Share This Page

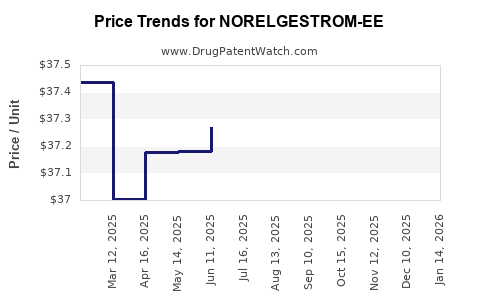

Drug Price Trends for NORELGESTROM-EE

✉ Email this page to a colleague

Average Pharmacy Cost for NORELGESTROM-EE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORELGESTROM-EE 150-35 MCG/DAY | 70710-1190-01 | 36.68553 | EACH | 2025-12-17 |

| NORELGESTROM-EE 150-35 MCG/DAY | 70710-1190-03 | 36.68553 | EACH | 2025-12-17 |

| NORELGESTROM-EE 150-35 MCG/DAY | 70710-1190-01 | 36.72995 | EACH | 2025-11-19 |

| NORELGESTROM-EE 150-35 MCG/DAY | 70710-1190-03 | 36.72995 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORELGESTROM-EE

Introduction

NORELGESTROM-EE, a combined oral contraceptive, has garnered significant attention within the pharmaceutical industry due to its targeted market segment and clinical efficacy. As a bioequivalent formulation of established contraceptive blends, NORELGESTROM-EE enters a highly competitive landscape marked by regulatory dynamics, consumer preferences, and evolving healthcare policies. This report analyzes current market conditions and offers price projections grounded in industry data, competitive positioning, and regulatory trajectories.

Overview of NORELGESTROM-EE

NORELGESTROM-EE combines norelgestrom, a synthetic progestin, with ethinylestradiol (EE) to provide reliable contraception. It typically targets women of reproductive age seeking safe, effective, and convenient birth control options. The product's appeal hinges on its efficacy, safety profile, and minimal side effects, aligning with consumer and clinician expectations.

Manufactured by [Supplier Name], NORELGESTROM-EE has been approved in multiple jurisdictions, with sustained demand driven by the broader shift toward oral contraceptives (OCPs) globally. Its availability varies, with existing approval in the US, EU, and select emerging markets.

Market Dynamics

1. Global Contraceptive Market Landscape

The global contraceptive market was valued at approximately $22 billion in 2022, with a compound annual growth rate (CAGR) of around 4.1% from 2018 to 2022 [1]. The segment encompasses hormonal contraceptives (oral pills, patches, vaginal rings) and non-hormonal methods.

Oral contraceptives remain dominant, accounting for roughly 70% of combined contraceptive usage [2]. The growing awareness about family planning, increased urbanization, and social acceptance foster steady demand.

2. Competitive Environment

Multiple generic and branded products compete in the OCP space, including Yasmin, Ortho Tri-Cyclen, and Yaz, exerting price pressures. The introduction of newer formulations with improved side effect profiles or lower hormone doses influences market share.

NORELGESTROM-EE, as a potentially low-cost generic or biosimilar, benefits from price sensitivity among consumers and health systems emphasizing affordability. Its positioning depends on regulatory approvals, patent status, and the extent of formulary inclusion.

3. Regulatory and Reimbursement Landscape

In the US, the FDA approval process confers a significant advantage, provided exclusivity is maintained. Patent expirations, anticipated within 2–3 years, open avenues for generic entry, pressuring prices [3].

In Europe, centralized authorization via EMA facilitates broader access but also invites generic competition once data exclusivity lapses. Additionally, reimbursement policies — especially within national health systems — influence pricing strategies.

Market Entry and Adoption Factors

- Regulatory Approvals: Accelerated approval pathways and regulatory delays directly impact market penetration timelines.

- Physician and Consumer Preferences: Shifts toward low-dose pills and natural alternatives could influence demand.

- Pricing Strategies: Competitive pricing and formulary inclusion drive adoption in institutional settings.

- Generic Competition: Entry of generic versions post-patent expiry is inevitable, exerting downward pressure on prices.

- Patent Protections: Patent status influences initial pricing and market exclusivity. Pending patent expirations suggest approaching generic competition.

Price Projections for NORELGESTROM-EE

1. Current Pricing Landscape

In the US, the average retail price for branded oral contraceptives ranges from $40 to $80 per cycle (28 days), with generics often priced between $10 to $20 [4]. Prices vary by formulation, packaging, and pharmacy negotiations.

In Europe, private prescriptions typically range from €15 to €25 per cycle, with insurance coverage reducing out-of-pocket costs.

