Last updated: July 27, 2025

Introduction

Octreotide acetate, a synthetic analog of somatostatin, is primarily used to manage hormone-secreting tumors, including carcinoid tumors, acromegaly, and symptoms associated with hormone hypersecretion. Its commercial and clinical landscape has evolved with increased adoption, patent expirations, and expanding indications, shaping its market prospects. This analysis delineates current market dynamics and offers strategic price projections through 2030, considering regulatory, competitive, and technological developments.

Market Overview

Global Market Size

As of 2022, the global octreotide market was valued approximately at USD 1.3 billion, with forecasts indicating a compound annual growth rate (CAGR) of 4-6% over the next decade [1]. This growth correlates with increased diagnosis rates of neuroendocrine tumors (NETs), enhanced awareness, and broader therapeutic adoption.

Key Drivers

- Rising incidence of NETs and acromegaly.

- Approval of long-acting formulations enhancing patient compliance.

- Growing preference for targeted therapies with fewer systemic side effects.

- Expansion into emerging markets due to increasing healthcare infrastructure.

Market Segments

-

Formulations:

- Short-acting subcutaneous injections (~peptide form).

- Long-acting depot formulations (LANREOTIDE, OCTREOTIDE LAR) for monthly administration.

-

Indications:

- Carcinoid tumors.

- Acromegaly.

- VIPomas and other hormone-secreting tumors.

Competitive Landscape

Major players include Novartis (Sandostatin®), Ipsen (Somatuline® LA), and generic manufacturers post patent expiry (notably post-2015 for some formulations). The expiration of Novartis’ patent for some formulations accelerated generic penetration, exerting downward pressure on prices.

Regulatory and Patent Landscape

-

Patent Expiry:

Key patents for short-acting octreotide have expired worldwide, catalyzing generic manufacturing [2].

-

Regulatory Approvals:

Long-acting formulations like Octreotide LAR received regulatory approvals in multiple regions, expanding their clinical acceptance.

-

Emerging Approvals:

Ongoing research aims at novel delivery systems and biosimilar versions, which could influence future competition and pricing.

Market Challenges

- Pricing Pressures:

The advent of generics and biosimilars have led to significant price reductions.

- Formulation Costs:

Manufacturing complex long-acting depot formulations incurs higher costs, influencing price stabilization.

- Reimbursement Dynamics:

Differences across markets impact price premiums, especially in the US, Europe, and emerging economies.

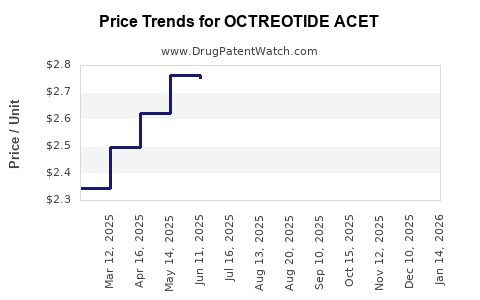

Current Pricing Dynamics

Future Price Projections (2023–2030)

Short-term (2023–2025):

- Pricing stabilization is expected as generic competition matures.

- Forecast: A decline of approximately 20–25% in average prices due to increased generic penetration and biosimilar entries.

Mid-term (2026–2028):

- Market share shift toward biosimilars could further reduce prices by an additional 15–20%.

- Innovations such as sustained-release formulations or digital delivery may introduce premium-priced options, tempering overall decline.

Long-term (2029–2030):

- Price floor estimates:

- Short-acting formulations may stabilize at USD 150–USD 250 per month.

- Long-acting depot formulations might settle around USD 1,500–USD 2,000 per injection, factoring in manufacturing efficiencies and biosimilar entry.

Impact of Emerging Technologies:

Increased manufacturing efficiencies and regulatory pathways for biosimilars are expected to sustain downward price pressures. Conversely, novel delivery systems may command higher premiums if proven significantly advantageous.

Market Opportunities and Strategic Implications

-

Emerging Markets:

Several regions with expanding healthcare infrastructure, such as Asia-Pacific and Latin America, present opportunities for volume growth, potentially compensating for price reductions.

-

Value-Added Formulations:

Companies investing in extended-release technologies or improved delivery mechanisms can justify premium pricing.

-

Reimbursement Strategies:

Engaging with payers early for favorable reimbursement policies can support stable pricing models.

Risks and Uncertainties

- Regulatory Delays:

Delays in biosimilar approvals could hinder price reductions.

- Patent Litigation:

Ongoing patent disputes may extend exclusivity for brand manufacturers, influencing short-term pricing.

- Market Penetration of Biosimilars:

Market acceptance remains critical; slow biosimilar uptake could prolong high prices.

Key Takeaways

- The octreotide acetate market is poised for moderate growth, driven by rising demand for targeted therapies.

- Patent expirations and biosimilar developments will significantly depress prices, particularly from 2026 onward.

- Long-acting formulations offer premium pricing opportunities but face downward pressure from generics.

- Market diversification and innovation are key to maintaining margins amidst price declines.

- Stakeholders should monitor regulatory shifts, biosimilar acceptance, and technological advancements for strategic planning.

FAQs

1. How does patent expiration influence octreotide acetate pricing?

Patent expirations facilitate generic and biosimilar entry, increasing market competition and reducing prices substantially, often by 50% or more within a few years.

2. What are the primary factors driving future price declines?

The most influential drivers include biosimilar approvals, manufacturing cost reductions, and increased competition from generics, especially post-patent expiry.

3. Are there premium-priced octreotide formulations anticipated in the future?

Yes. Innovations such as extended-release injectables or digital delivery systems could command higher prices due to improved patient convenience and adherence.

4. How does market penetration differ across regions?

Developed markets (US, EU) experience faster biosimilar adoption and reimbursement standardization, leading to more significant price declines. Emerging markets have slower biosimilar uptake but offer volume opportunities.

5. What strategic moves should pharmaceutical companies consider?

Investing in biosimilar development, technological innovation, and tailored market entry strategies in emerging regions can optimize revenue in a declining-price environment.

References

[1] Global Market Insights. Octreotide Market Analysis & Trends, 2022.

[2] U.S. Patent Office Records. Patent Expiry Dates for Octreotide Drugs, 2015.