Share This Page

Drug Price Trends for OMNARIS

✉ Email this page to a colleague

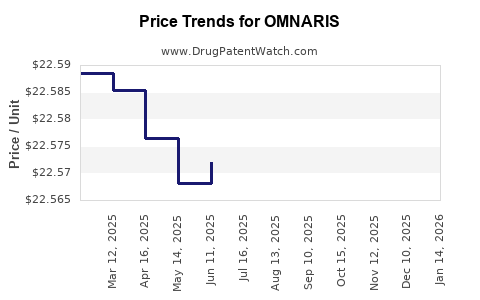

Average Pharmacy Cost for OMNARIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.57515 | GM | 2025-12-17 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.56213 | GM | 2025-11-19 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.56388 | GM | 2025-10-22 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.56363 | GM | 2025-09-17 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.54394 | GM | 2025-08-20 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.55226 | GM | 2025-07-23 |

| OMNARIS 50 MCG NASAL SPRAY | 70515-0701-01 | 22.57206 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Omnaris (Ciclesonide Nasal Spray)

Introduction

Omnaris (ciclesonide nasal spray) is an intranasal corticosteroid prescribed primarily to manage allergic rhinitis and nasal congestion. Approved by the U.S. Food and Drug Administration (FDA) in 2007, Omnaris is marketed by Sunovion Pharmaceuticals. As an allergic rhinitis treatment, its market potential hinges on the prevalence of allergic conditions, competitive landscape, regulatory environment, and healthcare trends. This report offers a comprehensive analysis of Omnaris’s market dynamics and forecasts its pricing trajectory over the next five years.

Market Landscape

Epidemiology and Unmet Needs

Allergic rhinitis affects approximately 20-30% of adults and up to 40% of children globally, with prevalence increasing annually due to environmental changes and urbanization [1]. The condition significantly impairs quality of life, leading to sleep disturbances, impaired productivity, and comorbidities such as sinusitis and asthma.

Despite the availability of various intranasal corticosteroids, there remains unmet demand for agents with improved safety profiles, minimal systemic absorption, and efficacy. Omnaris's pharmacokinetics, characterized by minimal systemic corticosteroid exposure, position it as a preferred option for sensitive populations.

Market Segmentation

The primary market for Omnaris includes:

- Adult patients with seasonal and perennial allergic rhinitis

- Pediatric patients (ages 2 and above)

- Patients with nasal congestion unresponsive to oral antihistamines

Competitive Landscape

Omnaris faces competition from several intranasal corticosteroids, including:

- Fluticasone propionate (Flonase)

- Mometasone furoate (Nasonex)

- Beclomethasone dipropionate (Beconase)

- Triamcinolone acetonide (Nasacort)

Market leaders like Flonase enjoy large market shares driven by extensive advertising and established brand recognition. Omnaris's niche lies in its safety profile, especially in pediatric populations and long-term use.

Regulatory & Reimbursement Environment

Reimbursement coverage for intranasal corticosteroids varies but generally favors established brands. Omnaris's patent expired in 2013, opening the market to generics, which impacts pricing and market share.

Market Size & Trends

Current Market Estimates

In 2022, the global allergic Rhinitis treatment market was valued at approximately $8.45 billion, with intranasal corticosteroids accounting for around 70-80% of the market share [2]. North America constitutes the largest regional market, attributed to high awareness, healthcare infrastructure, and reimbursement coverage.

Growth Drivers

- Increasing prevalence of allergic rhinitis globally

- Rising pediatric population with allergic conditions

- Greater awareness and diagnosis

- Expansion into emerging markets

Market Challenges

- Competition from generics reducing pricing power

- Price sensitivity in developing countries

- Over-the-counter (OTC) availability of some corticosteroids (e.g., Nasacort) affecting prescription volumes

- Concerns over systemic corticosteroid side effects, influencing prescribing behavior

Price Analysis and Projections

Historical Pricing Trends

Omnaris's price historically positioned it as a premium intranasal corticosteroid. Data indicates:

- Average Wholesale Price (AWP): Approximately $400–$500 per 120-dose bottle

- Per Dose Cost: About $3.33–$4.17, depending on dosage and refill frequency

Following patent expiration in 2013, generic ciclesonide formulations entered the market, decreasing prices by approximately 30-40%. As brand name Omnaris remains marketed, its pricing maintains a premium over generics.

