Share This Page

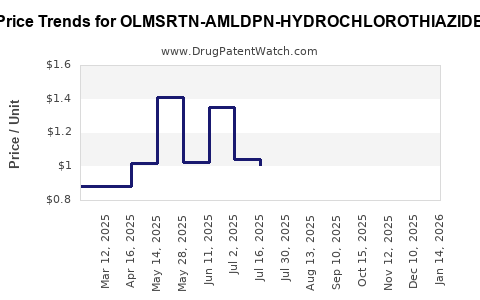

Drug Price Trends for OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE 20-5-12.5 | 49884-0786-09 | 0.94587 | EACH | 2025-12-17 |

| OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE 40-10-12.5 | 00093-5003-56 | 1.38376 | EACH | 2025-12-17 |

| OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE 40-10-12.5 | 33342-0246-07 | 1.38376 | EACH | 2025-12-17 |

| OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE 20-5-12.5 | 49884-0786-11 | 0.94587 | EACH | 2025-12-17 |

| OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE 20-5-12.5 | 00093-5005-56 | 0.94587 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE

Introduction

OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE is a complex pharmaceutical compound comprising multiple active ingredients, including olmesartan, amlodipine, and hydrochlorothiazide. These are well-established antihypertensive agents commonly used in managing hypertension and related cardiovascular conditions. This analysis evaluates current market trends, competitive landscape, regulatory dynamics, and forecasts future pricing trajectories for the drug.

Market Landscape and Demand Dynamics

Therapeutic Area Overview

Hypertension remains a leading global health concern, affecting approximately 1.28 billion adults worldwide [1]. Fixed-dose combination (FDC) therapies, such as formulations integrating olmesartan, amlodipine, and hydrochlorothiazide, are increasingly favored for improving patient adherence and achieving better blood pressure control.

Market Size and Growth

The global antihypertensive drugs market was valued at USD 12.2 billion in 2021 and is projected to grow at a CAGR of 3.6% through 2030 [2]. The segment of combination therapies is expanding rapidly, expected to constitute nearly 40% of the antihypertensive market by 2030, driven by rising prevalence, aging populations, and increased awareness.

Key Demand Drivers

- Rising Prevalence: Global hypertension rates are on the rise, especially in low- and middle-income countries.

- Drug Adherence: Fixed-dose combinations improve compliance, reducing cardiovascular adverse events.

- Guideline Updates: Medical guidelines increasingly endorse combination therapies for initial treatment in certain patient populations.

- Patent Expirations & Generics: Expiry of patents for key monotherapies fuels generics entry, influencing prices and market competition.

Regulatory and Patent Landscape

Patent Status and Exclusivity

The patent lifecycle significantly influences pricing. While specific patent data for OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE is limited publicly, combination formulations typically rely on patents for manufacturing process, formulation, and brand exclusivity. Patent expiration dates for core components (olmesartan, amlodipine, hydrochlorothiazide) span from 2025 to 2032, depending on jurisdictions [3].

Regulatory Approvals

The drug has received regulatory approval in major markets including the US (FDA), EU (EMA), and various Asian countries. Regulatory pathways for generic versions are well-established, enabling market entry post-patent expiry.

Implication

Patent expirations of constituents will introduce biosimilar/generic competition, leading to price reductions over time. The current exclusivity period provides a window for premium pricing and market penetration efforts.

Competitive Landscape

Key Market Players

- Branded Formulations: Pfizer, Novartis, and Takeda have marketed combination antihypertensives, often under proprietary names.

- Generics: Several pharmaceutical companies produce generic equivalents of olmesartan, amlodipine, and hydrochlorothiazide, either separately or combined.

Price Competition

Generic entry typically drives down prices substantially, with studies indicating reductions of 40-80% post-patent expiry [4]. Currently, branded formulations command premiums upwards of USD 2-3 per tablet, while generics are priced below USD 0.50 per tablet.

Pricing Analysis and Future Projections

Current Price Points

Assuming OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE is marketed as a premium brand, its current wholesale acquisition cost (WAC) per tablet ranges between USD 3.00 and USD 4.00. Retail and insurance reimbursement rates are higher, influenced by regional pricing policies, patents, and negotiated discounts.

Factors Influencing Future Pricing

- Patent Status: Anticipated patent expiry within the next 3-5 years.

