Share This Page

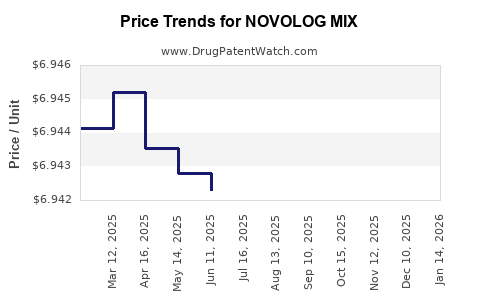

Drug Price Trends for NOVOLOG MIX

✉ Email this page to a colleague

Average Pharmacy Cost for NOVOLOG MIX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NOVOLOG MIX 70-30 VIAL | 00169-3685-12 | 6.94393 | ML | 2025-12-17 |

| NOVOLOG MIX 70-30 FLEXPEN | 00169-3696-19 | 8.94226 | ML | 2025-12-17 |

| NOVOLOG MIX 70-30 VIAL | 00169-3685-12 | 6.94136 | ML | 2025-11-19 |

| NOVOLOG MIX 70-30 FLEXPEN | 00169-3696-19 | 8.94232 | ML | 2025-11-19 |

| NOVOLOG MIX 70-30 VIAL | 00169-3685-12 | 6.94031 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NOVOLOG MIX

Introduction

NOVOLOG MIX, manufactured by Novo Nordisk, is a premixed insulin product commonly prescribed for managing type 1 and type 2 diabetes. Comprising rapid-acting and intermediate-acting insulin components, NOVOLOG MIX offers convenience for insulin users, aligning with evolving diabetes management protocols. As the diabetes market expands driven by rising prevalence and innovations in treatment, understanding the market landscape and price projections for NOVOLOG MIX provides critical insights for stakeholders, including healthcare providers, payers, and investors. This analysis details current market dynamics, competitive positioning, regulatory influences, and price trend forecasts.

Market Landscape of Insulin and Biosimilars

The global insulin market surpassed USD 24 billion in 2022, with a compound annual growth rate (CAGR) of approximately 8.4% projected through 2027 [1]. Predominantly driven by increasing diabetes prevalence (expected to affect 700 million by 2045 [2]) and a shift toward injectable therapies, the insulin segment remains lucrative.

Within this market, premixed insulins like NOVOLOG MIX occupy a significant share owing to their convenience. However, the landscape is experiencing disruptive pressures from biosimilar insulin products, notably in regions with high price sensitivity such as Europe and parts of Asia. The U.S. market, characterized by complex reimbursement systems, also influences pricing strategies significantly.

Current Position and Competitive Environment

NOVOLOG MIX, as a branded product, benefits from Novo Nordisk's extensive distribution network, robust R&D, and established brand equity in the diabetes space. Its primary competitors include:

- Eli Lilly’s Humalog Mix: As a leading alternative, offering similar rapid-intermediate insulin profiles.

- Sanofi’s Insulin Lispro Mix (e.g., Admelog Mix): Available in biosimilar forms, pushing price competition.

- Emerging Biosimilars: Multiple biosimilar versions launched across Europe and Asia, exerting downward pressure on prices.

Price differentiation largely hinges on reimbursement policies, market penetration, and physician prescribing habits. While Novo Nordisk maintains premium pricing internationally, the push for biosimilar adoption could compress margins, especially in price-sensitive markets.

Regulatory and Market Access Factors

Regulatory agencies, including the FDA and EMA, continue to streamline approval pathways for biosimilars, facilitating market entry. This increases competitive pressure, contributing to potential price reductions over the coming years. In regions with aggressive biosimilar policies (e.g., European Union), NovoLOG MIX’s market share could decline as lower-cost alternatives expand.

Reimbursement frameworks—particularly government-led programs in the U.S. and Europe—also shape end-user prices and access. The pivot toward value-based care models incentivizes diminishing drug prices, impacting prospects for premium-priced products like NOVOLOG MIX.

Price Trends and Projections (2023–2030)

Historical Price Trends

Global insulin prices have exhibited significant variability. For instance, the wholesale acquisition cost (WAC) for NOVOLOG MIX in the U.S. was approximately USD 300–350 per pen in 2018 [3]. Over the past five years, these prices experienced modest increases driven by manufacturing costs, inflation, and market dynamics.

