Share This Page

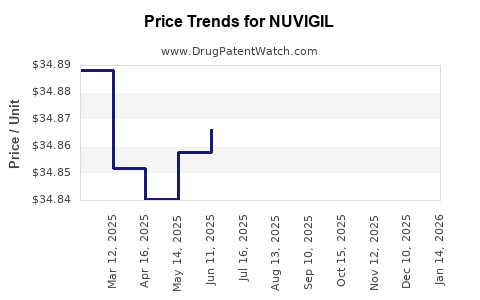

Drug Price Trends for NUVIGIL

✉ Email this page to a colleague

Average Pharmacy Cost for NUVIGIL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NUVIGIL 150 MG TABLET | 60505-4847-03 | 34.75200 | EACH | 2025-12-17 |

| NUVIGIL 150 MG TABLET | 63459-0215-30 | 34.75200 | EACH | 2025-12-17 |

| NUVIGIL 150 MG TABLET | 60505-4847-03 | 34.75200 | EACH | 2025-11-19 |

| NUVIGIL 150 MG TABLET | 63459-0215-30 | 34.75200 | EACH | 2025-11-19 |

| NUVIGIL 200 MG TABLET | 63459-0220-30 | 35.06240 | EACH | 2025-11-19 |

| NUVIGIL 200 MG TABLET | 60505-4849-03 | 35.06240 | EACH | 2025-11-19 |

| NUVIGIL 150 MG TABLET | 60505-4847-03 | 34.88229 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NUVIGIL (Modafinil)

Introduction

NUVIGIL, with the active ingredient modafinil, is a prescription wakefulness-promoting agent positioned primarily for the treatment of narcolepsy, shift work sleep disorder, and excessive daytime sleepiness associated with obstructive sleep apnea. Its unique pharmacological profile, characterized by increased cognitive alertness without typical stimulant side effects, has expanded its off-label use into cognitive enhancement markets, significantly influencing its market dynamics. This analysis examines the current market landscape for NUVIGIL, assesses key competitive influences, explores pricing trends, and offers forward-looking price projections.

Market Landscape Overview

Global Market Size and Growth Drivers

The global wakefulness-promoting agents market, driven predominantly by NUVIGIL and competing drugs such as Adderall and armodafinil, was valued at approximately USD 2.4 billion in 2021 and is projected to reach USD 3.5 billion by 2028, with a CAGR of about 6.2%[1]. Increasing diagnosis of sleep disorders, expanding off-label uses concerning cognitive enhancement, and rising awareness among neurological and psychiatric practitioners fuel demand.

Regulatory Environment & Approvals

In the US, NUVIGIL is approved by the FDA for narcolepsy, shift work sleep disorder, and excessive daytime sleepiness from obstructive sleep apnea. Its reputation as a less addictive alternative to traditional stimulants enhances its prescription appeal. Regulatory approvals in other major markets—such as Europe, Japan, and Canada—are similar but more variable, influencing market ingress and pricing.

Competitive Landscape

The core competitors include traditional stimulants like amphetamines, methylphenidate derivatives, and non-stimulant alternatives like armodafinil (sold as Nuvigil), with the latter sharing a similar mechanism. The key edge held by NUVIGIL lies in its lower abuse potential and enhanced tolerability, bolstering its market position[2].

Market Segmentation and Geographic Trends

By Application:

- Medical Use: Narcolepsy (~40%), shift work disorder (~35%), OSA-related sleepiness (~15%), others (~10%).

- Off-label & Cognitive Enhancements: Estimated to constitute approximately 20-25% of total sales, especially in the US and certain European markets.

Regional Insights:

- United States: Dominates due to high prevalence rates and favorable regulatory positioning.

- Europe: Growing acceptance but with slower adoption driven by regulatory hurdles.

- Asia-Pacific: Emerging market potential with increasing awareness but constrained by regulatory and cost barriers.

Pricing Trends and Factors

Current Price Landscape

In the US, NUVIGIL's wholesale acquisition cost (WAC) for a 30-tablet dose (200 mg) ranges from USD 12 to USD 22, depending on pharmacy and insurance arrangements[3]. Patient-specific retail prices often vary, with out-of-pocket costs between USD 15 to USD 50 per tablet.

