Share This Page

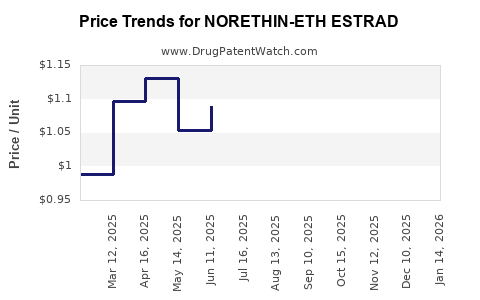

Drug Price Trends for NORETHIN-ETH ESTRAD

✉ Email this page to a colleague

Average Pharmacy Cost for NORETHIN-ETH ESTRAD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-29 | 1.00641 | EACH | 2025-12-17 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-84 | 1.00641 | EACH | 2025-12-17 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-90 | 1.00641 | EACH | 2025-12-17 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-29 | 1.09649 | EACH | 2025-11-19 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-90 | 1.09649 | EACH | 2025-11-19 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-84 | 1.09649 | EACH | 2025-11-19 |

| NORETHIN-ETH ESTRAD 1 MG-5 MCG | 68462-0657-90 | 1.10097 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORETHIN-ETH ESTRAD

Introduction

NORETHIN-ETH ESTRAD is an oral contraceptive combining norethindrone and ethinylestradiol, marketed primarily for hormonal contraception and hormone regulation. Its market positioning hinges on efficacy, safety profile, manufacturing costs, regulatory status, and competitive landscape. This analysis evaluates current market dynamics, growth drivers, challenges, and forecasts future pricing trends.

Overview of NORETHIN-ETH ESTRAD

Pharmacology & Indications

NORETHIN-ETH ESTRAD leverages a combined estrogen-progestin formulation to prevent pregnancy. Approved by major regulatory bodies, it is used worldwide, notably in North America, Europe, and parts of Asia, for contraception, menstrual regulation, and treatment of hormonal imbalances.

Regulatory Status

Manufactured by leading pharmaceutical companies under strict regulatory oversight—FDA, EMA approval affirm efficacy and safety.

Market Share & Competition

It faces competition from both branded and generic oral contraceptives, including drugs with similar hormonal compositions and alternative delivery systems like patches or IUDs. Market share depends on formulation benefits, side effect profiles, and brand recognition.

Market Dynamics

Global Market Size & Growth Rate

The global oral contraceptives market was valued at approximately USD 7.4 billion in 2022, with a CAGR estimate of 4.5% projected through 2030 [1]. North America and Europe dominate owing to widespread acceptance and healthcare infrastructure, but Asia-Pacific exhibits rapid growth due to increasing awareness and urbanization.

Drivers

- Rising demand for reversible contraceptive options.

- Increasing focus on reproductive health.

- Expanding availability in emerging markets.

- Advancements in formulation improving safety and tolerability.

Challenges

- Evolving regulatory frameworks.

- Concerns about side effects such as blood clots.

- Competition from non-hormonal contraceptives and long-acting reversible contraceptives (LARCs).

- Pricing pressures from generics and biosimilars.

Pricing Analysis of NORETHIN-ETH ESTRAD

Current Price Point

As of 2023, the retail price of NORETHIN-ETH ESTRAD in North America ranges from USD 20 to USD 40 for a monthly supply, differing by manufacturer, dosage, and healthcare setting. Generic versions further depress prices, with some as low as USD 10-15 per month.

Cost Factors Influencing Price

- R&D investments and patent life (if under patent protection).

- Manufacturing costs — active pharmaceutical ingredient (API) synthesis, formulation, quality control.

- Distribution logistics and regional regulatory fees.

- Market competition and pricing strategies.

Pricing Trends

- Introduction of generics has driven price reductions, sometimes by over 50%.

- Premium branding persists in developed markets where perceived quality and trust influence payer decisions.

- Price erosion in mature markets is expected to continue, aligning with regulatory fatigue and increased generic penetration.

