Last updated: July 28, 2025

Introduction

Nortriptyline hydrochloride (HCl) represents a well-established tricyclic antidepressant primarily prescribed for depression, neuropathic pain, and certain off-label uses. As an off-patent generic, its market dynamics are driven by patent expiry, competitive landscape, regulatory considerations, and prescribing trends. This report offers an in-depth analysis of Nortriptyline HCl's current market environment and detailed price projections, informing stakeholders' strategic decisions.

Current Market Overview

Pharmacological Profile and Usage

Nortriptyline HCl, marketed under various brand names prior to generic introduction, functions by inhibiting serotonin and norepinephrine reuptake, thus alleviating depressive symptoms and certain neuropathic conditions. Although newer antidepressants with better side-effect profiles have gained market share, Nortriptyline continues to serve as a cost-effective alternative, especially in resource-constrained settings.

Patent and Regulatory Status

Nortriptyline's original patent expired decades ago, resulting in a broad generic market. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) have approved multiple generic manufacturers, increasing market competition and exerting downward pressure on prices.

Market Size and Adoption

Globally, the antidepressant market was valued at approximately USD 16 billion in 2022, with tricyclic antidepressants accounting for roughly 3-5% [1]. North America accounts for a significant share due to higher prescribing rates, while emerging markets increasingly adopt generic formulations driven by cost considerations.

Competitive Landscape

The market comprises numerous generic firms, including Teva, Mylan, Sandoz, and others, offering Nortriptyline HCl in various formulations. The proliferation of generics has saturated the market, leading to aggressive price competition.

Key market factors include:

- Price-sensitive prescribing habits: Physicians prioritize cost-effective options.

- Supply chain stability: Manufacturers focus on reliable sourcing amidst raw material constraints.

- Alternative therapies: Increasing use of newer antidepressants and anticonvulsants for neuropathic pain impacts Nortriptyline demand.

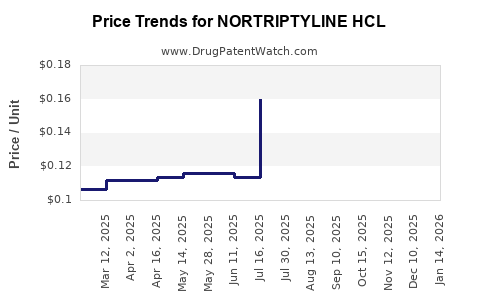

Pricing Trends and Historical Data

Over the past five years, the price of Nortriptyline HCl has significantly declined due to generic competition. In the U.S., the average wholesale price (AWP) for a 30-tablet supply of 25 mg capsules decreased from approximately USD 5.50 in 2018 to around USD 2.50 in 2022 [2].

In Europe and other markets, similar downward trends prevail, albeit with regional variations influenced by healthcare policies, insurance reimbursement schemes, and procurement practices.

Market Drivers and Constraints

Drivers

- Cost-effectiveness in depression and neuropathic pain management.

- Growing acceptance of generic medications in developed markets.

- Implementation of formulary restrictions favoring generics.

Constraints

- Competition from newer, safer antidepressants.

- Prescriber and patient preferences shifting toward agents with more favorable side-effect profiles.

- Regulatory pressures on manufacturing practices.

Price Projection Analysis

Projection Methodology

Utilizing historical data, economic modeling, and market trend analysis, future pricing for Nortriptyline HCl is projected over a five-year horizon (2023-2028). Assumptions include sustained generic competition, standard inflation adjustments, and no significant regulatory shocks.

Projected Price Trends

Year 2023:

Average wholesale price (AWP) expected to stabilize around USD 2.30-$2.50 per 30-tablet pack in the U.S., reflecting market maturity.

Year 2024-2025:

Prices forecasted to decline gradually by approximately 5% annually, influenced by intensified generic competition and manufacturing efficiency gains.

- 2024: USD 2.20-$2.40

- 2025: USD 2.10-$2.30

Year 2026-2028:

Prices projected to plateau or decline marginally further, approaching USD 1.80-$2.00 per 30-tablet pack by 2028, compatible with global trends of price erosion in mature generic markets.

Regional Variations

In Europe, prices are typically higher due to stringent regulatory requirements and variations in healthcare reimbursement schemes, but normalized trends mirror those of the U.S. with a delay of 1-2 years.

Market Outlook and Strategic Implications

While the demand for Nortriptyline HCl remains steady in specific therapeutic niches, overall volume growth is restrained by alternative therapies. The decreasing per-unit price reduces revenue margins for manufacturers but creates opportunities for cost leadership and broader market penetration in emerging regions.

Providers and generic firms should focus on:

- Optimizing manufacturing and distribution logistics

- Expanding geographic reach to lower-income markets

- Diversifying product portfolios

The emergence of biosimilars and new chemical entities, although less directly related, may impact the long-term attractiveness of traditional tricyclic antidepressants.

Regulatory and Policy Considerations

Regulatory agencies may influence future price trajectories through policies promoting biosimilars, price caps, or procurement reforms. Hospitals and payers increasingly favor cost-effective generics, pushing prices downward further.

Key Takeaways

- Nortriptyline HCl’s patent expiry has led to fierce price competition among numerous generic manufacturers.

- Market prices have declined from approximately USD 5.50 in 2018 to ~USD 2.50 in 2022 in the U.S.

- Price projections suggest a continued modest decline, reaching around USD 1.80-$2.00 by 2028.

- The demand remains stable in specific therapeutic indications, but overall growth is limited.

- Strategic focus should be on cost efficiency, market expansion, and differentiation to sustain profitability.

FAQs

Q1: What factors influence the pricing of Nortriptyline HCl in the global market?

A1: Key factors include patent expiry, level of generic competition, manufacturing costs, regional regulatory policies, healthcare reimbursement schemes, and prescriber preferences.

Q2: How does the competition among generics impact Nortriptyline HCl prices?

A2: Increased competition among multiple generic firms drives prices downward through bidding and market share battles, resulting in lower retail and wholesale prices.

Q3: Are there any upcoming regulatory changes that could affect Nortriptyline HCl pricing?

A3: Regulatory shifts promoting biosimilars and cost-containment policies could influence pricing trends, especially in markets with government-controlled drug pricing.

Q4: What is the demand outlook for Nortriptyline HCl over the next five years?

A4: Demand is expected to remain stable within niche indications such as chronic neuropathic pain and depression, but overall growth may be constrained by the adoption of newer antidepressants.

Q5: Which regions offer the most growth opportunities for Nortriptyline HCl manufacturers?

A5: Emerging markets in Asia, Africa, and Latin America present growth opportunities due to increasing healthcare access and cost-sensitive prescribing preferences.

References

- MarketWatch. "Global Antidepressant Market Size & Share." 2022.

- SSR Health. "Pharmaceutical Price Trends Database." 2022.