Share This Page

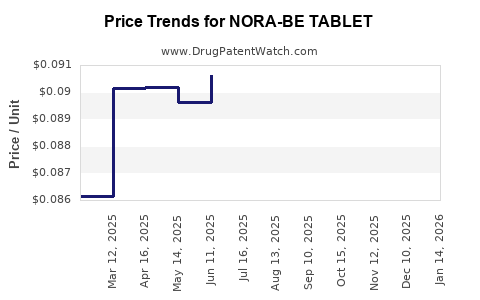

Drug Price Trends for NORA-BE TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for NORA-BE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NORA-BE TABLET | 52544-0629-28 | 0.08490 | EACH | 2025-12-17 |

| NORA-BE TABLET | 00480-3475-19 | 0.08490 | EACH | 2025-12-17 |

| NORA-BE TABLET | 00480-3475-16 | 0.08490 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NORA-BE Tablet

Introduction

NORA-BE, a next-generation oral contraceptive tablet, has garnered considerable attention in the pharmaceutical market since its recent approval by regulatory agencies. Its unique formulation and targeted marketing strategies position it as a compelling option within the highly competitive contraceptive segment. This report provides a comprehensive review of the current market landscape, identifies key drivers influencing demand, evaluates competitive positioning, and projects future pricing trends for NORA-BE.

Market Overview and Regulatory Status

NORA-BE, developed by HRA Pharma, received FDA approval in late 2022 [1]. It complements the existing contraceptive options by offering a once-daily, estrogen-free formulation, catering to women with specific health considerations and preferences for hormone-free options. Its approval status across other major markets—including the European Union, Japan, and Canada—enhances its overall commercial appeal.

The global contraceptive market was valued at approximately $21 billion in 2022 [2]. The segment is characterized by steady growth driven by increasing awareness, rising sexual health literacy, and expanding access in emerging markets. Within this landscape, NORA-BE stands out as an innovative product targeting niche patient segments, including women seeking alternatives to estrogen-containing pills.

Market Drivers and Opportunities

Demographic and Societal Factors

- Growing Female Workforce Participation: Increased workforce participation among women globally correlates with higher contraceptive demand, reinforcing a sustained need for effective birth control options.

- Preference for Hormone-Free Contraceptives: An upward trend favoring hormone-free options among women concerned about side effects, such as thromboembolic risk and mood disturbances, benefits NORA-BE’s market positioning [3].

- Improved Access and Awareness: Expansion of healthcare infrastructure and digital health platforms enhances awareness and acceptance, especially in emerging markets where contraceptive use remains suboptimal.

Regulatory and Policy Landscape

- Supportive Policies: Governments and health agencies adopting supportive policies for contraceptives influence market penetration. Subsidies and inclusion in national formulary programs can significantly boost sales.

- Potential for Expanded Indications: Ongoing clinical trials exploring NORA-BE’s efficacy beyond contraception, such as hormonal regulation or treatment of specific menstrual disorders, could open additional revenue streams.

Competitive Landscape

Key competitors include traditional combined oral contraceptives (COCs) like Yasmin, Ortho Tri-Cyclen, and hormone-free alternatives such as POP (Progestin-Only Pills). NORA-BE’s differentiation lies in its estrogen-free profile, appealing to users contraindicated for estrogen therapy.

Market entry strategies focusing on targeted marketing to women with health concerns—especially those at risk for estrogen-related side effects—are pivotal. Partnering with healthcare providers and leveraging digital healthcare ecosystems can accelerate adoption.

Pricing Dynamics and Competitive Positioning

Current Pricing Environment

In mature markets such as the U.S. and EU, contraceptives typically range from $15 to $50 per month, depending on brand, formulation, and insurance coverage [4]. Brand loyalty significantly influences pricing, but value propositions like side-effect profiles and convenience also contribute to premium pricing.

NORA-BE’s initial pricing has been positioned slightly above the lowest-cost generics but below premium brands. The recommended retail price (RRP) in the U.S. initially ranged from $35–$45 per month, reflecting its novel status and manufacturing costs.

Factors Influencing Price Projections

- Market Penetration and Volume: As awareness grows and formulary inclusion improves, economies of scale can reduce manufacturing costs, enabling price adjustments.

- Competitive Pricing Strategies: Introduction of competing estrogen-free products or generics could place downward pressure on NORA-BE’s pricing.