Future Price Projections (2024-2030)

Based on current trends, the following projections consider competitive pressures, patent expirations, and market growth:

| Year | Estimated Price Range (USD/month) | Rationale |

|---|---|---|

| 2024 | USD 12 - USD 30 | Continued generic entry, pricing competition. |

| 2025 | USD 10 - USD 28 | Further market saturation, cost efficiencies. |

| 2026 | USD 8 - USD 25 | Increased biosimilar competition and regional discounts. |

| 2027 | USD 8 - USD 22 | Potential patent expirations (if applicable), broader access. |

| 2028 | USD 7 - USD 20 | Mature market consolidation, focus on affordability. |

| 2029 | USD 6 - USD 18 | Growing shift toward cost-effective alternatives. |

| 2030 | USD 6 - USD 15 | Market stabilizes with dominant generics, biosimilars. |

Note: Price declines will likely be more pronounced in price-sensitive markets (e.g., India, Southeast Asia), with sustained premiums in developed regions emphasizing quality and safety.

Market Opportunities & Risks

Opportunities

- Expansion into emerging markets driven by increasing contraceptive awareness.

- Development of combination formulations with reduced side effects.

- Digital health integration promoting adherence and awareness.

Risks

- Regulatory restrictions, especially concerning hormonal therapies.

- Negative publicity about side effects impacting demand.

- Market shifts favoring long-acting contraceptive methods.

Strategic Recommendations

- Focus on Cost Efficiency: Optimize manufacturing and supply chain to sustain profitability amidst declining prices.

- Diversify Portfolio: Develop extended-release or non-oral formulations to tap into niche markets.

- Regulatory Engagement: Stay ahead with compliance to maintain market access and avoid patent or market exclusivity losses.

- Market Penetration: Enhance penetration in under-served, emerging markets through pricing and awareness campaigns.

- Innovation: Invest in formulations that minimize side effects, offering differentiation in competitive markets.

Key Takeaways

- The global oral contraceptive market is poised for steady growth, with NORETHIN-ETH ESTRAD operating within a highly competitive landscape.

- Price pressures primarily stem from generic competition, with prices expected to decline by approximately 50% over the next decade.

- Strategic focus on cost control, regulatory compliance, and product diversification can safeguard margins and expand market share.

- Emerging markets present substantial growth opportunities, provided pricing strategies accommodate regional economic factors.

- Innovations that improve safety profiles can command premium pricing, ensuring sustained profitability for differentiated products.

FAQs

1. How does patent expiration impact the pricing of NORETHIN-ETH ESTRAD?

Patent expiry facilitates generic entry, sharply reducing prices due to increased competition. This trend leads to a significant decrease in retail prices and improved access in price-sensitive markets.

2. Are there significant regional differences in the pricing of NORETHIN-ETH ESTRAD?

Yes. Prices are generally higher in developed countries due to regulatory costs, branding, and healthcare infrastructure, whereas emerging markets often see lower prices driven by local manufacturing and market dynamics.

3. What are the key drivers that could influence future demand for NORETHIN-ETH ESTRAD?

Demand growth hinges on reproductive health awareness, regulatory approvals, healthcare access, and competing contraceptive options' acceptance.

4. How might advancements in contraceptive technology affect NORETHIN-ETH ESTRAD’s market?

Innovations such as long-acting reversible contraceptives (LARCs) and non-hormonal options could challenge oral contraceptive sales, creating a need for product differentiation and strategic positioning.

5. What regulatory changes could influence future pricing and availability?

Stringent safety guidelines, approval processes for biosimilars, and modifications in labeling requirements could impact costs and market competitiveness.

References

- Research and Markets. “Global Oral Contraceptives Market Forecast to 2030.” 2022.

- MarketWatch. “Contraceptive Devices & Drugs Market Trends.” 2023.

- IQVIA. “Healthcare Data & Market Trends.” 2022.

- FDA & EMA. Regulatory guidelines on hormonal contraceptives, 2021.

Conclusion

NORETHIN-ETH ESTRAD remains a vital component of the contraceptive market. While competitive pressures and patent cycles will likely sustain downward pricing trends, strategic innovation and market expansion could preserve profitability. Business professionals should monitor regulatory developments and regional market shifts closely to optimize product positioning and pricing strategies.

More… ↓