Pricing Influencers

- Patent Status & Generics: As of 2023, NUVIGIL remains under patent protection, preventing generic competition and maintaining high prices.

- Market Penetration & Prescriber Preferences: Clinicians favor NUVIGIL for its safety profile, which sustains premium pricing.

- Insurance Coverage: Reimbursement policies influence consumer access and price sensitivity.

- Alternative Treatments: The availability and popularity of generics for armodafinil and stimulants influence perceived value and pricing strategies.

Future Price Projections

Market Dynamics Influencing Projections

- Patent Expiry & Generics: Expected around 2027-2028, which could lead to significant price declines, similar to other branded pharmaceuticals.

- Off-Label Use and Cognition Market: Continued ABC expansion could temporarily sustain high prices due to increased demand outside approved indications.

- Regulatory Changes & Adoption: Shifts in legal frameworks regarding cognitive enhancement may either restrict or expand market access.

- Manufacturing & Supply Chain Stability: Cost efficiencies following patent expiration and potential biosimilar entries could reduce prices.

Forecasted Pricing Trends (2023-2030)

| Year | Price per 30-tablet pack (USD) | Factors |

|---|---|---|

| 2023 | USD 20 - USD 22 | Patent protection, high demand, off-label use |

| 2024-2025 | USD 19 - USD 21 | Growing competition from branded armodafinil, insurance influence |

| 2026 | USD 18 - USD 19 | Approaching patent expiry, pricing adjustments |

| 2027-2028 | USD 10 - USD 15 | Likely patent expiry, emergence of generics |

| 2029-2030 | USD 8 - USD 12 | Market saturation with generics, SKU diversification |

(Note: Exact prices depend on regional factors, regulatory updates, and market dynamics.)

Implications for Stakeholders

- Manufacturers: Strategic patent management and early entry into generic production are vital for maintaining profitability.

- Investors: Potential revenue streams diminish post-patent expiry but opening opportunities in off-label and cognitive markets.

- Healthcare Providers: Cost considerations influence prescribing habits; high prices could limit access post-patent.

- Patients & Payers: Price reductions post-generic entry may enhance accessibility but could impact formulation quality or branding.

Conclusion

NUVIGIL maintains a strong market position through its pharmacological profile, safety advantages, and limited generic competition until at least 2027. Price projections indicate stable premium pricing until patent expiration, after which generics are expected to precipitate substantial price declines. The expanding off-label cognitive enhancement market presents an additional revenue stream but introduces regulatory and reimbursement uncertainties. Stakeholders must balance innovation, regulatory shifts, and market dynamics to optimize positioning.

Key Takeaways

- The global wakefulness-promoting drugs market is growing, driven by sleep disorder prevalence and off-label cognitive use.

- NUVIGIL’s patent protection sustains high prices through 2027, with current retail costs around USD 20-22 per 30-tablet pack.

- Price competition from generics post-2027 could reduce costs by approximately 50% or more.

- Market expansion into cognitive enhancement will influence demand, pricing, and regulatory landscape.

- Strategic patent management and early generic incorporation are essential for sustaining profitability.

FAQs

-

What is the expected timeline for generic versions of NUVIGIL?

Patent expiry is anticipated around 2027-2028, after which generic versions are likely to enter the market, significantly affecting pricing. -

How does NUVIGIL compare to traditional stimulants in terms of safety and efficacy?

NUVIGIL offers a lower abuse potential and fewer side effects compared to stimulants like amphetamines, while providing comparable wakefulness support for approved indications. -

What are the primary off-label uses influencing NUVIGIL's market?

Off-label use for cognitive enhancement in healthy individuals is growing, although it remains unapproved by regulatory bodies and varies by region. -

How do insurance reimbursement policies impact NUVIGIL pricing?

Insurance coverage can significantly reduce out-of-pocket costs, influencing demand and perceived value; however, reimbursement policies vary globally and can affect market access. -

What potential regulatory changes could influence NUVIGIL’s future market?

Changes in drug classification, off-label use regulation, or approval of competing generics can shift the market landscape, potentially impacting pricing and sales volume.

Sources:

[1] Grand View Research, "Wakefulness-Promoting Agents Market Size & Trends," 2022.

[2] FDA Drug Approvals and Safety Reports, 2021-2022.

[3] Pharmacy Benefit Management Data, 2023.

More… ↓