Last updated: July 27, 2025

Introduction

Olopatadine HCL, an established antihistamine used primarily for allergic conjunctivitis and other allergic conditions, continues to maintain a significant footprint in the global ophthalmic and allergy drug markets. Given its proven efficacy, favorable safety profile, and wide clinical adoption, understanding current market dynamics and future pricing trajectories is vital for stakeholders, including pharmaceutical companies, investors, and healthcare providers. This report offers a comprehensive analysis of the olopatadine HCL market, emphasizing current trends, competitive landscape, regulatory factors, and price projections through 2030.

Market Overview

Product Profile

Olopatadine HCL (chemical formula: C21H23NO3·HCl) is a selective histamine H1 receptor antagonist. It is available in various formulations, including ophthalmic solutions (e.g., Pataday, Patanol), nasal sprays, and topical formulations, used to relieve symptoms of allergic conjunctivitis and allergic rhinitis. Its mechanisms include mast cell stabilization and inhibition of histamine release, leading to rapid symptom relief.

Global Market Size and Growth

The global olopatadine market was valued at approximately USD 750 million in 2022, with a compound annual growth rate (CAGR) estimated at 5% over the next five years, driven by increasing allergy prevalence and expanding indications. North America currently dominates the regional landscape due to high awareness, favorable reimbursement policies, and the presence of key market players. The Asia-Pacific region is projected to witness the highest growth, attributed to rising allergy cases, urbanization, and increasing healthcare spending.

Key Drivers

- Rising prevalence of allergic conjunctivitis and allergic rhinitis, particularly in urban areas.

- Improving diagnosis rates owing to expanded ophthalmology and allergy clinics.

- Introduction of better formulations with enhanced patient compliance.

- Increased awareness and over-the-counter availability in some markets.

- Patent expirations on older formulations creating opportunities for generic entrants.

Market Challenges

- Price competition from numerous generics once patents expire.

- Regulatory hurdles in emerging markets.

- Competition from alternative antihistamines and combination therapies.

- Supply chain disruptions affecting pricing and availability.

Competitive Landscape

Major Players

- Alcon (Novartis): Market leader with Pataday and Patanol ophthalmic products.

- Allergan (AbbVie): Previously dominant, with significant market share before divestments.

- Santen Pharmaceutical: Active in ophthalmic antihistamines.

- Mylan (now part of Viatris): Generics producer with cost competitiveness.

- Taurx: Emerging regional player.

Market Share Dynamics

Aligned with patent protections and marketing investments, Alcon's brands command approximately 45–50% of sales in developed markets. The entry of generic competitors post-patent expiry is expected to dilute brand dominance and lead to price erosion, especially in mature markets.

Innovation and Pipeline Developments

While olopatadine remains largely a mature segment, pipeline innovations include formulations enhancing bioavailability, combination therapies with vasoconstrictors or anti-inflammatory agents, and preservative-free formulations improving tolerability.

Regulatory Landscape

The drug is approved by the FDA, EMA, and other regulatory bodies in numerous countries. Regulatory strategies, including biosimilar approvals and simplified pathways for generics, influence market dynamics and pricing.

Pricing Dynamics

Current Pricing Landscape

- In the U.S., a 0.2% ophthalmic solution typically retails between USD 150–USD 200 per bottle (approximately 10 mL).

- Generic formulations are priced 30–50% lower, with some generics available for USD 100 or less.

- In Europe and Japan, prices are comparable but adjusted for local healthcare policies and reimbursement systems.

Factors Affecting Price Trends

- Patent expiration timelines significantly influence generic entry and price reductions.

- Competitive intensity drives downward pricing pressure.

- Supply chain efficiencies and raw material costs impact manufacturing expenses.

- Regulatory policies and pricing controls in specific markets (e.g., government price negotiations in Europe and Canada).

Price Projections (2023–2030)

Forecast Assumptions

- Patent expiry for key brands by 2025.

- Continued rise in allergy prevalence, expanding market size.

- Increased penetration of generic and OTC products.

