Share This Page

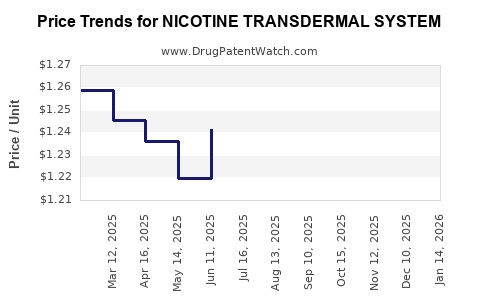

Drug Price Trends for NICOTINE TRANSDERMAL SYSTEM

✉ Email this page to a colleague

Average Pharmacy Cost for NICOTINE TRANSDERMAL SYSTEM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.50893 | EACH | 2025-12-17 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.46992 | EACH | 2025-11-19 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.44324 | EACH | 2025-10-22 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.37290 | EACH | 2025-09-17 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.31902 | EACH | 2025-08-20 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.26032 | EACH | 2025-07-23 |

| NICOTINE TRANSDERMAL SYSTEM | 43598-0445-56 | 1.24143 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Nicotine Transdermal System

Introduction

The nicotine transdermal system (NTS) has solidified its position as a cornerstone in smoking cessation therapies globally. As a non-invasive, controlled-release delivery mechanism, it offers an effective alternative to traditional cessation methods, addressing a significant public health challenge. This analysis explores the market landscape, key drivers, competitive dynamics, regulatory environment, and future price trajectories for NTS, providing stakeholders with comprehensive insights to inform strategic decisions.

Market Overview and Landscape

The global nicotine transdermal system market has experienced steady growth, driven by increasing awareness of smoking-related health risks and supportive regulatory policies. As of 2022, the market size was estimated at approximately USD 860 million, with projections indicating a compound annual growth rate (CAGR) of around 5.2% through 2027 [1].

Key regional markets include North America, Europe, and Asia-Pacific. North America dominates the market due to high smoking cessation awareness, robust healthcare infrastructure, and regulatory approvals. Europe exhibits significant growth potential because of stringent anti-tobacco legislation and increasing manufacturer focus. Asia-Pacific, with its vast population base and rising smoking prevalence, presents considerable expansion opportunities.

Market Drivers

-

Growing Smoking Cessation Initiatives: Governments and health authorities are increasingly promoting nicotine replacement therapies (NRT), including NTS, to reduce smoking prevalence. Campaigns like the U.S. FDA’s endorsement of NRTs bolster market growth [2].

-

Regulatory Support and Approvals: Regulatory agencies' approvals for various NTS formulations underpin market stability and expansion. Over-the-counter (OTC) availability in key markets enhances accessibility.

-

Consumer Preference for Non-Invasive Relief: The convenience and discreet nature of transdermal systems appeal to adult smokers seeking minimal hassle, further boosting product adoption.

-

Rising Awareness of Health Risks of Smoking: Public health campaigns underscore the benefits of quitting, generating demand for effective cessation tools.

-

Technological Innovations: Advances in patch design, drug delivery systems, and personalized treatments improve efficacy and user experience.

Competitive Landscape

Major players in the NTS market include GlaxoSmithKline (GSK), Johnson & Johnson, Novartis, and Perrigo. These companies focus on product innovation, strategic collaborations, and expanding distribution networks to capture market share.

-

Product Differentiation: New formulations offering faster absorption, lower side-effect profiles, and improved adhesion are gaining traction. For example, GSK’s Nicorette range remains prominent due to its extensive distribution.

-

Pricing Strategies: Manufacturers employ various pricing models, including premium offerings for differentiated patches and volume discounts for institutional buyers. Competitive pricing is pivotal in price-sensitive emerging markets.

-

Market Entry Barriers: Patent protections, strict regulatory pathways, and high R&D costs serve as barriers for new entrants, consolidating market control among established companies.

Regulatory Environment

Regulations significantly influence market accessibility and pricing. In the U.S., the FDA classifies NTS under NRTs, facilitating OTC sales but demanding rigorous safety and efficacy data. Europe’s EMA similarly regulates these products, emphasizing quality standards. Emerging markets are witnessing evolving policies, often aligning with WHO Framework Convention on Tobacco Control (FCTC) guidelines.

