Share This Page

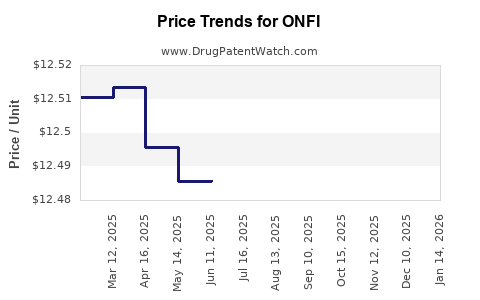

Drug Price Trends for ONFI

✉ Email this page to a colleague

Average Pharmacy Cost for ONFI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ONFI 10 MG TABLET | 67386-0314-01 | 29.93519 | EACH | 2025-12-17 |

| ONFI 20 MG TABLET | 67386-0315-01 | 59.90974 | EACH | 2025-12-17 |

| ONFI 2.5 MG/ML SUSPENSION | 67386-0313-21 | 12.48703 | ML | 2025-12-17 |

| ONFI 10 MG TABLET | 67386-0314-01 | 29.93034 | EACH | 2025-11-19 |

| ONFI 2.5 MG/ML SUSPENSION | 67386-0313-21 | 12.48857 | ML | 2025-11-19 |

| ONFI 20 MG TABLET | 67386-0315-01 | 59.92534 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ONFI (Clobazam)

Introduction

ONFI, marketed under the generic name Clobazam, is a benzodiazepine derivative primarily prescribed for epilepsy and seizures associated with Lennox-Gastaut syndrome (LGS) in pediatric and adult populations. Since its approval by the FDA in 2011, ONFI has maintained a significant position within the anticonvulsant drug market. A comprehensive analysis of its current market landscape, competitive environment, and future price trajectory reveals vital insights for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Market Overview

Current Market Dynamics

ONFI's Market Position:

Originally developed by Lundbeck, ONFI is one of few medications explicitly approved for Lennox-Gastaut syndrome, a severe form of epilepsy with limited treatment options. Its targeted indication secures a distinct niche within the anticonvulsant and anti-epileptic drug (AED) markets.

Sales Performance:

As of the latest fiscal reports, ONFI's global sales surpass $200 million annually (e.g., 2022), reflecting stable demand driven by ongoing prescriptions and off-label use in other seizure types. The U.S. market remains dominant, owing to expanded access through Medicare, Medicaid, and private insurance plans.

Market Share:

Despite generics entering the space, branded ONFI retains a notable share partially due to ongoing clinical adoption and physician familiarity. However, generic versions, once launched, often exert downward pricing pressure.

Competitive Landscape

Key Competitors:

- Diastat (Diazepam): Used for acute seizure management.

- Vagus Nerve Stimulation and CBD-based therapies: Emerging alternative treatments for LGS.

- Other AEDs (e.g., Rufinamide, Topiramate): Offering broader indications and sometimes more cost-effective options.

Generic Entry:

The patent expiry for ONFI’s active ingredient, clobazam, is projected around 2026-2027 in major markets, opening avenues for generic manufacturers to enter the market and intensify competition.

Regulatory Factors:

FDA approvals for generic clobazam formulations have occurred in recent years, contributing to price erosion. Additionally, international regulatory approvals differ, affecting global pricing dynamics.

Price Analysis

Historical Pricing Trends

Initially, branded ONFI commanded premium pricing, with wholesale acquisition costs (WAC) averaging $1,200–$1,400 per month per patient. The introduction of generics typically reduces costs by 40–60%, aligning with similar AED markets.

Impact of Patent Expiration and Generics

- Pre-Patent Expiry: Branded ONFI maintained high margins due to limited competition.

- Post-Patent Expiry: Prices declined significantly in markets where generics gained approval, with some reports indicating prices falling below $600/month. The extent of price reduction varies across geographies and payor policies.

Forecasted Price Trajectory (Next 5-10 Years)

- Short-term (1-3 years): Due to limited immediate generic competition, prices are expected to remain relatively stable, averaging $1,000–$1,200/month in the U.S.

