Share This Page

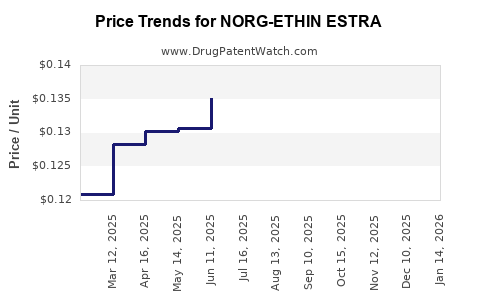

Drug Price Trends for NORG-ETHIN ESTRA

✉ Email this page to a colleague

Average Pharmacy Cost for NORG-ETHIN ESTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68462-0309-84 | 0.12304 | EACH | 2025-12-17 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68180-0840-71 | 0.12304 | EACH | 2025-12-17 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68180-0840-73 | 0.12304 | EACH | 2025-12-17 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68462-0309-29 | 0.12304 | EACH | 2025-12-17 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68462-0309-84 | 0.12372 | EACH | 2025-11-19 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68180-0840-71 | 0.12372 | EACH | 2025-11-19 |

| NORG-ETHIN ESTRA 0.25-0.035 MG | 68462-0309-29 | 0.12372 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORG-ETHIN ESTRA

Introduction

NORG-ETHIN ESTRA, a combined hormonal contraceptive, has garnered attention for its efficacy and favorable safety profile. As a combination of norethindrone (NORG) and ethinylestradiol (ESTRA), it fits within the broader category of oral contraceptives, which boasts a mature market with evolving treatment paradigms and pricing dynamics. This analysis explores its market position, competitive landscape, key drivers, regulatory status, and price trend projections.

Market Landscape and Demand Drivers

Global Contraceptive Market Context:

The global contraceptive market is expected to reach USD 21.4 billion by 2028, with a CAGR of approximately 5.7% from 2021 to 2028 [1]. Oral contraceptives account for the lion’s share, driven by their ease of use and high efficacy. The rise in awareness surrounding women’s reproductive health, alongside increasing acceptance of hormonal contraceptives, underpins robust demand.

NORG-ETHIN ESTRA’s Market Position:

As a well-established formulation, NORG-ETHIN ESTRA is positioned within a mature product segment. It competes against generics and branded equivalents, including products like Yasmin, Yaz, and other combination pills. Its market penetration depends heavily on factors such as physician prescribing habits, insurance coverage, and consumer preferences.

Regulatory and Geographic Considerations:

The drug's approval status varies by jurisdiction; in the U.S., NORG-ETHIN ESTRA is likely classified as a prescription drug with specific indications. Its market availability in emerging markets, such as India and parts of Southeast Asia, influences volume and potential revenue streams.

Impact of Alternative Contraceptive Modalities:

The growing popularity of long-acting reversible contraceptives (LARCs), such as IUDs and implants, presents a competitive challenge. However, oral contraceptives remain the most prescribed modality, maintaining significant market relevance.

Competitive Landscape

Existing Formulations:

NORG-ETHIN ESTRA faces competition from both branded and generic versions of combined oral contraceptives (COCs). Companies like Bayer, Teva, and Sandoz produce competing formulations with similar active ingredients.

Innovation and Differentiation Factors:

In this mature market, product differentiation hinges on packaging, formulation convenience, side-effect profiles, and safety data. Newer formulations offering reduced hormonal doses or extended cycle options have recently gained traction, potentially impacting NORG-ETHIN ESTRA’s market share.

Pricing Strategies:

Manufacturers often adopt aggressive pricing for generics to capture market share. Premium branded products tend to command higher prices, leveraging brand recognition and perceived quality.

Regulatory and Patent Considerations

Patent Status and Exclusivity:

NORG-ETHIN ESTRA's patent landscape affects its pricing and market exclusivity. Once patents expire, generic entrants typically introduce lower-priced versions, exerting downward pressure on prices.

Regulatory Environment Impact:

Regulatory approvals, such as FDA clearance or EMA authorization, influence market access and reimbursement policies, which directly impact pricing strategies.

Price Trends and Projection Models

Historical Pricing Patterns:

Prescription prices for hormonal contraceptives generally show slow inflation, aligned with general pharmaceutical inflation rates (~2-4% annually). However, specific formulations can diverge due to market competition and regulatory changes.

