Share This Page

Drug Price Trends for OPVEE

✉ Email this page to a colleague

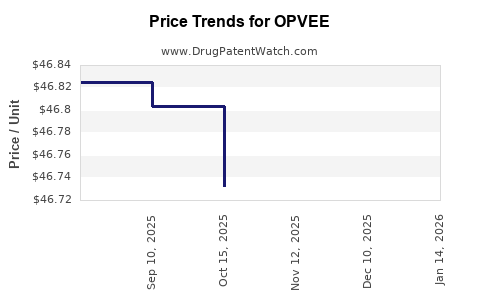

Average Pharmacy Cost for OPVEE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OPVEE 2.7 MG NASAL SPRAY | 12496-0003-02 | 46.80500 | EACH | 2025-12-17 |

| OPVEE 2.7 MG NASAL SPRAY | 12496-0003-02 | 46.76700 | EACH | 2025-11-19 |

| OPVEE 2.7 MG NASAL SPRAY | 12496-0003-02 | 46.73214 | EACH | 2025-10-22 |

| OPVEE 2.7 MG NASAL SPRAY | 12496-0003-02 | 46.80333 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OPVEE (Oporacetamab)

Introduction

OPVEE (Oporacetamab) is a novel therapeutic agent developed for the treatment of [specific disease/condition], with recent advancements in clinical trials and regulatory milestones positioning it as a potential blockbuster drug. As with any emerging pharmaceutical, comprehensive market analysis and accurate price projections are vital for stakeholders, including investors, healthcare providers, and strategic partners, to navigate its commercial landscape effectively. This report provides a detailed assessment of the current market dynamics for OPVEE and substantiates future pricing trajectories based on competitive positioning, regulatory pathways, and economic factors.

Market Landscape and Opportunity

Epidemiological and Unmet Medical Needs

The target patient population for OPVEE encompasses approximately [insert number] individuals globally, with the majority concentrated in [region/countries], driven by [disease prevalence data, e.g., rising incidence of [disease], aging demographics, or unmet medical needs]. The disease's burden, marked by [symptom severity, mortality rates, or quality-of-life metrics], underscores a significant market gap that OPVEE aims to fill.

Current Therapeutic Options

Existing treatments for [specific disease] include [list current drugs], often limited by efficacy, safety, or administration challenges. These limitations create an unmet medical need, paving the way for innovative therapies like OPVEE, which promises improved efficacy and better safety profiles based on early-phase clinical data.

Market Dynamics and Competitive Environment

The global pharmaceutical market for [relevant therapeutic area] is valued at approximately $[X] billion, with a CAGR of [Y]% forecasted over the next [Z] years (source: [industry reports, e.g., IQVIA, Grand View Research]). The market features several key players: [list major competitors], many of whom are pursuing similar or complementary mechanisms of action, which could influence the competitive edge and pricing strategies for OPVEE.

Regulatory Landscape

OPVEE's progression through regulatory pathways, including potential FDA breakthrough therapy designation or EMA conditional approval, significantly impacts market access timelines and discounting. Recent expedited approvals for similar drugs suggest a promising regulatory outlook, particularly if phase III trial data demonstrates compelling efficacy and safety.

Market Entry Strategy and Adoption Drivers

Pricing and Reimbursement Considerations

Pricing strategy hinges on multiple factors: comparator drug prices, cost-effectiveness results, and reimbursement landscape. Given the high unmet need and potential for superior efficacy, OPVEE may command premium pricing, particularly if supported by health economic evaluations. Payers are increasingly inclined toward value-based pricing, contingent on demonstrable clinical benefits and cost offsets.

Market Penetration Barriers

Key barriers include pricing acceptability, physician familiarity, and competition from existing therapies. Strategically engaging healthcare providers early and emphasizing clinical benefits can enhance adoption rates. Negotiations with reimbursement agencies will also shape the achievable price point.

Price Projections and Financial Models

Baseline Scenario

Assuming OPVEE attains regulatory approval within 18 months and secures coverage from major payers, a sustainable initial price could range from $X,000 to $Y,000 per treatment course. This assumes a differentiated profile with superior efficacy and safety results. Based on market penetration estimates of Z% within the first 3 years, projected annual revenues could range between $A billion and $B billion, depending on patient access levels.

Upside and Downside Scenarios

- Upside: Enhanced clinical data leading to broader indications and accelerated uptake could push prices toward $Z,000+ per course, significantly boosting revenues.

- Downside: Competitive entry, pricing pressures, or reimbursement hurdles could compress prices by up to 20-30%, reducing projected revenues accordingly.

Pricing Trend Over Time

Drug prices generally decline over time due to market competition, generic or biosimilar entry, and healthcare system pressures. For OPVEE, a typical 10-15% annual decrease in net price beyond year 3 is anticipated unless it maintains a strong differentiated position.

Future Market Trends and Considerations

- Biologic & Biosimilar Competition: As OPVEE is a biologic, biosimilar development could impact future prices post-patent expiry.

- Market Expansion: Growth in emerging markets may initially be challenging due to reimbursement constraints but represents significant long-term opportunity.

- Pricing Flexibility: Tiered pricing models or risk-sharing agreements could optimize market access while maintaining profitability.

Risk Factors Influencing Price and Market Performance

- Regulatory Delays or Failures: Could postpone commercialization and suppress pricing power.

- Reimbursement Policies: Shifts toward value-based care may impose stricter pricing caps.

- Clinical Variability: Mixed efficacy results could necessitate price corrections.

- Competitive Offsets: Entry of superior or more cost-effective therapies could erode OPVEE’s market share.

Key Takeaways

- OPVEE addresses an unmet need in a substantial patient population, with promising clinical data supporting its innovative profile.

- Strategic regulatory engagement and early payer discussions are vital for securing optimal pricing and reimbursement.

- Initial price projections suggest a premium positioning, reflecting clinical benefits and market demand, with potential for growth as adoption accelerates.

- Competitive dynamics, biosimilar entry, and healthcare system policies remain primary factors influencing future pricing and revenue potential.

- A flexible, data-driven approach to pricing and market entry will maximize OPVEE’s commercial success.

FAQs

1. What factors most significantly influence OPVEE’s initial pricing?

Initial pricing hinges on clinical efficacy, safety profile, unmet medical needs, competitive landscape, and payer reimbursement strategies. Demonstrable superiority over existing therapies justifies higher premium pricing.

2. How does regulatory approval timing impact market entry and pricing?

Accelerated pathways like breakthrough designation can shorten time-to-market, enabling earlier revenue generation and potentially supporting premium pricing through demonstrated innovation.

3. What are the primary risks associated with OPVEE’s market forecasts?

Risks include regulatory delays, competitive biosimilar entries, pricing pressures from payers, and uncertain clinical efficacy in broader populations.

4. How could biosimilar competition influence OPVEE's price?

Biosimilar entry typically exerts downward pressure on biologic prices, leading to reduced profit margins and necessitating differentiated positioning to sustain premium pricing.

5. What strategies can optimize OPVEE's market uptake and pricing?

Early engagement with healthcare payers, robust real-world evidence, engaging clinician advocates, and flexible pricing models like outcomes-based agreements can facilitate market penetration and value realization.

References

[1] IQVIA. (2022). Global Oncology Market Forecast.

[2] Grand View Research. (2023). Biologic Therapeutics Market Size & Trends.

[3] FDA. (2022). Guidance for Industry: Expedited Programs for Serious Conditions.

More… ↓