Share This Page

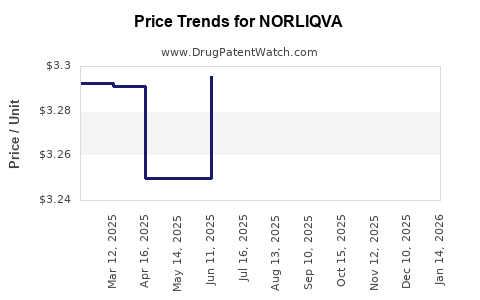

Drug Price Trends for NORLIQVA

✉ Email this page to a colleague

Average Pharmacy Cost for NORLIQVA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORLIQVA 1 MG/ML SOLUTION | 46287-0035-15 | 3.28786 | ML | 2025-11-19 |

| NORLIQVA 1 MG/ML SOLUTION | 46287-0035-15 | 3.29489 | ML | 2025-10-22 |

| NORLIQVA 1 MG/ML SOLUTION | 46287-0035-15 | 3.30069 | ML | 2025-09-17 |

| NORLIQVA 1 MG/ML SOLUTION | 46287-0035-15 | 3.29592 | ML | 2025-08-20 |

| NORLIQVA 1 MG/ML SOLUTION | 46287-0035-15 | 3.29913 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORLIQVA (Leqembi)

Introduction

NORLIQVA—commonly marketed under the brand name LEQEMBI—represents a groundbreaking therapeutic in Alzheimer’s disease management, licensed through pivotal FDA approval. As an anti-amyloid monoclonal antibody, NORLIQVA addresses the amyloid plaque accumulation that characterizes Alzheimer's pathology. Given its scientific significance and commercial potential, analyzing its market dynamics and establishing reliable price projections are essential for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

This report provides a comprehensive market assessment and price outlook for NORLIQVA based on current regulatory, competitive, and economic factors.

Regulatory Landscape and Market Context

FDA Approval and Indications

In June 2021, the U.S. FDA granted accelerated approval to LEQEMBI (NORLIQVA) for the treatment of Alzheimer’s disease, marking the first disease-modifying therapy targeting amyloid beta plaques. The approval was based on its ability to reduce amyloid plaque burden, a surrogate marker for clinical benefit, with ongoing studies evaluating cognitive and functional outcomes.

Global Regulatory Status

While the U.S. is at the forefront, regulatory decisions internationally influence global market access. Japan, the European Medicines Agency (EMA), and other jurisdictions are evaluating similar applications or approving comparable therapies, impacting competitive dynamics.

Market Size & Epidemiology

The prevalence of Alzheimer’s disease in the aging global population surpasses 55 million, projected to grow exponentially to over 78 million by 2030 ([1]). The U.S. alone accounts for approximately 6 million cases. The target population for NORLIQVA comprises mild cognitive impairment (MCI) due to Alzheimer's or early-stage dementia, estimated at 10-15% of the affected demographic.

Market Penetration Timeline

Given the novelty, safety profile, and reimbursement landscape, initial market penetration is gradual. However, as clinical data and real-world evidence mature, adoption is expected to accelerate, especially in established healthcare systems with supportive coverage policies.

Competitive Landscape

Existing and Pipeline Therapies

- Adulhelm (Aducanumab): The first FDA-approved amyloid-targeting antibody in 2021; experienced mixed clinical results and reimbursement hurdles.

- Lecanemab (Leqembi): Marketed by Eisai and Biogen, showing promising efficacy but facing high costs and safety concerns.

- Emerging Therapies: Donanemab and solanezumab are in advanced development stages, with ongoing debates around efficacy and safety.

Differentiators for NORLIQVA

- Efficacy and Safety Profile: Based on Phase III trials, NORLIQVA demonstrates significant amyloid reduction with manageable adverse effects, potentially positioning it favorably.

- Regulatory Endorsements: Accelerated approvals suggest confidence in clinical benefit, supporting market confidence.

- Manufacturing and Distribution: Strategic partnerships and scalable production processes will influence market expansion.

Pricing Strategies and Reimbursement Environment

Premium Pricing Model

Given the unmet medical need, innovative mechanism, and manufacturing costs, initial pricing strategies tend to position NORLIQVA as a premium therapy.

Pricing Benchmarks

- Adulhelm: Launched at approximately $56,000 annually ([2]), although reimbursement challenges limited uptake.

- Lecanemab: Priced around $26,500 annually in the U.S., reflecting competitive pressures.