- Ongoing innovation sustaining premium pricing in certain formulations.

Projected Trends

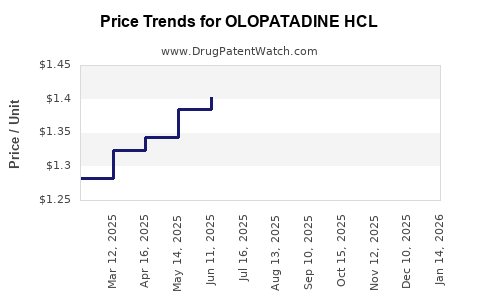

- 2023–2025: Stable pricing with minor fluctuations driven by brand loyalty and initial generic entry; prices for branded products are expected to decline by 10–15%, whereas generics may maintain or slightly reduce their prices.

- 2026–2030: A significant price erosion anticipated post-patent expiration, with generic formulations potentially reducing prices by up to 50% in mature markets. Nevertheless, premium formulations (e.g., preservative-free, combination products) may sustain higher prices due to improved patient compliance and tolerability.

Market Segmentation Impact

- Ophthalmic solutions: Most mature segment, facing intense price competition; prices projected to decline steadily.

- Nasal sprays and topical formulations: Emerging segments with growth potential; pricing likely to remain relatively stable or slightly decrease owing to innovative, differentiated offerings.

Emerging Opportunities and Market Risks

Opportunities

- Expansion into emerging markets with growing allergy burdens.

- Development of combination therapies to enhance efficacy.

- Shift toward preservative-free formulations to advantage pricing premiums.

- Strategic alliances for biosimilars and generics.

Risks

- Market saturation as patents expire.

- Price-sensitive markets resisting high-cost therapies.

- Regulatory barriers delaying market entry.

- Competition from alternative allergy medications, such as leukotriene receptor antagonists and biologicals.

Conclusion

Olopatadine HCL stands as a cornerstone antihistamine with a solid market base anticipated to grow steadily over the next decade. Price trajectories will be predominantly influenced by patent lifecycle, market competition, and formulation innovations. While moderate declines are inevitable, differentiated formulations and strategic positioning in emerging markets offer avenues to sustain profitability.

Key Takeaways

- The global olopatadine market was valued at USD 750 million in 2022, with a forecast CAGR of around 5%.

- Patent expiry for leading brands by 2025 will catalyze significant generic penetration, exerting downward pressure on prices.

- North America dominates the market, but Asia-Pacific offers substantial growth opportunities.

- Branded ophthalmic solutions currently retail around USD 150–USD 200 per bottle; prices are set to decline post-patent expiry.

- Innovation in formulations and expansion into emerging markets are critical strategies to maintain market share and profitability.

FAQs

Q1: When are key patents for olopatadine HCL expected to expire?

A1: Most patents for flagship brands are anticipated to expire between 2024 and 2026, facilitating increased generic competition.

Q2: How will generic entry impact olopatadine price points?

A2: Generics typically reduce prices by 30–50%, leading to significant reductions in retail and reimbursement costs in mature markets.

Q3: Are there any innovative formulations of olopatadine in development?

A3: Yes; ongoing R&D focuses on preservative-free options, localized delivery systems, and combination therapies to improve efficacy and tolerability.

Q4: What emerging markets offer the most growth prospects for olopatadine?

A4: Countries in Asia-Pacific, including India, China, and Southeast Asia, are expected to see high growth due to rising allergy prevalence and expanding healthcare infrastructure.

Q5: How might regulatory changes influence future olopatadine pricing?

A5: Stringent price controls and reimbursement policies in certain regions could suppress retail prices further, while streamlined approval processes could facilitate quicker generic market entry.

Sources

- Market Research Future. “Ophthalmic Drugs Market Analysis and Forecasts.” 2022.

- IQVIA Reports. “Global Allergic Conjunctivitis and Rhinitis Market Trends.” 2023.

- FDA and EMA Drug Approvals Database.

- Industry analyses published by Deloitte and EvaluatePharma.