Share This Page

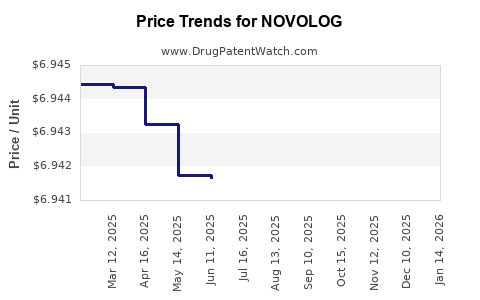

Drug Price Trends for NOVOLOG

✉ Email this page to a colleague

Average Pharmacy Cost for NOVOLOG

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NOVOLOG PENFILL 100 UNIT/ML | 00169-3303-12 | 8.56807 | ML | 2025-12-17 |

| NOVOLOG 100 UNIT/ML FLEXPEN | 00169-6339-10 | 8.93810 | ML | 2025-12-17 |

| NOVOLOG 100 UNIT/ML VIAL | 00169-7501-11 | 6.93911 | ML | 2025-12-17 |

| NOVOLOG MIX 70-30 VIAL | 00169-3685-12 | 6.94393 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NOVOLOG

Introduction

NOVOLOG (insulin aspart) is a rapid-acting insulin analog marketed by Novo Nordisk, primarily used for managing blood sugar levels in individuals with diabetes mellitus. Since its approval, NOVOLOG has carved out a significant share within the healthcare market for insulin therapies, driven by its fast onset and short duration of action. This analysis provides a comprehensive overview of NOVOLOG’s current market landscape, competitive positioning, and future price projections amid evolving healthcare dynamics, regulatory environments, and technological advancements in diabetes management.

Market Overview

Current Market Size

The global insulin market was valued at approximately USD 40 billion in 2022, with rapid-acting insulins accounting for a growing segment due to increasing prevalence of diabetes worldwide. According to the International Diabetes Federation, the global diabetic population is projected to reach 783 million by 2045, fueling sustained demand for insulin products, including NOVOLOG.

Market Segmentation

- Type 1 Diabetes: Requires consistent insulin therapy, with rapid-acting insulins like NOVOLOG preferred for prandial coverage.

- Type 2 Diabetes: Increasing adoption of insulin therapy driven by rising obesity rates and insulin resistance.

- Geography: North America and Europe dominate the market due to high diabetes prevalence, advanced healthcare infrastructure, and reimbursement coverage. Emerging markets in Asia-Pacific show rapid growth potential owing to rising healthcare access and awareness.

Competitive Landscape

NOVOLOG competes with other rapid-acting insulins such as Humalog (insulin lispro), Apidra (insulin glulisine), and biosimilar formulations. Novo Nordisk’s early entry and strong brand recognition afford NOVOLOG a competitive edge, yet price pressures and biosimilar entries pose ongoing challenges.

Factors Influencing the Market

Increasing Diabetes Prevalence

Rising incidence, especially in developing countries, sustains demand. Lifestyle shifts, urbanization, and aging populations contribute significantly.

Technological Innovations

The adoption of insulin pumps, continuous glucose monitoring (CGM), and closed-loop systems increase reliance on fast-acting insulins like NOVOLOG for precise glycemic control.

Regulatory and Reimbursement Dynamics

Regulatory approvals in emerging markets expand access, while reimbursement policies influence affordability and uptake.

Patent and Biosimilar Landscape

Patent expiration timelines and biosimilar development directly impact pricing strategies. Novo Nordisk's patent for NOVOLOG is expiring in key jurisdictions, paving the way for biosimilar competition.

Price Trends and Projections

Current Pricing Landscape

In the United States, the average wholesale price (AWP) for NOVOLOG is approximately USD 300-350 per vial, with pen formulations costing around USD 80-100 per dose. These prices are subject to insurance negotiations and discount programs.

Price Drivers

- Market Competition: Entry of biosimilars can induce price reductions, typically by 10-30% upon market entry.

- Healthcare Policy: US and European initiatives to reduce drug prices may influence future costs.

- Manufacturing and Supply Chain: Cost efficiencies and scale-up impact pricing, especially in emerging markets.

