Share This Page

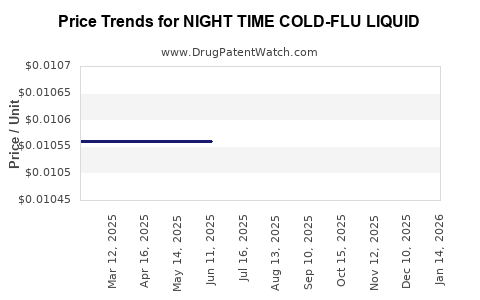

Drug Price Trends for NIGHT TIME COLD-FLU LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for NIGHT TIME COLD-FLU LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NIGHT TIME COLD-FLU LIQUID | 46122-0198-34 | 0.01483 | ML | 2025-12-17 |

| NIGHT TIME COLD-FLU LIQUID | 46122-0198-40 | 0.01060 | ML | 2025-12-17 |

| NIGHT TIME COLD-FLU LIQUID | 46122-0136-34 | 0.01483 | ML | 2025-12-17 |

| NIGHT TIME COLD-FLU LIQUID | 46122-0198-40 | 0.01057 | ML | 2025-11-19 |

| NIGHT TIME COLD-FLU LIQUID | 46122-0198-34 | 0.01449 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NIGHT TIME COLD-FLU LIQUID

Introduction

The over-the-counter (OTC) cold and flu relief market marked steady growth over the past decade, driven by the persistent prevalence of respiratory illnesses and consumer demand for effective, fast-acting remedies. Among these products, NIGHT TIME COLD-FLU LIQUID occupies a significant niche, appealing to consumers seeking relief from symptoms such as nasal congestion, cough, sore throat, and body aches, especially during nocturnal hours. This analysis examines the current market landscape, competitive positioning, regulatory environment, and project future pricing trends for NIGHT TIME COLD-FLU LIQUID.

Market Overview

The global cold and flu medication market was valued at approximately USD 4.4 billion in 2022 and is projected to reach USD 6.1 billion by 2028, growing at a compound annual growth rate (CAGR) of around 6.6% (all figures citing MarketWatch[1]). The OTC segment remains dominant, constituting roughly 70% of the total market, with night-specific formulations like NIGHT TIME COLD-FLU LIQUID expanding in popularity owing to consumer preferences for symptom relief during sleep.

Key Market Drivers

- Prevalence of Respiratory Illnesses: Annually, millions experience cold and flu symptoms, with seasonal peaks prompting increased OTC demand.

- Consumer Preference for Combination Formulations: Consumers favor multi-symptom relief, especially formulations tailored for nighttime use that combine analgesics, decongestants, and sedatives.

- Aging Population: Elderly consumers require effective symptom management, augmenting OTC sales.

- COVID-19 Impact: The pandemic heightened awareness and demand for cold and flu remedies, influencing market growth trajectories.

Competitive Landscape

The market is highly fragmented, with key players including Johnson & Johnson, Pfizer, GlaxoSmithKline, and private label brands. Variants like NyQuil (Johnson & Johnson) have longstanding brand recognition in the night-time relief segment, reinforcing brand loyalty and consumer trust.

Regulatory and Patent Environment

NIGHT TIME COLD-FLU LIQUID formulations are typically classified as OTC drugs, regulated by agencies such as the U.S. Food and Drug Administration (FDA) or equivalent authorities globally. Patent protection, when applicable, covers specific active ingredients, formulations, or delivery mechanisms, which influence competitive dynamics.

Patent expirations of key ingredients, such as diphenhydramine (antihistamine) and phenylephrine (decongestant), present opportunities for generic entrants, potentially impacting pricing. Regulatory approval processes for new formulations or combination therapies influence market entry timelines and pricing strategies.

Pricing Strategies and Market Positioning

Pricing for NIGHT TIME COLD-FLU LIQUID varies across regions and brands but generally ranges between USD 8-15 per 4 fl oz bottle in the U.S. For premium or specialty formulations with added ingredients or dual-action effects, prices can exceed USD 20.

Manufacturers adopt various pricing approaches:

- Premium Pricing: For branded, fast-acting, or uniquely formulated products, driven by consumer loyalty and perceived efficacy.