Patent expirations for key formulations open avenues for generic manufacturers, intensifying price competition. Conversely, innovative, patent-protected patches command premium pricing.

Price Dynamics and Projections

Current Pricing Trends:

The typical retail price of a 14-day nicotine transdermal patch ranges from USD 20 to USD 35, depending on brand, formulation, and geographic market. Generic patches offer a cost advantage, priced between USD 15 and USD 25.

Factors Influencing Prices:

- Patent Status: Patent expirations tend to reduce prices as generics enter the market. For instance, the upcoming patent expiry for GSK’s Nicorette patches could lead to significant price reductions over the next 2-3 years.

- Manufacturing Costs: Innovations in production processes lower costs, potentially translating into reduced consumer prices.

- Regulatory Costs: Approval procedures and quality compliance can inflate initial pricing, especially for innovative formulations.

- Market Competition: Increased competition from generics and emerging regional players exerts downward pressure on prices.

Future Price Projections (2023-2027):

- Stable Premium Segment: Brand-name patches will maintain higher prices, estimated at USD 25-35 per 14-day course, driven by brand loyalty and perceived efficacy.

- Generic Market Expansion: Entry of generics could reduce prices to USD 10-20, with a projected average reduction of 20-30% over five years.

- Impact of Innovation: Next-generation patches with enhanced features (e.g., faster absorption, reduced skin irritation) may command premium pricing in niche segments, supporting higher price points.

Regional Variance:

Developed markets will see stable or declining prices due to mature competition, while emerging markets may experience price erosion driven by local manufacturing and increased competition.

Future Market and Price Outlook

The combined influence of patent expirations, technological advances, and regional market expansion suggests a consolidating landscape with variable pricing strategies. Premium prices for innovative solutions are expected to persist in developed markets, while a significant shift toward cost-effective generics will dominate emerging economies.

Overall, the global NTS market is poised for moderate growth, with price pressures primarily stemming from generic competition and localized regulatory pathways. Innovative, differentiated patches with improved safety profiles and user convenience will sustain higher price points, particularly in premium segments.

Key Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets through localized manufacturing and distribution channels.

- Development of personalized patches with controlled dosing tailored to individual pharmacodynamics.

- Integration with digital health solutions, such as adherence tracking via mobile apps.

Challenges:

- Patent cliff effects that threaten premium pricing models.

- Regulatory hurdles in new or emerging markets.

- Competition from alternative smoking cessation modalities like e-cigarettes and pharmacotherapy.

Key Takeaways

- The nicotine transdermal system remains a vital component of smoking cessation strategies globally, with a steadily expanding market.

- Patent expirations and technological innovation are driving price declines, especially in generics and emerging markets.

- Premium branded patches will sustain higher prices due to perceived efficacy and brand loyalty.

- Future growth hinges on regional expansion, product differentiation, and integration with digitized health platforms.

- Regulatory stability and compliance remain critical for maintaining market position and pricing power.

FAQs

-

What factors most significantly influence the price of nicotine transdermal patches?

Patent status, manufacturing costs, regulatory compliance, market competition, and product innovation predominantly determine prices. -

How will patent expirations impact the market?

Patent expirations facilitate generic entry, increasing competition and driving prices downward, especially over the next 2-3 years. -

Are innovative nicotine patches priced higher than traditional ones?

Yes, patches with enhanced features (e.g., faster absorption, reduced skin irritation) typically command premium prices. -

What regional markets offer the greatest growth potential for NTS?

Emerging markets in Asia-Pacific and Latin America present significant growth opportunities due to rising smoking prevalence and expanding healthcare access. -

How does the competitive landscape affect pricing strategies?

Strong competition from generics and new entrants compels manufacturers to adopt aggressive pricing, discounts, and value-added features to differentiate products.

Sources Cited:

[1] GlobeNewswire. “Nicotine Replacement Therapy Market Size, Share & Trends Analysis Report.” 2022.

[2] U.S. Food and Drug Administration. “FDA Approves First Over-the-Counter Nicotine Replacement Therapy Products.” 2020.

More… ↓