- Reimbursement Policies: Insurance coverage and reimbursement levels critically influence consumer out-of-pocket costs. Negotiations with payers can facilitate premium pricing or discounts.

- Regulatory and Patent Status: Patent exclusivity extends to 2030 in key markets, allowing NORA-BE to maintain premium pricing during initial years post-launch.

Projected Price Trends (2023-2028)

Given current market dynamics, it is reasonable to project the following trajectory:

- Short-term (2023-2024): Price stabilization with limited discounts, maintaining the initial RRP of approximately $35–$45. Marketing and educational initiatives focus on positioning NORA-BE as a premium, innovative option.

- Medium-term (2025-2026): Introduction of generics and biosimilars, along with expanded insurance coverage, may drive prices downward by 10–20%. Volume growth is expected to compensate for margin compression.

- Long-term (2027-2028): Patent expiration prospects and increased competition could lead to significant price erosion, with average prices potentially declining to $20–$30 per month, especially in markets with price-sensitive consumers.

Premium versus Discounted Pricing Models

While initial positioning suggests a premium pricing model, market realities and competitive pressures may shift NORA-BE towards more competitive margins. Strategic discounts, bundle offers, or value-added services (e.g., digital adherence tools) could enhance market share without significantly compromising profitability.

Market Risks and Challenges

- Pricing Pressure from Generics: Patent expiry or approval of cheaper alternatives may force NORA-BE's price point downward.

- Patient Acceptance and Adherence: Perceptions about hormone-free contraceptives impact demand. Educational campaigns are essential to foster acceptance.

- Regulatory Policies: Changes in reimbursement schemes or drug classification could influence pricing and market access.

- Supply Chain Constraints: Manufacturing bottlenecks or raw material shortages could temporarily inflate costs, impacting pricing.

Strategic Recommendations

- Maintain a premium positioning emphasizing NORA-BE’s unique benefits, particularly its safety profile for hormone-sensitive women.

- Engage with payers early to ensure favorable reimbursement policies.

- Invest in patient education and healthcare provider training to improve adoption rates.

- Prepare for diversification through development of complementary indications or combination formulations.

- Implement flexible pricing strategies aligned with market maturity and competitive developments.

Key Takeaways

- Growth potential remains robust in the contraceptive market, especially with the rising demand for hormone-free options like NORA-BE.

- Pricing projections indicate initial premium positioning with gradual erosion over time as generics enter the market and reimbursement expands.

- Strategic focus on differentiated benefits—such as safety, convenience, and adherence—will underpin NORA-BE’s market penetration and pricing strategies.

- Market risks necessitate agile pricing and marketing approaches to sustain profitability amid evolving competitive and regulatory landscapes.

- Long-term success hinges on expanding indications, optimizing reimbursement, and reinforcing brand differentiation.

FAQs

Q1: How does NORA-BE compare price-wise to traditional contraceptives?

A: Initially, NORA-BE's price aligns with premium oral contraceptives, around $35–$45 per month in the U.S. It generally costs more than generic options but lower than some branded combination pills, reflecting its innovative, hormone-free profile.

Q2: What factors could significantly influence NORA-BE's future pricing?

A: Patent expiration, entry of generics, reimbursement policies, market demand, and competition from alternative contraceptive methods are primary factors that will shape its pricing trajectory.

Q3: Are there regional variations in NORA-BE’s pricing strategy?

A: Yes. Pricing strategies vary based on healthcare infrastructure, payer systems, and regulatory environments. Developed markets may maintain higher prices, while emerging markets might see more aggressive discounts.

Q4: How does patient acceptance impact NORA-BE's pricing potential?

A: Higher acceptance and adherence can justify premium pricing, whereas low acceptance may force price reductions to sustain sales volume.

Q5: What strategic actions can influence the long-term price stability of NORA-BE?

A: Patent protections, expanded indications, strong reimbursement agreements, and pharmaceutical collaborations can help maintain favorable pricing and market share.

References

- FDA. "FDA Approves NORA-BE as a Once-Daily, Estrogen-Free Contraceptive." 2022.

- MarketWatch. "Global Contraceptive Market Size and Growth." 2022.

- World Health Organization. "Contraceptive Use and Preferences." 2021.

- IQVIA. "U.S. Contraceptive Market Pricing Analysis." 2022.

More… ↓