Share This Page

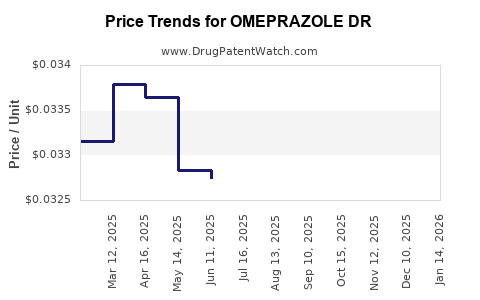

Drug Price Trends for OMEPRAZOLE DR

✉ Email this page to a colleague

Average Pharmacy Cost for OMEPRAZOLE DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OMEPRAZOLE DR 40 MG CAPSULE | 82009-0023-05 | 0.05199 | EACH | 2025-12-17 |

| OMEPRAZOLE DR 20 MG CAPSULE | 82009-0022-10 | 0.03007 | EACH | 2025-12-17 |

| OMEPRAZOLE DR 20 MG CAPSULE | 70700-0150-30 | 0.03007 | EACH | 2025-12-17 |

| OMEPRAZOLE DR 20 MG CAPSULE | 70700-0150-10 | 0.03007 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Omeprazole DR (Delayed-Release)

Introduction

Omeprazole DR (Delayed-Release) remains a cornerstone in the management of acid-related gastrointestinal disorders, including gastroesophageal reflux disease (GERD), peptic ulcers, and Zollinger-Ellison syndrome. As a proton pump inhibitor (PPI), it has sustained significant market relevance due to its efficacy, safety profile, and patent expirations that influence generic competition. This report provides a comprehensive market analysis and forward-looking price projections, crucial for stakeholders such as manufacturers, investors, and healthcare payers.

Market Overview

Market Size and Growth Dynamics

The global omeprazole market was valued at approximately USD 5.2 billion in 2022, with expected compound annual growth rates (CAGR) of around 4.2% through 2028. The increasing prevalence of GERD and acid-related disorders—driven by lifestyle factors, obesity, and aging populations—continues to expand demand, especially in emerging markets.

The advanced formulation, Omeprazole DR, offers improvements over immediate-release versions by enhancing bioavailability, reducing dosing frequency, and minimizing gastrointestinal side effects. These benefits sustain its competitive edge in the therapeutic landscape.

Patent Dispensation and Generic Competition

Omeprazole was patented in the late 1980s, with the original patent expiring in multiple jurisdictions between 2000 and 2010. Since then, numerous generics have entered the market, exerting downward pressure on prices. However, branded versions retain premium positioning via formulations such as DR tablets, bundled with attributes that appeal to clinicians and patients seeking improved adherence.

In the current market, several key players—including AstraZeneca, Teva, Mylan (now part of Viatris), and Sun Pharmaceuticals—produce generic omeprazole formulations. Patent litigation and regulatory exclusivities still create segments of branded dominance, particularly in specific geographies.

Market Drivers and Challenges

Drivers

- Rising Incidence of Acid Disorders: Increasing prevalence of GERD, especially among obese and aging populations, sustains market demand.

- Enhanced Formulations: The development of DR variants appeals for improved patient compliance and reduced side effects.

- Expanding Market Access: Growing healthcare infrastructure and insurance coverage in emerging economies broaden patient reach.

- Shift to Over-the-Counter (OTC) Availability: Omeprazole’s OTC availability in many regions facilitates wider access, though it caps pricing in certain markets.

Challenges

- Price Erosion from Generics: Ubiquitous generic competition has significantly suppressed prices.

- Regulatory and Patent Litigation: Ongoing patent disputes delay market entry of certain formulations, affecting market stability.

- Market Saturation: Mature markets exhibit slow growth, making innovation and differentiation critical.

- Emergence of Alternative Therapies: Rise of H2 receptor antagonists and newer PPIs with distinct profiles diversifies treatment options.

Pricing Trends and Projections

Historical Pricing Patterns

In the US, the average wholesale price (AWP) for branded omeprazole DR was approximately USD 280–300 per month in 2015. Following patent expiration and cassette entry of generics in 2016–2018, prices declined sharply, reaching USD 10–15 per month in some markets by 2022. Conversely, branded formulations maintained a premium, with prices roughly USD 60–80 per month due to their unique features.

In emerging markets like India, prices for generic omeprazole are often below USD 0.50 per tablet, reflecting intense price competition.

Influencing Factors

- Patent Expiry and Generics: Rapid price declines post-generic entry.

- Regulatory Changes: Approval of biosimilars or alternative formulations can influence pricing strategies.