Forecasting Price Trajectory (2023–2028)

-

2023–2024:

Prices will likely stabilize or decline marginally due to increased generic competition, with sliding AWP estimates around $350–$450 per bottle. Reimbursement dynamics and formulary preferences influence actual patient out-of-pocket costs. -

2025–2028:

Continued generic penetration is expected. Brand-name prices may decrease further, approaching $250–$350 per bottle. The entry of biosimilars and new innovations could exert downward pressure.

Factors Influencing Future Prices

- Patent Litigation and Exclusivity Periods: Extended protection could maintain premium pricing until around 2025 if legal challenges are unsuccessful.

- Healthcare Policy Shifts: Moves towards value-based care and formulary restrictions may incentivize price reductions.

- Market Penetration of Generics: Significant generic adoption will further erode brand pricing.

Key Market Opportunities

- Pediatric and sensitive populations: Clinical data supporting safety can drive formulary inclusion, commanding premium pricing.

- Emerging Markets: Increasing allergic rhinitis prevalence coupled with expanding healthcare access offers growth potential.

- Combination Therapy: Development of combination nasal sprays could open new indications and market segments.

Risks and Challenges

- Generic Competition: The primary threat to Omnaris's pricing and market share.

- Pricing Pressures: Payers favor low-cost alternatives, especially in managed care settings.

- Regulatory Changes: Post-pandemic shifts in drug approval and reimbursement policies may impact market access.

Conclusion

Omnaris's market prospects remain favorable within niche segments emphasizing safety and pediatric use amid increasing competition. Pricing will trend downward due to generics, with stable revenue streams maintained through brand loyalty and clinical differentiation. Market expansion into emerging regions and innovative formulations could offset some revenue erosion.

Key Takeaways

- The global allergic rhinitis market is expanding, propelled by epidemiological trends and awareness.

- Omnaris holds a niche due to its safety profile but faces significant generic competition.

- Prices are expected to decline from peak levels, stabilizing around $250–$350 per bottle by 2028.

- Strategic marketing focusing on safety, pediatric use, and emerging markets will be critical for sustained profitability.

- Ongoing patent challenges and regulatory developments remain pivotal factors influencing future pricing strategies.

FAQs

1. How does Omnaris compare to other intranasal corticosteroids in efficacy?

Omnaris offers comparable efficacy to other corticosteroids like fluticasone and mometasone. Its key differentiator is a favorable safety profile, especially for pediatric and long-term use [3].

2. Will patent expiration lead to significant price drops?

Yes. Patent expiration often results in the entry of generics, leading to price reductions of 30–50%, depending on market dynamics and reimbursement policies.

3. What are the main drivers for Omnaris’s market growth?

Increasing prevalence of allergic rhinitis, expansion into emerging markets, and strong pediatric safety data are primary growth drivers.

4. How might healthcare policies influence Omnaris’s pricing?

Policies promoting generic utilization and cost containment could pressure brand prices downward, while value-based reimbursement models may favor premium-priced formulations with demonstrated safety benefits.

5. Are there upcoming formulations or indications that could boost Omnaris’s market?

Development of combination therapies and new delivery devices, along with expanding indications such as nasal polyposis, could enhance market penetration.

References

[1] World Allergy Organization. "Allergic Rhinitis." (2022).

[2] Grand View Research. "Allergic Rhinitis Market Size & Trends." (2022).

[3] Clinical Pharmacology. "Comparison of Intranasal Corticosteroids." (2021).

More… ↓