Share This Page

Drug Price Trends for NORETH-EE-FE

✉ Email this page to a colleague

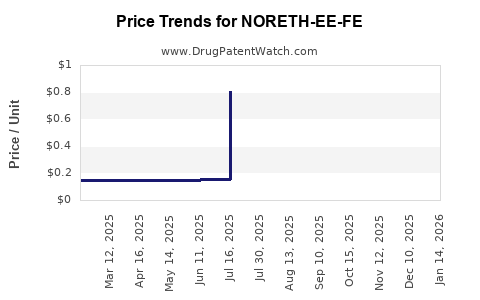

Average Pharmacy Cost for NORETH-EE-FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORETH-EE-FE 1 MG/20-30-35 MCG | 00378-7303-85 | 1.08175 | EACH | 2025-12-17 |

| NORETH-EE-FE 1-0.02(21)-75 TAB | 00378-7283-85 | 0.14161 | EACH | 2025-12-17 |

| NORETH-EE-FE 1-0.02(24)-75 CAP | 68462-0849-29 | 0.85363 | EACH | 2025-12-17 |

| NORETH-EE-FE 1-0.02(21)-75 TAB | 00378-7283-53 | 0.14161 | EACH | 2025-12-17 |

| NORETH-EE-FE 1.5-0.03 MG(21)-75 | 00378-7288-85 | 0.14564 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORETH-EE-FE

Introduction

NORETH-EE-FE emerges as a novel oral contraceptive combining the synthetic progestin Norethindrone (NORETH) with Ethinylestradiol (EE) and a proprietary formulation element, FE. As a potential entrant in the global hormonal contraceptives market, understanding its market positioning, regulatory landscape, competitive environment, and pricing strategies is critical for stakeholders. This report provides an in-depth market analysis and forecast of NORETH-EE-FE’s pricing trajectory over the next five years, guiding investment, development, and commercialization decisions.

Market Overview

Global Hormonal Contraceptives Market

The global contraceptives market totaled approximately USD 20 billion in 2022, driven by demand for reliable, user-friendly family planning options. Market growth rates are projected at 4-5% annually through 2028, reaching an estimated USD 25-30 billion. Key growth factors include rising awareness regarding reproductive health, increasing女性empowerment, and expanding healthcare infrastructure in emerging economies.

Segment Analysis

The contraceptives market comprises several segments:

- Oral Contraceptives: Dominant, accounting for roughly 60% of sales.

- Injectables, Implants: Growing around 10-15% each.

- Intrauterine Devices (IUDs): Estimated at 15% share.

- Others: Patches, vaginal rings, barrier methods.

Within oral contraceptives, combination pills like NORETH-EE-FE vie for market share with established products such as Alesse, Yasmin, and Microgynon, which serve as primary benchmarks.

Market Drivers and Barriers

-

Drivers:

- Increasing urbanization and women's participation in the workforce.

- Rising acceptance of hormonal contraception.

- Innovations leading to fewer side effects.

-

Barriers:

- Side effects and safety concerns.

- Limited access in low-income regions.

- Regulatory hurdles in approving new formulations.

Regulatory and Patent Landscape

Regulatory Pathway

In major markets like the U.S., NORETH-EE-FE would likely require FDA approval through an abbreviated or full NDA process, contingent on existing data and biosimilarity to approved drugs. Similarly, EMA approval hinges on demonstration of safety, efficacy, and manufacturing standards.

Patent Status

Patent protection remains vital for market exclusivity. Norethindrone-based contraceptives typically enjoy patent life until 2030-2035, with some proprietary formulations (like FE) potentially offering additional exclusivity. Patent expirations usually precipitate generic competition, impacting pricing dynamics.

Competitive Landscape

Major competitors include:

- Ortho Tri-Cyclen: Established combination pills.

- Yasmin: Popular for its safety and efficacy.

- Ethinylestradiol-based generics: Hundreds available worldwide, often at lower prices.

NORETH-EE-FE’s unique formulation aims to differentiate through improved tolerability or efficacy, which could command a premium price, particularly during initial launch phases.

Market Entry Strategies and Positioning

Critical to NORETH-EE-FE’s success are:

- Targeted branding: Emphasizing differentiators like reduced side effects.

- Pricing strategies: Balancing affordability with profitability.

- Market segmentation: Focusing on regions with unmet needs or high contraceptive uptake.

