral GnRH antagonists, like relugolix, presents both challenges and opportunities, emphasizing the need for differentiated value propositions.

- Revenue Outlook: Despite potential downward pricing pressures, increased adoption rates and expanded indications should sustain stable growth in sales.

- Regulatory Environment: Patent protections and approvals for new indications will significantly influence market longevity and pricing strategies.

FAQs

1. How does ORILISSA compare price-wise to traditional hormonal therapies?

ORILISSA’s price per treatment cycle (~USD 9,000–USD 10,000) exceeds traditional contraceptives, yet it offers targeted efficacy and fewer side effects, positioning it as a premium option.

2. Will generic versions of ORILISSA be available soon?

Not before 2030, as patent protections are expected to last until then. However, legal challenges or patent expirations could accelerate generic entry.

3. What factors could accelerate ORILISSA’s market growth?

Expanded approvals for additional indications, increased physician awareness, demonstrated long-term safety, and favorable reimbursement policies.

4. How might competition from relugolix affect ORILISSA’s pricing?

Relugolix’s entry could exert downward pricing pressure, especially if priced lower or marketed more aggressively, prompting price adjustments for ORILISSA.

5. Are there any upcoming regulatory changes that could impact ORILISSA’s market?

Potential shifts towards value-based pricing, reimbursement reforms, or new guideline recommendations could influence prescribing patterns and pricing.

References

[1] Institute for Optimizing Endometriosis Care. (2020). Epidemiology of Endometriosis.

[2] American College of Obstetricians and Gynecologists. (2020). Uterine Fibroids Overview.

[3] MarketsandMarkets. (2021). Endometriosis Therapeutics Market Size and Forecast.

[4] EvaluatePharma. (2022). 2022 Pharmaceutical Sales Data for ORILISSA.

This article provides a comprehensive analysis tailored for professionals seeking insights into ORILISSA's market positioning and future pricing landscape.

More… ↓