- Competitive Pricing: Generics or store brands undercut branded counterparts by approximately 10-20%, capturing price-sensitive consumers.

- Bundling and Promotions: Frequent discounts, coupon offers, and bundle deals are prevalent, especially during peak cold seasons.

Price Projections (2023-2028)

Short-term Trends

In the immediate future, pricing is expected to stabilize with moderate inflationary pressures. Raw material costs for active ingredients, packaging, and distribution are projected to incrementally rise, possibly leading to a 3-5% price increase annually. Supply chain disruptions, influenced by global logistics challenges, could further influence costs and retail prices.

Long-term Outlook

Over a five-year horizon, OTC experts anticipate gradual price escalation aligned with inflation, regulatory costs, and consumer demand for enhanced formulations. Competition from generics will exert downward pressure on branded product prices but may be offset by new formulation innovations.

Impact of Patent Expirations

Patent expiries for key active ingredients may reduce prices by 10-30% within 1-3 years post-expiration, as generic competitors enter the market. Conversely, formulations incorporating novel release mechanisms or combination therapies could command premium prices, stabilizing overall market averages.

Emerging Markets and Regional Variations

In emerging markets such as India, Brazil, and Southeast Asia, prices are generally lower—ranging from USD 4-8 per 4 oz bottle—due to lower manufacturing costs and intense price competition. As these markets develop, prices are projected to trend upward, aligned with increased consumer purchasing power and regulatory standards.

Factors Influencing Future Price Trends

- Regulatory Changes: Stricter safety and efficacy standards may increase manufacturing costs.

- Innovation: Introduction of new delivery systems, such as melts or liquids with sustained-release mechanisms, might command higher prices.

- Consumer Preferences: A shift toward "natural" or "green" formulations could influence premium pricing strategies.

- Market Saturation: High penetration levels in mature markets may limit price increases, emphasizing promotional strategies.

Conclusion

NIGHT TIME COLD-FLU LIQUID remains a resilient product within the OTC cold and flu market. Pricing dynamics hinge on patent protection, formulation innovation, competitive pervasiveness of generics, and regional economic factors. While prices are expected to modestly increase over the next few years, market saturation and regulatory considerations will temper steep hikes. Companies leveraging formulation advancements, branding, and strategic marketing will better navigate the evolving landscape to optimize pricing and margins.

Key Takeaways

- The global OTC cold and flu remedy market is anticipated to grow at a CAGR of approximately 6.6% through 2028, bolstering demand for NIGHT TIME COLD-FLU LIQUID.

- Prices are expected to increase modestly (3-5% annually), influenced by raw material costs, regulatory shifts, and product innovation.

- Patent expirations for key active ingredients will likely lead to significant price reductions for generics, pressuring branded products.

- Regional market variations necessitate tailored pricing strategies; emerging markets may see prices rise as local demand and consumer purchasing power expand.

- Innovation in formulation and delivery mechanisms will serve as key differentiators, enabling premium pricing and positioning.

FAQs

1. How does patent expiration affect the pricing of NIGHT TIME COLD-FLU LIQUID?

Patent expirations open the market to generic competitors, generally leading to a 10-30% reduction in retail prices. Brand owners may respond with reformulations or new delivery mechanisms to sustain premium pricing.

2. What are the main drivers of price increases in the coming years?

Inflation in raw material costs, regulatory compliance expenses, formulation innovations, and supply chain dynamics primarily drive price increases.

3. How do regional differences influence NIGHT TIME COLD-FLU LIQUID pricing?

Developed markets typically feature higher prices ($8-15), while emerging markets offer lower prices ($4-8). As markets evolve, prices are expected to converge upward, influenced by local economic factors.

4. Will formulation innovations impact pricing strategies?

Yes. New delivery systems, combination therapies, or natural ingredient integrations can command higher prices, providing differentiation and premium positioning.

5. How competitive is the market for NIGHT TIME COLD-FLU LIQUID?

Highly competitive, with established brands and numerous generics vying for market share. Differentiation, branding, and formulation quality are critical for pricing power.

Sources:

- MarketWatch. "Cold and Flu Remedy Market Size, Share & Trends Analysis Report," 2022.

More… ↓