Last updated: August 8, 2025

Introduction

Olopatadine is a selective antihistamine primarily used to treat allergic conjunctivitis and allergic rhinitis. Since its initial approval, it has become a cornerstone therapy in allergy management, generating substantial market interest. An understanding of the current market landscape and future price trajectories is critical for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers.

Current Market Landscape

Regulatory Status and Approvals

Olopatadine is marketed globally in various formulations, including ophthalmic solutions (e.g., Pataday, Patanol) and nasal sprays (e.g., Patanase). Regulatory approvals span multiple jurisdictions, with the U.S. FDA, EMA, and other agencies recognizing its efficacy and safety profile. The drug's approval history reflects a consistent increase in indications and formulations, contributing to expanded market penetration.

Market Dynamics and Leading Players

The market is highly concentrated, with key players such as Alcon, Bausch + Lomb, and Mylan holding significant share. The ophthalmic segment dominates due to its primary indication in allergic conjunctivitis. The nasal spray segment, although smaller, is experiencing growth driven by increasing allergy prevalence.

Market Drivers

- Rising Prevalence of Allergic Conditions: Global increases in allergic rhinitis (AR) and allergic conjunctivitis (AC) due to environmental factors contribute to steady demand growth (WHO estimates AR affects over 400 million people worldwide).

- Advancements in Formulations: Novel delivery systems and combination therapies enhance patient compliance and efficacy.

- Expanding Indications: Off-label use and additional allergy-related indications are proliferating.

- Increased Awareness and Diagnosis: Public awareness campaigns has improved diagnosis rates, especially in emerging markets.

Market Challenges

- Patent Expirations and Generics: The imminent entry of generic formulations threatens branded sales.

- Pricing Pressures: Price negotiations and healthcare reimbursement policies influence market penetration.

- Competition from Alternative Therapies: Non-histamine-based therapies, such as corticosteroids and immunotherapies, offer competition.

Market Size and Revenue Estimation

Global Revenue Figures

In 2022, the global market for olopatadine-based products was estimated at approximately USD 1.2 billion, with ophthalmic formulations accounting for 80% of sales. The market is projected to grow at a CAGR of 4-6% over the next five years, driven by demographic and epidemiological trends.

Regional Insights

- North America: The largest market, driven by high awareness, insurance coverage, and broad product availability.

- Europe: Moderate growth, with regulatory harmonization aiding market expansion.

- Asia-Pacific: Fastest-growing segment, owing to rising allergy prevalence, increased healthcare access, and expanding pharmaceutical markets.

- Latin America and Middle East: Emerging markets with significant growth potential.

Future Price Projections

Factors Influencing Prices

- Patent Cliff and Generic Competition: Entry of generics, projected within the next 2-4 years, typically leads to reduced prices in the affected segments.

- Regulatory and Reimbursement Dynamics: Price negotiations with payers in different markets can lead to downward adjustments.

- Manufacturing Costs and Supply Chain Dynamics: Overall costs influence wholesale and retail prices.

- Market Demand and Brand Loyalty: Strong brand presence may sustain premium pricing in the short term.

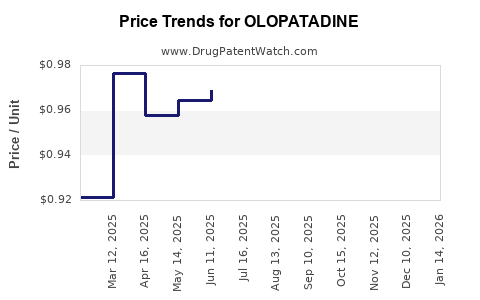

Price Trajectory Forecasts

- Branded Ophthalmic Formulations: Currently retailing at USD 15-20 per single-use unit, expected to stabilize or decrease marginally by 2025 due to impending generics but may retain premium positioning in certain markets.

- Generic Versions: Anticipated to enter the market within the next 2-3 years, with unit prices potentially halving or more, reaching USD 5-10.

- Nasal Spray Formulations: Slightly higher prices due to formulation complexity, expected to decline from USD 25-30 per 30-dose bottle to USD 15-20 post-generic entry.

Pricing Trends Post-Patent Expiry

Historically, the introduction of generics has resulted in 40-60% price reductions within 1-2 years. For olopatadine, similar trends are expected, especially in mature markets like the U.S. and Europe. Emerging markets may experience less pronounced price reductions due to regulatory and market access differences.

Market Opportunities and Risks

Opportunities

- Development of Biosimilars and Next-Generation Formulations: Potential to capture niche segments.

- Expansion in Emerging Markets: Increasing allergy prevalence and healthcare infrastructure growth provide avenues for higher sales and premium pricing.

- Combination Therapy Developments: Partnerships with biotechnology firms could augment market share.

Risks

- Price Competition: Rapid generic penetration could significantly compress margins.

- Regulatory Barriers: Delays or restrictions could hamper market entry.

- Market Saturation: High penetration rates reduce the scope for upward price adjustments in mature markets.

Conclusion

Olopatadine's market remains robust, driven by its proven safety and efficacy profile. While immediate revenues are challenged by upcoming generic entries, strategic positioning with new formulations and expansion into emerging markets presents substantial upside. Price projections indicate a decline post-patent expiry, aligning with historical trends in similar small-molecule drugs. Stakeholders should adapt to competitive pressures while exploring innovation to sustain profitability.

Key Takeaways

- The global olopatadine market was valued at USD 1.2 billion in 2022, with steady growth prospects.

- Patent expirations over the next 2-4 years will catalyze significant price reductions driven by generic competition.

- Regional variations influence price trajectories, with emerging markets offering greater growth opportunities.

- Companies can leverage formulation innovations and market expansion strategies to maintain profitability amid declining drug prices.

- Strategic planning should incorporate anticipatory measures for market share erosion due to generics, alongside avenues for innovation.

FAQs

1. When are generic olopatadine products expected to enter the market?

Generic versions are projected to become available within 2-4 years, following patent expirations in key markets such as the U.S. and Europe.

2. How will the entry of generics impact olopatadine prices?

Historically, generic entry results in 40-60% price reductions within one to two years, impacting revenues for branded formulations.

3. Are there any promising new formulations or indications for olopatadine?

Yes. Development of combination therapies, nasal spray versions, and sustained-release formulations could open new markets and justify premium pricing.

4. Which regions offer the most significant growth opportunities for olopatadine?

Emerging markets in Asia-Pacific and Latin America hold considerable growth potential due to rising allergy prevalence and increasing healthcare access.

5. What strategies should companies adopt to maintain profitability?

Companies should innovate through new formulations, explore geographical expansion, and diversify indications to offset revenue losses from price reductions.

References

[1] World Health Organization. Allergic Rhinitis Fact Sheet. 2021.

[2] MarketWatch. Olopatadine Market Size, Share & Trends. 2023.

[3] FDA Drug Approvals and Patent Data. 2022.

[4] IMS Health (IQVIA). Pharmaceutical Market Data. 2022.

[5] GlobalData. Future Outlook on Ophthalmic Drugs. 2023.