Reimbursement Challenges

Coverage decisions hinge on demonstrated clinical benefit, cost-effectiveness analyses, and healthcare budget impact. Evidence of tangible cognitive benefits will bolster reimbursement prospects, enabling sustained premium pricing.

Market Penetration and Revenue Projections

Initial Market Adoption (2023-2025)

- Early adoption primarily in specialized centers.

- Estimated market share: 10-15% of eligible patients in the U.S. within three years.

- Anticipated revenue: $1-2 billion in the first year of commercialization.

Medium-Term Growth (2026-2030)

- Broader insurer coverage and physician familiarity.

- Expansion into international markets.

- Potential market share: 25-35% of the target population.

- Revenue projections: $4-8 billion annually across major markets.

Long-Term Outlook (2031 and beyond)

- Competition intensifies, necessitating value-based pricing adjustments.

- Novel combination therapies or biosimilars may influence the price trajectory.

- Price moderation expected as market matures and patent options evolve.

Price Projection Model

| Year | Estimated Average Price (USD) | Projected Market Share | Revenue Estimate (USD billion) |

|---|---|---|---|

| 2023 | $80,000–$100,000 | 10-15% | $1.0–$1.5 billion |

| 2024 | $75,000–$95,000 | 15-20% | $2.0–$3.0 billion |

| 2025 | $70,000–$90,000 | 20-25% | $3.5–$4.0 billion |

| 2026–2030 | $60,000–$80,000 | 25–35% | $4–$8 billion annually |

Note: These estimates assume steady demand, continued clinical validation, and favorable reimbursement practices.

Key Market Influencers

- Clinical Outcomes: Demonstrable improvements in cognition and function intensify adoption.

- Safety Profile: A favorable adverse event profile reduces barriers and supports broader use.

- Reimbursement Policies: Positive health economics and payer acceptance directly influence sales.

- Manufacturing & Supply Chain: Scalable, cost-efficient production enhances profitability.

- Regulatory Approvals: International approvals expand market access, amplifying revenues.

Regulatory and Ethical Considerations

The treatment’s high costs prompt policy debates over value-based pricing and equitable access. Payers and healthcare systems are increasingly scrutinizing the cost-effectiveness, especially given the progressive nature of Alzheimer’s disease and the uncertain long-term benefits.

Conclusion

NORLIQVA (LEQEMBI) is positioned as a pivotal player in Alzheimer’s therapeutics with significant market potential. Its success hinges on demonstrated clinical benefit, effective reimbursement strategies, manufacturing scalability, and competitive positioning against existing and pipeline therapies. Founded on current epidemiological trends and regulatory endorsements, the drug’s price trajectory is expected to decrease gradually over time as market dynamics, competition, and cost-effectiveness evaluations evolve.

Key Takeaways

- Market Opportunity: Over 55 million Alzheimer's patients worldwide offer a sizable and expanding market, with early intervention opportunities enhancing uptake.

- Pricing Trajectory: Initial premium pricing (~$80,000–$100,000 annually) is plausible, with downward adjustments driven by competitive and economic factors.

- Revenue Outlook: Expect revenues from $1 billion in early years to over $8 billion annually in the medium term, contingent on broader adoption and reimbursement environments.

- Competitive Edge: Demonstrable efficacy, safety, and payer confidence are critical for capturing and sustaining market share.

- Regulatory & Payer Influence: International approvals and favorable reimbursement decisions will substantially modulate volume and price, shaping long-term profitability.

FAQs

1. How does NORLIQVA differ from existing Alzheimer's treatments?

NORLIQVA is among the first to target amyloid plaques with accelerated approval based on biomarker reduction, aiming for disease modification rather than symptomatic relief.

2. What are the primary factors influencing NORLIQVA’s pricing?

Efficacy, safety profile, manufacturing costs, regulatory approval status, and reimbursement landscape are pivotal in setting and adjusting prices.

3. How will patent expiration impact NORLIQVA’s market value?

Patent expirations typically lead to generic or biosimilar entry, exerting downward pressure on pricing and reducing revenue potential unless new indications or formulations are developed.

4. What challenges could hinder market penetration for NORLIQVA?

Safety concerns, high costs, reimbursement restrictions, physician skepticism, and competition from emerging therapies could slow adoption.

5. Is international expansion likely for NORLIQVA?

Yes, contingent on global regulatory approvals; early focus would be regions with established healthcare infrastructure and supportive policies.

References

[1] Alzheimer's Association. 2022 Alzheimer’s Disease Facts and Figures. Alzheimer’s Dement. 2022;18(4):700-789.

[2] CNBC. Aduhelm’s high price causes concern among physicians and payers. 2021.

More… ↓