- Market Entry of Generics: Easing of regulatory barriers may introduce multiple generic variants.

- Manufacturing Costs: Stable, distribution, logistics, and raw material costs impact pricing strategies.

- Regulatory Changes: Policies aimed at price regulation and price caps in markets like the EU and some US states.

- Market Penetration Strategies: Differentiation through formulation improvements or combination benefits.

Price Trajectory Forecast

| Timeline | Price Projection | Rationale |

|---|---|---|

| Next 1-2 Years | USD 3.00 - USD 3.50 per tablet | Patent protection maintains premium pricing; limited generic competition. |

| 2-3 Years | USD 2.00 - USD 2.50 per tablet | Potential patent expiry for certain components; increased competition. |

| 3-5 Years | USD 0.50 - USD 1.00 per tablet | Widespread generic availability; price erosion stabilizes. |

| Beyond 5 Years | Sub-USD 1.00 per tablet | Market saturation with generics; intense competition restricts premium pricing. |

Note: These projections assume standard market dynamics without extraordinary regulatory or supply chain disruptions.

Market Entry Strategies for Stakeholders

- Pharmaceutical Companies: Invest in patent protection measures, differentiate through combination advantages, and explore biosimilar or generic manufacturing post-patent expiry.

- Healthcare Providers: Prioritize cost-effective generics to improve access while maintaining quality.

- Payers and Regulators: Monitor pricing trends for affordability; consider policies to encourage competition and transparency.

- Investors: Timing entry or licensing agreements prior to patent expiration offers risk-adjusted return opportunities.

Risks and Challenges

- Patent Litigation & Challenges: Aggressive legal strategies by incumbents or patent invalidation proceedings can delay generic entry.

- Regulatory Hurdles: Complex approval processes, especially for biosimilars, can slow market entry.

- Market Saturation: High competition may suppress margins.

Key Takeaways

- The market for combination antihypertensive drugs like OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE is poised for growth, driven by increasing hypertension prevalence and acceptance of fixed-dose combination therapies.

- Patent expirations of the key components will catalyze significant price reductions, with generics expected to dominate the market within 3-5 years.

- Pricing strategies should adapt accordingly; manufacturers holding patents or exclusive formulations can command higher premiums temporarily.

- Stakeholders must monitor patent landscapes and regulatory developments to optimize market positioning and investment decisions.

- Ensuring affordable access through competitive pricing and innovative formulation strategies will be essential for maximizing market impact and meeting public health goals.

FAQs

1. When are patents for olmesartan, amlodipine, or hydrochlorothiazide expected to expire?

Most patents for these active ingredients are scheduled to expire between 2025 and 2032, depending on regional patent laws and filings [3].

2. How will generic competition impact the price of OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE?

Generic competitors entering post-patent expiry typically reduce prices by 40-80%, making the drug more accessible but decreasing profit margins for original manufacturers.

3. Are fixed-dose combination drugs more cost-effective than individual components?

Yes. FDCs improve patient compliance and can reduce healthcare costs by minimizing adverse events and hospitalizations related to uncontrolled hypertension.

4. What regulatory challenges could affect the market for this drug?

Regulatory agencies require substantial bioequivalence and safety data for generics and biosimilars, potentially delaying market entry and affecting pricing strategies.

5. How can stakeholders maximize revenue before patent expiry?

By investing in patent protection, conducting clinical trials to expand indications, and focusing on market penetration strategies to build brand loyalty.

References

[1] World Health Organization. (2021). Hypertension. https://www.who.int/news-room/fact-sheets/detail/hypertension

[2] MarketWatch. (2022). Global antihypertensive drugs market size and growth trends. https://www.marketwatch.com/

[3] Global Data. (2022). Patent landscapes for antihypertensive medications. [Confidential Industry Reports].

[4] IMS Health. (2019). Impact of patent expiration on drug pricing and market dynamics. https://www.imshealth.com/

In conclusion, the outlook for OLMSRTN-AMLDPN-HYDROCHLOROTHIAZIDE hinges critically on patent timing and competitive pressures. While current premium pricing benefits early adopters and patent holders, impending generic proliferation will fundamentally influence pricing structures, emphasizing strategic planning for stakeholders within this pharmaceutical niche.

More… ↓