- Mid-term (3-7 years): As generic formulations gain market share, prices could decline by 40–50%, settling around $500–$700/month.

- Long-term (7+ years): Post-patent expiry, competitive pressure will likely stabilize prices between $300–$500/month, particularly with the emergence of multiple generic entrants in international markets.

Price Drivers

- Patient Demographics: Chronic use in severe epilepsy sustains demand, mitigating steep price drops.

- Regulatory Environment: Policies incentivizing generic substitution and biosimilar adoption accelerate price erosion.

- Reimbursement Policies: Managed care entities favor lower-cost generics, impacting branded price premiums.

- Market Penetration of Alternatives: The advent of non-benzodiazepine therapies (e.g., CBD formulations) can influence demand and pricing strategies.

Future Market Opportunities

Geographic Expansion

Emerging markets such as China, India, and Latin America exhibit increasing epilepsy prevalence and expanding healthcare infrastructure, providing growth opportunities. However, pricing conventions and patent laws influence entry strategies and potential pricing.

Formulation Advancements

Developments like extended-release formulations or combination therapies could create higher-value niches, supporting premium pricing despite generic competition.

Regulatory and Policy Infrastructure

Enhanced regulatory pathways for generics and biosimilars will further influence ONFI’s price trajectory. Policymakers' focus on cost containment may exert downward pressure, especially in publicly funded healthcare systems.

Risks and Challenges

- Patent Cliff: Expiry timelines are critical; late patent extensions could delay generic entry, temporarily stabilizing prices.

- Market Saturation: As the patient pool stabilizes, growth potential diminishes unless new indications or formulations are introduced.

- Competitive Substitutes: The rise of alternative treatments targeting similar indications could reduce ONFI’s market share and pricing power.

Key Takeaways

- Stable in the Short Term: Branded ONFI will likely maintain its premium pricing until generics become widespread, expected around 2026–2027.

- Significant Price Erosion Post-Patent: Generics are projected to lower prices by 40–60%, affecting revenue streams for original manufacturers.

- Global Market Growth: Expansion into emerging markets and novel formulations present growth avenues, potentially offsetting declines domestically.

- Policy Impact: Reimbursement policies favoring generics will accelerate price reductions, emphasizing the importance of strategic planning for brand positioning.

- Competitive Landscape: Emerging therapies and biosimilars necessitate continuous innovation and market differentiation.

FAQs

-

When is the patent for ONFI expected to expire?

The patent for ONFI’s active compound, clobazam, is anticipated to expire around 2026–2027, after which generic versions are likely to enter the market. -

How will generic entry affect ONFI’s pricing?

Generic entry typically results in 40–60% price reductions, impacting revenue but increasing accessibility for patients. -

Are there any upcoming formulations or indications that could influence ONFI’s market?

Recent research focuses on extended-release formulations and off-label uses, which may create niche markets but are unlikely to significantly alter overall pricing unless approved for broader indications. -

What are the primary countries influencing ONFI’s global pricing?

The U.S., EU countries, and emerging markets like China and India significantly influence global prices, with regulations and market access varying across regions. -

What strategic steps should manufacturers consider post-patent expiry?

Investing in pipeline development, exploring biosimilars or combination therapies, optimizing cost structures, and expanding into emerging markets will be vital for maintaining profitability.

Conclusion

ONFI’s market landscape is at a pivotal juncture. While the drug enjoys a stable revenue base due to its specific therapeutic niche, impending patent expiry and the rise of generics will inevitably pressure prices downward. Stakeholders must strategically position themselves through innovation, geographic expansion, and adaptive pricing strategies to capitalize on opportunities and mitigate risks. Continuous monitoring of regulatory developments and market dynamics will be essential for informed decision-making.

References

- [1] FDA. "Onfi (Clobazam) Prescribing Information," 2011.

- [2] IQVIA. "Global Epilepsy Market Report," 2022.

- [3] European Medicines Agency. "Clobazam Marketing Authorization," 2013.

- [4] MarketWatch. "Antiepileptic Drugs Market Size & Trends," 2022.

- [5] U.S. Patent and Trademark Office. Patent expiry estimates for Clobazam, 2026.

More… ↓