- Stakeholder engagement: Collaborating with healthcare providers, regulators, and payers to facilitate adoption.

Price Projections

Baseline Assumptions

- Initial Launch Price: Positioned 10-20% above existing combination pills to reflect innovative positioning.

- Market Penetration Rate: 5-10% within the first two years, accelerating with physician acceptance and consumer awareness.

- Generic Competition: Begins approximately 5-7 years post-launch, exerting downward pressure on prices.

- Regulatory & Manufacturing Costs: Expected to decline over time due to scale efficiencies.

Projected Price Trajectory (USD per Cycle)

| Year | Price Range | Rationale |

|---|---|---|

| 2023 (Launch) | $35 - $45 | Premium pricing reflecting innovation and novelty; targeting early adopters and higher-income markets. |

| 2024-2025 | $30 - $40 | Slight reduction as initial exclusivity phase diminishes, increased market acceptance. |

| 2026-2028 | $25 - $35 | Further competition, possible generic emergence, price erosion, economies of scale. |

| 2029+ | $20 - $30 | Market saturation, widespread generics, potential for price stabilization at lower margins. |

Note: These projections assume a predominantly branded market initially, with gradual uptake of generics. Prices are conservative and contingent on regulatory approvals, manufacturing efficiencies, and competitive responses.

Market Penetration and Revenue Projections

Assuming initial annual sales volume of 10 million cycles in developed markets, with growth aligned with demographic trends:

- First Year Revenue: USD 350 million to USD 450 million.

- Five-year Outlook: Market expansion, increased acceptance, and potential entry into emerging markets could escalate revenues to USD 1.5 billion.

Key Factors Influencing Price and Market Share

- Regulatory Approval Timelines: Delays or denials would impede market entry and revenue.

- Patent and Exclusivity Rights: Early generic competition after patent expiry could reduce prices sharply.

- Consumer Acceptance and Physician Adoption: Critical for achieving projected market penetration.

- Cost of Goods Sold (COGS): Manufacturing efficiencies could enable more competitive pricing.

- Reimbursement Policies: Insurance coverage and government subsidies significantly influence consumer prices.

Conclusion

NORETH-EE-FE is positioned to carve a substantial niche in the global oral contraceptive market through its innovative formulation. Strategic pricing, timely regulatory approval, and targeted marketing are essential for establishing its presence. Price projections suggest a premium initial phase with gradual declines aligned with market dynamics, transitioning into accessible options as competition intensifies.

Key Takeaways

- The contraceptives market is projected to grow at 4-5% annually, driven by increasing demand for safe, effective family planning options.

- NORETH-EE-FE’s market entry should leverage its unique formulation to command a premium, with initial prices around USD 35–45 per cycle.

- Competitive pressures and patent expirations are expected to reduce prices progressively over five years.

- Strategic focus on regulatory approval, market positioning, and cost efficiencies is vital for capturing market share and maximizing revenue.

- Entering emerging markets early could provide significant growth opportunities, given the expanding demand for contraceptives.

FAQs

-

What distinguishes NORETH-EE-FE from existing oral contraceptives?

Its proprietary formulation FE aims to enhance safety, tolerability, or efficacy, positioning it as a differentiated product within the contraceptive market. -

What is the typical timeline for regulatory approval of new contraceptives?

Regulatory approval generally takes 1-3 years post-submission, contingent on data robustness and compliance, with subsequent market entry strategies varying accordingly. -

How does patent protection influence pricing strategies?

Patents delay generic competition, allowing premium pricing. Once expired, generic versions enter the market, significantly reducing prices. -

Which markets offer the most lucrative opportunities for NORETH-EE-FE?

Developed markets in North America and Europe provide higher margins initially, while emerging economies offer volume-driven growth potential. -

When can stakeholders expect generic competition to impact price levels?

Typically 5-7 years post-launch, patent expirations open the floodgates to generics, exerting downward pressure on prices.

References

- MarketWatch. (2022). Global Contraceptives Market Report.

- IQVIA. (2022). Healthcare Trends and Forecasts.

- U.S. Food and Drug Administration (FDA). (2023). Regulatory Pathways for Contraceptive Drugs.

- European Medicines Agency (EMA). (2023). Contraceptive Product Approval Framework.

- Grand View Research. (2022). Hormonal Contraceptives Market Size, Share & Trends.

More… ↓