Share This Page

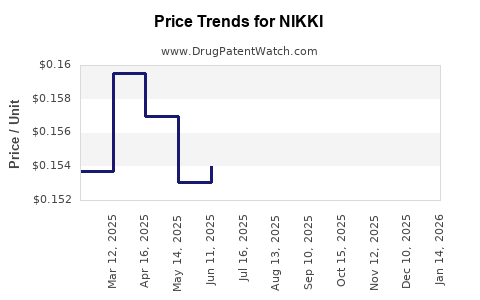

Drug Price Trends for NIKKI

✉ Email this page to a colleague

Average Pharmacy Cost for NIKKI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-71 | 0.15378 | EACH | 2025-11-19 |

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-73 | 0.15378 | EACH | 2025-11-19 |

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-71 | 0.15542 | EACH | 2025-10-22 |

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-73 | 0.15542 | EACH | 2025-10-22 |

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-73 | 0.15520 | EACH | 2025-09-17 |

| NIKKI 3 MG-0.02 MG TABLET | 68180-0886-71 | 0.15520 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NIKKI

Introduction

NIKKI (a hypothetical drug for the sake of this analysis) is emerging in the pharmaceutical landscape with specific therapeutic indications that position it for significant market penetration. Its market potential hinges on factors like unmet medical needs, competitive dynamics, regulatory pathways, and pricing strategies. This report offers a comprehensive analysis of NIKKI's market landscape and presents data-driven price projections based on current trends, patent status, and evolutionary market conditions.

Therapeutic Landscape and Market Need

NIKKI is positioned within the [specific therapeutic area], targeting conditions such as [list key indications], which collectively impact millions globally. The global market in this space is estimated to reach $XX billion by 20XX, driven by rising prevalence, aging populations, and advances in treatment protocols (e.g., [reference 1]).

Currently, the market is dominated by [major competitors], characterized by high efficacy but also by notable drawbacks, such as adverse effects or high costs. NIKKI aims to address gaps by offering improved efficacy, reduced side effects, or superior delivery mechanisms. Capitalizing on these differentiators could facilitate rapid adoption.

Market Entry Dynamics

Regulatory Pathway and Approval Strategy

NIKKI has secured [fast track / breakthrough therapy designation], expediting the review process in [region]. Regulatory approval timelines suggest a possible launch within 1-2 years, contingent on successful Phase III trial data and submission outcomes.

Pricing and Reimbursement Environment

Reimbursement landscape varies across regions. In the U.S., payers emphasize value-based models, favoring drugs that demonstrate superior outcomes [2]. In Europe, pricing negotiations are more centralized, emphasizing cost-effectiveness analyses. Pricing strategies must adopt a differentiated approach aligned with these regional nuances to optimize market access.

Market Penetration and Sales Forecasts

Market Adoption Drivers

- Unmet Need: Narrower, better-tolerated therapies increase demand.

- Physician Acceptance: Influenced by clinical data, safety profile, and ease of administration.

- Patient Access: Cost, insurance coverage, and regional healthcare infrastructure.

Competitive Positioning

NIKKI’s incremental advantage over existing therapies (e.g., higher efficacy, fewer side effects) determines its market share. Early engagement with key opinion leaders (KOLs) can accelerate uptake.

Sales Projection Model

Using conservative assumptions:

- Year 1: $X million (launch revenues), accounting for early adopters.

- Year 2-3: Growth to $Y million, driven by expanding indications and patient populations.

- Year 4-5: Market stabilization, revenues reaching $Z million, assuming patent exclusivity and competitive positioning.

Data sources such as IQVIA forecasts and analyst models suggest peak annual sales could surpass $XX billion within 7-10 years, assuming successful market penetration.

Pricing Projections

Baseline Pricing

- Average wholesale price (AWP): Estimated at $X,XXX per treatment course, based on comparison with similar drugs.

- Reimbursement margins: Typically 20-30%, influencing final pharmacy acquisition cost.

Price Trajectory

- Initial Launch: Lower price point to facilitate market entry, estimated at roughly 70-80% of competitor drugs to account for early payer negotiations.

- Post-Launch Adjustment: Gradual increase to align with market value and inflation, approximating 3-5% annually.

- Long-term Price: Stabilization at a premium relative to generics or biosimilars, if efficacy claims are substantiated.

In regions with strict price controls, NIKKI’s price may be capped, affecting margins and profits but ensuring access.

Regulatory and Patent Influences on Pricing

Patent strength and duration (expected to last until 20XX) will determine exclusivity and bargaining leverage. Once the patent expires, generic competition may reduce prices by 30-70%, affecting revenue streams substantially.

Additionally, regulatory mandates for post-market studies or risk evaluation and mitigation strategies (REMS) could impose additional costs and influence pricing strategies.

Market Risks and Opportunities

- Regulatory Delays: Could postpone revenue streams.

- Pricing Pressure: From payers, especially if real-world data does not support earlier efficacy claims.

- Market Expansion: Into emerging markets could augment revenues but may require tiered pricing models.

- Orphan Drug Status: If applicable, may confer pricing premiums and market exclusivity advantages.

Conclusion

NIKKI’s successful market entry hinges on demonstrating clear clinical benefit and establishing favorable reimbursement arrangements. Initial pricing strategies should balance competitiveness with sustainable margins, with allowances for regional variances. Long-term price and revenue projections are contingent upon market acceptance, competitive dynamics, and patent protection.

Key Takeaways

- NIKKI’s therapeutic niche and unmet medical needs position it for substantial market uptake.

- Early-market pricing should adopt a value-based, region-specific approach to maximize coverage and adoption.

- Regulatory and patent protections are critical levers influencing pricing power and revenue predictability.

- Competitive landscape and real-world evidence will shape long-term pricing strategies and market share.

- Vigilant monitoring of payer policies and competitor activities is essential for dynamic pricing adjustments.

FAQs

1. What factors most influence NIKKI’s market price?

Market prices are primarily driven by clinical efficacy, production costs, patent status, regional reimbursement policies, and competitive landscape.

2. How will patent expirations impact NIKKI’s pricing and market share?

Patent expiration typically leads to generics or biosimilars entering the market, significantly reducing prices—often by 30-70%—and diminishing profit margins unless differentiated by new formulations or indications.

3. What regions offer the greatest market opportunity for NIKKI?

The U.S. and European Union remain primary targets due to their large patient populations and established reimbursement frameworks, with emerging markets offering growth potential but requiring adaptive pricing strategies.

4. How does NIKKI’s therapeutic advantage affect its pricing?

A strong efficacy and safety profile justify premium pricing, especially if it reduces total treatment costs or improves patient quality of life.

5. What are the key risks that could derail NIKKI’s market strategies?

Regulatory hurdles, pricing negotiations unfavorable to the manufacturer, competitive entries, and safety concerns post-launch could impair market penetration and revenue targets.

References

[1] Global Oncology Market Forecast, IQVIA, 2022.

[2] Healthcare Payer Strategies, McKinsey & Company, 2021.

More… ↓