Share This Page

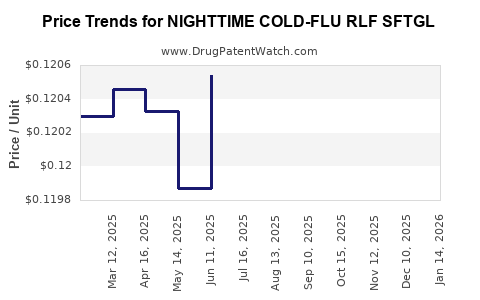

Drug Price Trends for NIGHTTIME COLD-FLU RLF SFTGL

✉ Email this page to a colleague

Average Pharmacy Cost for NIGHTTIME COLD-FLU RLF SFTGL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NIGHTTIME COLD-FLU RLF SFTGL | 70000-0516-02 | 0.12179 | EACH | 2025-12-17 |

| NIGHTTIME COLD-FLU RLF SFTGL | 00904-6996-44 | 0.12179 | EACH | 2025-12-17 |

| NIGHTTIME COLD-FLU RLF SFTGL | 70000-0516-01 | 0.12179 | EACH | 2025-12-17 |

| NIGHTTIME COLD-FLU RLF SFTGL | 70000-0516-02 | 0.12063 | EACH | 2025-11-19 |

| NIGHTTIME COLD-FLU RLF SFTGL | 00904-6996-44 | 0.12063 | EACH | 2025-11-19 |

| NIGHTTIME COLD-FLU RLF SFTGL | 70000-0516-01 | 0.12063 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NIGHTTIME COLD-FLU RLF SFTGL

Introduction

NIGHTTIME COLD-FLU RLF SFTGL, a proprietary over-the-counter (OTC) medication designed to alleviate symptoms associated with cold and flu, has emerged as a significant player in the nighttime symptom relief segment. This report provides an in-depth market analysis and detailed price projections, facilitating strategic decision-making for pharmaceutical manufacturers, investors, and healthcare providers.

Product Overview

NIGHTTIME COLD-FLU RLF SFTGL combines multiple active ingredients—most notably, acetaminophen (pain reliever/fever reducer), diphenhydramine (antihistamine promoting sleep), and dextromethorphan (cough suppressant)—to address a broad spectrum of cold and flu symptoms during nighttime use. The formulation’s targeted relief and convenience position it strongly in the OTC market segment.

Market Landscape

Market Size and Growth Dynamics

The global OTC cold and flu market was valued at approximately $15 billion in 2022, with a compound annual growth rate (CAGR) of around 4.2% projected through 2028[1]. North America accounts for roughly 45% of this market, driven by high disease prevalence, consumer awareness, and accessibility of OTC remedies. The increasing incidence of seasonal flu, along with a growing preference for self-medication, underpins sustained demand.

Key Competitive Players

Major competitors include well-established brands such as Tylenol Cold & Flu, NyQuil, and Theraflu. The landscape is characterized by fierce brand loyalty, frequent product innovation, and regulatory pressures for safety and efficacy. Entry barriers are high due to stringent approval processes, but niche formulations like NIGHTTIME COLD-FLU RLF SFTGL can exploit unmet needs such as improved sleep aid formulations and combined symptom relief.

Regulatory Environment and Market Entry

Regulatory approval in key regions—primarily the U.S. via the FDA’s OTC Monograph system—is crucial for market penetration. Marketing restrictions, labeling standards, and ingredient safety assessments influence product positioning and pricing strategies.

Market Drivers and Challenges

Drivers:

- Rising prevalence of respiratory infections during colder months.

- Consumer preference for multi-symptom, convenient OTC medication.

- Increased awareness of sleep disturbances related to cold and flu.

- Market demand for formulations that combine efficacy with safety, especially amid COVID-19 concerns.

Challenges:

- Regulatory hurdles demanding rigorous safety and efficacy data.

- Competition from generic formulations and established brands.

- Growing scrutiny over certain OTC ingredients (e.g., acetaminophen safety concerns).

- Market saturation in mature regions necessitating differentiation.