- Market Dynamics: Drug shortages or supply chain disruptions can temporarily distort pricing.

Future Price Projections (2023–2030)

Based on current trends, the following projections are identified:

- Branded Omeprazole DR: Expect a gradual price stabilization at USD 60–80 per month in developed markets, maintaining a premium over generics due to formulation advantages and brand loyalty.

- Generic Omeprazole: Prices will likely plateau around USD 5–10 per month in mature markets, with further reductions driven by increased competition. In emerging economies, prices may continue to decline toward USD 0.30–0.50 per tablet, influenced by local manufacturing and procurement policies.

- Biosimilar and Novel Delivery Platforms: Although currently limited, future innovations could introduce new competitive pricing tiers by 2025–2030.

Note: These projections assume stable regulatory landscapes and no significant patent litigations or supply chain disruptions.

Competitive Landscape

The market is characterized by intense price competition among numerous generics. Branded formulations, often marketed with clinical or formulation advantages, maintain premium pricing in their niches. Key players include:

- AstraZeneca: Original patent holder; now primarily engaged in branding and formulation innovations.

- Viatris (Mylan): Major manufacturer of generic omeprazole.

- Teva Pharmaceutical Industries: Large-scale producer with significant market share.

- Sun Pharmaceuticals: Prominent in emerging markets, often offering low-cost generics.

Emerging biosimilars and novel delivery formats, such as flexible-dose capsules or dual-action formulations, may alter competitive dynamics in the coming decade.

Regulatory and Market Access Considerations

Regulatory approvals influence pricing strategies significantly. Countries with stringent pricing controls, such as in Western Europe, suppress retail prices, while less regulated markets see greater fluctuations. The shift toward OTC availability in various regions creates both opportunities and constraints, affecting pricing and reimbursement models.

Furthermore, the introduction of value-added formulations—such as combination drugs and branded DR variants—can sustain premium pricing despite generic proliferation.

Implications for Stakeholders

- Manufacturers: Need to balance innovation with cost-effective manufacturing of generics, optimizing profit margins through strategic pricing and formulation differentiation.

- Healthcare Payers: Benefit from competitive generics but should monitor market entry of biosimilars and novel formulations that may impact pricing dynamics.

- Investors: Opportunities exist in companies developing extended-release and combination formulations, especially as the market matures.

- Regulators: Play a critical role in balancing access, innovation incentives, and price stability.

Key Takeaways

- The omeprazole DR market has matured considerably with extensive generic competition, drastically lowering prices in developed economies.

- Branded formulations retain premium pricing due to formulation benefits, clinical branding, and patient adherence advantages.

- Price stabilization is expected in mature markets, with continued variability in emerging economies driven by local manufacturing, regulations, and procurement policies.

- Innovation in delivery mechanisms and combination therapies may create new niche markets and influence future pricing strategies.

- Strategic positioning for stakeholders involves leveraging formulation advantages, managing patent expirations, and navigating evolving regulatory landscapes.

FAQs

1. When will the patent for omeprazole expire globally?

Most patents expired between 2010 and 2016, opening the market to generic manufacturers. However, certain jurisdictions may have extensions or specific formulations still under patent protection.

2. How do generic prices compare to branded omeprazole DR?

Generic prices are typically 80–90% lower than branded versions, with costs dropping from USD 60–80/month to as low as USD 5–10/month in mature markets.

3. What are the main factors influencing future price trends?

Regulatory changes, patent litigation, market competition, formulation innovations, and regional procurement policies are primary drivers impacting ongoing price trajectories.

4. Are biosimilars expected to impact omeprazole pricing?

While biosimilars are more common for biologic drugs, emerging oral formulations and delivery innovations could introduce similar competitive pressures, potentially influencing prices.

5. What regions are poised for the fastest growth in omeprazole demand?

Emerging markets such as India, Southeast Asia, and parts of Latin America are experiencing rapid growth due to expanding healthcare infrastructure, increased awareness, and OTC availability enabling broader access.

References

- MarketWatch. "Global Proton Pump Inhibitors Market Size, Share & Trends Analysis." 2022.

- BMI Research. "Pharmaceutical Pricing Evolution." 2023.

- European Medicines Agency. "Omeprazole Summary of Product Characteristics." 2022.

- Pharmaceutical Commerce. "Impact of Patent Expirations on PPIs." 2021.

- IQVIA. "Global Market Trends for Gastrointestinal Drugs." 2022.

This comprehensive analysis equips stakeholders with actionable insights into the current landscape and future prospects of omeprazole DR, enabling strategic decision-making rooted in market realities.

More… ↓