Short-Term Price Projections (Next 1–3 Years)

Given patent expirations scheduled around 2024-2025, expect biosimilar entrants to leverage pricing strategies that could reduce NOVOLOG’s retail prices by 15-25%. Novo Nordisk may respond with value-based pricing, bundled therapies, or patient assistance programs to preserve market share.

Long-Term Price Outlook (3–5 Years)

In markets where biosimilar penetration is robust, a potential price erosion of 25-40% for NOVOLOG’s insulin analogs is anticipated. Conversely, premium pricing may persist in jurisdictions with strong reimbursement and brand loyalty. The integration of digital health tools and personalized medicine may further influence pricing dynamics, emphasizing value over volume.

Impact of Biosimilar Competition

Biosimilar insulins such as Tour’s Insulin Lispro (Eurofins), and soon-to-be-launched biosimilars, will contribute to price compression. Historically, biosimilars in Europe achieved 20-30% discounts compared to innovator prices, a trend likely mirrored in the insulin sector.

Strategic Outlook

Novo Nordisk’s pipeline expansions, including ultra-rapid insulins and smart insulin formulations, could redefine pricing strategies, emphasizing therapeutic innovation. The integration of telehealth, digital glucose monitoring, and closed-loop systems will augment the premium value of NOVOLOG and related therapies.

Regulatory and Policy Implications

The global shift towards affordability initiatives, such as the US Inflation Reduction Act and European price controls, will exert downward pressure on insulin prices. Governments’ push for biosimilar adoption aims to foster market competition, which may expedite price declines but could also impact profitability margins.

Conclusion

The market for NOVOLOG remains robust, driven by persistent diabetes prevalence and advances in diabetes technology. However, impending patent expiries and biosimilar introductions forecast a medium-term decline in pricing. Novo Nordisk’s strategic focus on innovation, digital integration, and value-based care will be pivotal to maintaining competitiveness.

Key Takeaways

- The global insulin market is projected to grow significantly, fueled by rising diabetes prevalence and technological integration.

- NOVOLOG's pricing will face downward pressure over the next 3-5 years due to biosimilar competition and policy measures.

- In developed markets, premium branding and innovation will sustain higher price points, while emerging markets will see more aggressive price reductions.

- Digital health advancements will create opportunities for differentiated value propositions, potentially sustaining premium pricing.

- The evolving regulatory landscape emphasizes affordability, influencing future price strategies and market share.

FAQs

Q1: How will biosimilar entry affect NOVOLOG’s market share and price?

Biosimilar insulins are expected to reduce NOVOLOG’s market share in affected regions, with prices likely decreasing by 15-30% upon biosimilar launch, driven by competitive pricing strategies to gain market penetration.

Q2: What factors are most likely to influence NOVOLOG’s price in the next five years?

Patent expirations, biosimilar competition, healthcare policies, reimbursement frameworks, and technological innovations in diabetes management will be key determinants.

Q3: Are there geographic variations in NOVOLOG’s pricing strategies?

Yes. Developed markets like the US and Europe retain higher prices due to better reimbursement systems and brand loyalty, whereas emerging markets will see more rapid price declines driven by price sensitivity and biosimilar availability.

Q4: How does digital health technology impact NOVOLOG’s market outlook?

Digital technologies enhance therapeutic efficacy, patient adherence, and personalized care, enabling value-based pricing and expanded market opportunities for NOVOLOG.

Q5: What strategic moves should Novo Nordisk consider to preserve market position?

Investing in innovation, expanding digital health offerings, forming strategic alliances, and engaging in flexible pricing strategies—such as biosimilar partnerships and patient assistance programs—are vital.

Sources:

[1] International Diabetes Federation. IDF Diabetes Atlas, 9th Edition, 2019.

[2] Market Research Future. Global Insulin Market Overview, 2022.

[3] IQVIA. The Impact of Biosimilars in Diabetes Care, 2021.

[4] Novo Nordisk. NOVOLOG Prescribing Information, 2023.

[5] PhRMA. Biologics and Biosimilars Market Dynamics, 2022.

More… ↓