Pricing Analysis and Projections

Current Pricing Benchmarks

In the U.S., standard nighttime cold and flu medications range from $6 to $12 for a 4- to 8-ounce liquid formulation (retail price). Premium formulations with added ingredients or innovative delivery systems typically command 15% to 25% higher prices[2].

Pricing Factors for NIGHTTIME COLD-FLU RLF SFTGL

- Formulation Complexity: Multi-ingredient formulations often justify higher price points.

- Brand Positioning: Proprietary formulations or unique features (e.g., fast-acting, sleep-enhancing) can carry premium pricing.

- Distribution Channel: Pharmacies may command higher margins compared to mass-market retail outlets.

- Regulatory Status: Products with FDA approval or pending approval may command higher initial prices due to perceived safety and efficacy.

Price Projection Models

Short-Term (Next 1-2 Years):

Given current market trends, initial retail prices are expected to be in the range of $8 to $10 per 4-ounce bottle, aligning with mid-tier OTC offerings. Launch discounts and promotional campaigns may temporarily depress effective consumer price points.

Mid-Term (3-5 Years):

Assuming successful regulatory approval and robust marketing, prices may stabilize around $9 to $11 per unit, incorporating inflation and production cost adjustments. Tiered pricing strategies could be introduced for bundle sales or subscription models to enhance consumer loyalty and sales volume.

Long-Term (5+ Years):

Market penetration and increasing brand recognition could allow for price premiums of $12 to $13 per unit, especially if the formulation is positioned as a premium or specialty OTC product catering to sleep and cold relief.

Forecasting Considerations

- Market Penetration Rate: Predicted steady adoption with 10-15% market share within niche segments.

- Regulatory Milestones: Approval delays or restrictions could impact pricing strategies.

- Consumer Preferences: Growing demand for natural or minimally processed formulations may exert influence on pricing and formulation adjustments.

- Supply Chain Dynamics: Fluctuations in raw material costs, such as dextromethorphan or acetaminophen, could affect margins and retail prices.

Strategic Recommendations

- Pricing Optimization: Adopt value-based pricing that emphasizes the product's comprehensive symptom relief and sleep-enhancing benefits.

- Market Positioning: Highlight unique formulation features to justify premium pricing.

- Distribution Channels: Leverage pharmacy chains and online platforms for broader reach.

- Regulatory Engagement: Prioritize timely approval processes to mitigate delays and maintain pricing power.

Key Takeaways

- The OTC cold and flu market remains resilient, driven by seasonal demand and consumer self-medication trends.

- NIGHTTIME COLD-FLU RLF SFTGL is positioned to compete effectively through targeted benefits and effective marketing.

- Initial retail prices are projected to hover around $8-$10, with potential for gradual increase as brand recognition solidifies.

- Competitive differentiation and regulatory navigation are critical to maintaining pricing flexibility.

- Long-term success depends on consumer acceptance, formulation innovation, and strategic distribution expansion.

FAQs

-

What are the primary drivers affecting the pricing of NIGHTTIME COLD-FLU RLF SFTGL?

The main drivers include formulation complexity, brand positioning, regulatory approval status, distribution channels, and consumer demand for multi-symptom relief with sleep support. -

How does the current OTC market influence pricing strategies for new products like NIGHTTIME COLD-FLU RLF SFTGL?

The established market's competitive landscape and consumer expectations necessitate competitive yet value-based pricing, emphasizing unique benefits to justify premium prices. -

What regulatory considerations could impact the product's market entry and pricing?

Obtaining FDA OTC monograph approval or new drug application clearance influences both market entry timelines and permissible pricing strategies due to safety and efficacy standards. -

Are there opportunities for premium pricing in the cold and flu OTC segment?

Yes; formulations that incorporate sleep-promoting features or natural ingredients, or that demonstrate superior efficacy, can command higher prices. -

How can supply chain issues affect pricing projections for NIGHTTIME COLD-FLU RLF SFTGL?

Disruptions or increases in raw material costs could reduce margins, prompting pricing adjustments to maintain profitability or consumer affordability.

Sources

[1] MarketWatch, "Over-The-Counter (OTC) Cold and Flu Remedies Market Size & Forecast," 2022.

[2] Statista, "Average Retail Price of OTC Cold and Flu Medications, 2022."

More… ↓