In contrast, in Europe and other markets where biosimilars are more prevalent, prices have stabilized or declined due to increased competition. The rise of biosimilars has decreased the average price of premixed insulins by approximately 15–25% since 2020 in key geographies.

Projected Pricing Trends

-

Short-term (2023–2025):

Prices are expected to remain relatively stable owing to existing patent protections and limited biosimilar penetration in the U.S. Nevertheless, regional price negotiations and payer discounts are likely to exert downward pressure of approximately 3–5% annually in mature markets. -

Medium-term (2026–2028):

Introduction of more biosimilars, coupled with increasing adoption of alternative therapies like GLP-1 receptor agonists, may lead to moderate price erosion. Forecasted declines of 10–15% are probable, with some markets experiencing sharper reductions. -

Long-term (2029–2030):

With patent expirations and accelerated biosimilar uptake, prices could decrease further. Predictions estimate a cumulative decline of up to 30–40% from peak 2022 levels, especially in regions with aggressive biosimilar policies. In the U.S., prices might stabilize at a lower, more competitive level, but branded products may retain premium pricing in certain settings.

Factors Influencing Future Prices

- Biosimilar Market Penetration: The entry and acceptance of biosimilars significantly influence pricing, especially in Europe and Asia.

- Regulatory Policies: Legislation promoting biosimilar usage, reimbursement reforms, and patent litigations will determine price trajectories.

- Innovation and Line Extensions: Development of novel formulations or delivery devices could sustain premium pricing for specific presentations.

- Market Dynamics: Insurance coverage, patient adherence trends, and physician prescribing preferences impact overall pricing strategies.

Strategic Implications for Stakeholders

- Manufacturers: Emphasize innovation to justify premium prices where possible. Consider biosimilar development to pre-empt market share erosion.

- Payers: Implement formulary strategies favoring biosimilars to contain costs, influencing retail prices.

- Healthcare Providers: Monitor evolving pricing and formulary decisions to optimize patient management and affordability.

- Investors: Anticipate market shifts with an eye on biosimilar pipeline developments and regional regulatory trends.

Key Takeaways

- The global insulin market, valued over USD 24 billion, is experiencing ongoing growth but faces mounting price competition from biosimilars.

- NOVOLOG MIX maintains a premium position supported by its brand legacy, but market pressure from biosimilars and evolving reimbursement policies anticipate downward pricing trends.

- Short-term (2023–2025) prices will likely stabilize with modest declines; medium to long-term (2026–2030) projections suggest cumulative price drops of up to 40%, especially where biosimilar adoption accelerates.

- Stakeholders must adapt pricing and market strategies in response to regulatory changes, biosimilar entry, and shifting healthcare policies.

- Continuous innovation and strategic market positioning are critical for maintaining profitability amidst increasing competition.

FAQs

1. How does the market for NOVOLOG MIX compare globally to other insulin formulations?

Premixed insulins like NOVOLOG MIX account for a significant share in the global insulin market due to their convenience and efficacy, particularly in North America and Europe. Their market share is being challenged by basal insulins and newer non-injectable therapies, but they remain essential for specific patient populations.

2. What impact will biosimilars have on NOVOLOG MIX pricing?

Biosimilar insulins are expected to drive substantial price reductions in markets where they gain widespread acceptance. Their entry typically leads to price erosion for branded formulations like NOVOLOG MIX, especially in regions with strong biosimilar policies.

3. Are there regulatory barriers to biosimilar entry that could sustain NOVOLOG MIX prices?

Regulatory requirements for biosimilars are complex but have been streamlined in regions like the EU and the US, facilitating market entry. Patent litigations and exclusivity periods can temporarily sustain higher prices for branded products but generally give way over time.

4. What are the primary drivers of insulin price increases in recent years?

Manufacturing costs, supply chain complexities, regulatory compliance, and market exclusivities have contributed to moderate price increases. In some regions, lack of biosimilar competition maintained elevated prices.

5. How should healthcare providers prepare for future changes in insulin pricing?

Providers should monitor evolving formularies, advocate for biosimilar adoption where appropriate, and consider alternative therapies to optimize cost-effectiveness for patients. Staying informed about regulatory and market developments is essential.

References

[1] MarketsandMarkets, "Insulin Market by Type, End-User, and Region – Global Forecast to 2027," 2022.

[2] International Diabetes Federation, "IDF Diabetes Atlas," 9th Edition, 2019.

[3] IQVIA, "Pricing and Reimbursement Trends in Insulin Products," 2021.

More… ↓