Current Price Benchmarks:

In the United States, the average wholesale price (AWP) for branded COCs ranges from USD 35 to USD 60 per cycle, whereas generics are often priced between USD 10 and USD 30 [2]. In emerging markets, prices are typically lower, influenced by local market dynamics and procurement channels.

Projected Price Trajectory (Next 3-5 Years):

-

Scenario 1: Patent Extension or Market Exclusivity

If NORG-ETHIN ESTRA maintains patent protection or exclusive rights, prices might stabilize or even see slight increases (2-3%) driven by inflation and production costs. -

Scenario 2: Patent Expiry and Generic Entry

Upon patent expiration, prices could decline sharply, with generics undercutting branded equivalents by 30-50%. The initial post-expiry period often witnesses a price drop of approximately 20-30% within the first year. -

Scenario 3: Market Expansion in Emerging Economies

Entry into price-sensitive markets can lead to significant price reductions, possibly stabilizing around USD 5-10 per cycle in the long term due to intense competition.

Influencing Factors:

- Regulatory approvals and patent litigations could alter price trajectories.

- Consumer preferences towards newer formulations or contraceptive methods affect demand and pricing.

- Healthcare reimbursement policies influence access and pricing dynamics, especially in developed markets.

Opportunities and Risks

Opportunities:

- Growing acceptance and demand for oral contraceptives across developing regions.

- Potential for formulation improvements that address safety or convenience.

- Expansion into new geographic territories with unmet contraceptive needs.

Risks:

- Patent cliffs and market saturation.

- Cross-competition from LARCs and non-hormonal contraceptives.

- Regulatory hurdles and reimbursement challenges.

- Pricing pressures from generic entrants.

Summary and Strategic Insights

NORG-ETHIN ESTRA occupies a stable but highly competitive segment within the global contraceptive market. Its future pricing trajectory hinges on patent status, regulatory developments, and competitive pressures. In mature markets, prices are likely to remain relatively steady unless patent protections expire. Exposure to emerging markets offers growth potential but at reduced price points.

Effective strategies for stakeholders include leveraging differentiated formulations, optimizing cost efficiencies, and aligning with evolving regional healthcare policies to sustain profitability.

Key Takeaways

- The global contraceptive market offers steady demand, with oral contraceptives maintaining key market share amidst evolving preferences.

- Price projections suggest stability in the short term under patent protection, with significant declines upon patent expiry due to generic competition.

- Geographic expansion into emerging markets offers growth but necessitates price adjustments aligned with local financial contexts.

- Continued innovation and regulatory navigation are critical for maintaining competitive advantages and favorable pricing.

- Monitoring patent statuses, healthcare policies, and competitive launches is essential for accurate future pricing forecasts.

FAQs

1. How does patent expiration influence the price of NORG-ETHIN ESTRA?

Patent expiration typically leads to the entry of generic competitors, significantly reducing prices—often by 30-50%—due to increased competition and lower production costs for generics.

2. What regional factors most heavily impact NORG-ETHIN ESTRA pricing?

Regulatory approval procedures, reimbursement policies, healthcare infrastructure, and local purchasing power are primary drivers affecting regional pricing. Developed markets tend to sustain higher prices, whereas emerging markets favor lower-cost options.

3. Are there significant regulatory hurdles affecting NORG-ETHIN ESTRA’s market expansion?

Yes. Variations in regulatory requirements, such as clinical data submissions and approval timelines, can delay or restrict market access, impacting overall pricing strategies and revenue potential.

4. What competitive strategies are critical for maintaining NORG-ETHIN ESTRA’s market share?

Differentiation through formulation improvements, strategic pricing, strong branding, and expanding geographic reach are vital. Moreover, staying ahead of regulatory developments and patent protections is crucial.

5. How does the rise of alternative contraceptive methods influence NORG-ETHIN ESTRA’s market?

The emergence of LARCs and non-hormonal options may reduce the share of oral contraceptives. However, the convenience and familiarity of daily pills maintain their relevance, especially in markets with limited alternatives.

References

[1] Research and Markets. (2022). Global Contraceptive Market Forecast, 2021-2028.

[2] GoodRx. (2022). Average Wholesale Price (AWP) of Birth Control Pills.

More… ↓