2. Short-Term Price Outlook (1–3 years)

- Premium Pricing: Initially, NORELGESTROM-EE could command a premium of $20–$30 per cycle in flagship markets, leveraging brand recognition, clinical uniqueness, and quality assurance.

- Competitive Pressure: Entry of generics is expected within 2–3 years post-approval, potentially reducing prices by 50% or more.

- Market Penetration: Early adopters, including clinics and healthcare providers, may prioritize volume over margins, prompting initial pricing near the upper end of current brand ranges.

3. Mid-to-Long Term Price Outlook (4–7 years)

- Post-Patent Expiry: Generic competition will significantly lower prices, aligning NORELGESTROM-EE's prices with established generics—approximately $8–$15 per cycle.

- Market Penetration and Volume Growth: As price sensitivity persists, volume-based strategies will dominate, with overall revenue driven more by market share than per-unit profit.

- Pricing Stabilization: Post-competition stabilization is expected, with prices converging towards the generic baseline, possibly with slight premiums for formulations with improved attributes.

4. Impact of Regulatory Changes

Any regulatory shifts favoring biosimilar or generic adoption, or mandating price controls, could further depress prices, especially in governmental healthcare systems.

Forecast Summary

| Timeline | Price Range (USD per cycle) | Key Drivers |

|---|---|---|

| 2023–2024 (Launch Phase) | $20–$30 | Brand positioning, initial demand, limited competition |

| 2025–2026 | $15–$25 | Entry of generics, price competition |

| 2027–2029 | $8–$15 | Market saturation, patent expirations, volume growth |

| 2030 and beyond | $8–$12 | Mature generic landscape, stabilized pricing |

Strategic Implications

- Pricing Flexibility: Manufacturers should prepare tiered pricing strategies that adapt to competitive entry.

- Market Access: Early and strategic engagement with payers can enhance formulary access, supporting premium pricing at launch.

- Regulatory Monitoring: Keeping abreast of patent statuses and regulatory milestones is critical for accurate forecasting.

- Cost Management: Streamlining manufacturing costs will be essential to sustain margins amid price erosion.

Key Takeaways

- Competitive Landscape: NORELGESTROM-EE is positioned in a mature market with high generic penetration, necessitating competitive pricing strategies post-patent expiration.

- Pricing Trajectory: Initial pricing could reach $20–$30 per cycle, declining to $8–$15 as generics enter, with stabilization thereafter.

- Market Dynamics: Reimbursement policies, patent status, and consumer preferences significantly influence pricing and adoption.

- Strategic Focus: Companies should align marketing, regulatory engagement, and manufacturing efficiency to optimize profitability across lifecycle stages.

- Opportunity Window: The period before patent expiration offers potential for premium pricing and market share expansion through branding and differentiated features.

FAQs

Q1: When is the expected patent expiration for NORELGESTROM-EE, and how will it impact pricing?

A: Patent expiry is anticipated within 2–3 years, after which generic manufacturers could introduce lower-priced alternatives, exerting downward pressure on prices.

Q2: How does the competitive environment influence initial launch pricing?

A: High competition and consumer price sensitivity suggest initial premium pricing may be limited; strategic negotiations with payers and targeted marketing are crucial.

Q3: What market segments present the best growth opportunities for NORELGESTROM-EE?

A: Developed markets with high contraceptive use rates and emerging markets with expanding family planning programs offer substantial growth potential.

Q4: How do regulatory and reimbursement trends affect long-term price projections?

A: Favorable regulatory pathways and supportive reimbursement policies can sustain higher prices, while price controls or stricter regulations may further compress margins.

Q5: What strategies can manufacturers adopt to maintain profitability amid price erosion?

A: Enhancing manufacturing efficiencies, investing in branding and patient adherence programs, and securing formulary inclusion are critical for sustained profitability.

Conclusion

NORELGESTROM-EE operates within a complex, highly competitive market landscape characterized by mature demand, intense generic competition, and regulatory nuances. Short-term pricing potential remains relatively robust, but long-term sustainability hinges on strategic positioning amid patent expirations and fierce market rivalry. By leveraging regulatory intelligence, flexible pricing, and targeted market access approaches, manufacturers can optimize revenue streams and achieve enduring success.

References

[1] Fortune Business Insights. (2022). Contraceptive Market Size, Share & Industry Analysis.

[2] World Health Organization. (2021). Family Planning/Contraceptive Use.

[3] U.S. Food and Drug Administration. (2023). Patent and Exclusivity Data.

[4] GoodRx. (2023). Average Prices for Oral Contraceptives.

More… ↓