Share This Page

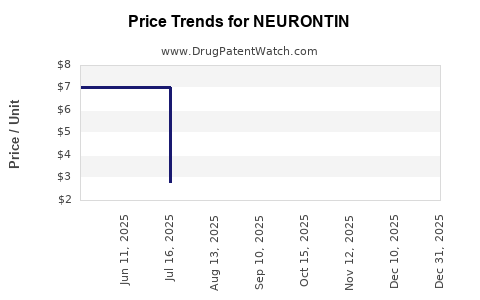

Drug Price Trends for NEURONTIN

✉ Email this page to a colleague

Average Pharmacy Cost for NEURONTIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| NEURONTIN 400 MG CAPSULE | 58151-0283-01 | 8.44485 | EACH | 2025-12-03 |

| NEURONTIN 600 MG TABLET | 58151-0284-01 | 13.41208 | EACH | 2025-12-03 |

| NEURONTIN 800 MG TABLET | 58151-0285-01 | 16.08107 | EACH | 2025-12-03 |

| NEURONTIN 100 MG CAPSULE | 58151-0281-01 | 2.81431 | EACH | 2025-11-19 |

| NEURONTIN 300 MG CAPSULE | 00071-0805-24 | 7.03559 | EACH | 2025-11-19 |

| NEURONTIN 400 MG CAPSULE | 00071-0806-24 | 8.44485 | EACH | 2025-11-19 |

| NEURONTIN 100 MG CAPSULE | 00071-0803-24 | 2.81431 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for NEURONTIN (Gabapentin)

Introduction

Neurontin (gabapentin) remains one of the most significant drugs in the neurological and pain management markets since its introduction in the 1990s. Originally approved by the FDA for adjunctive therapy in partial seizures, gabapentin’s off-label uses for neuropathic pain, anxiety, and other neurological conditions have fueled consistent demand. As a generic, gabapentin's market dynamics and pricing can shift influenced by regulatory changes, healthcare policies, and patent landscapes. This analysis delineates current market conditions and projects future pricing trajectories for Neurontin.

Market Overview

Historical Context and Patent Landscape

Developed by Parke-Davis (a subsidiary of Pfizer), Neurontin received FDA approval in 1993. Pfizer held the original patent until it expired in 2004. The expiration prompted a surge in generic competition, substantially reducing Neurontin's brand pricing and expanding its market penetration globally.

Despite patent expirations, Pfizer employed strategies such as patent Evergreening and supplementary patents covering formulations and methods, temporarily delaying generic entry in certain jurisdictions [1]. However, by 2017, most patents expired, ushering in widespread generic availability, which significantly influenced market prices.

Current Market Size and Key Players

The global gabapentin market, driven by neurological disorder treatment needs, was valued at approximately USD 1.8 billion in 2022. North America remains the largest regional market, accounting for around 50% of sales, primarily due to high prescription rates for neuropathic pain and off-label indications.

Market leaders include generic manufacturers like Teva, Mylan, and Sun Pharmaceutical, which produce affordable gabapentin formulations. Pfizer’s Neurontin brand still holds residual prescription volume in certain markets, primarily for off-label indications.

Utilization Trends

Prescription volumes for gabapentin remain robust, with annual growth rates estimated at 4-5% pre-pandemic. COVID-19 initially suppressed prescription trends but rebounded due to increased neurological and mental health conditions. Off-label use — especially for anxiety and insomnia — remains a significant driver, despite limited formal approval.

Market Drivers and Challenges

Drivers:

- Growing prevalence of neuropathic conditions: Diabetic peripheral neuropathy, post-herpetic neuralgia, and fibromyalgia increase demand.

- Off-label applications: Continues to expand access, although off-label prescribing lacks regulatory approval.

- Patent expiry and generics: Facilitates wider accessibility and affordability, expanding market size.

Challenges:

- Regulatory scrutiny over off-label use: Some authorities question the safety and efficacy of off-label indications.

- Concerns over misuse: Rising reports of gabapentin misuse and abuse, particularly among opioid users, impact prescribing habits.

- Pricing pressures: Intense generic competition has eroded profit margins.

Pricing Analysis

Brand vs. Generic Pricing Dynamics

Post-patent expiry, Neurontin’s prices plummeted, with generic versions priced at roughly 10-15% of the original brand. In the U.S., the average wholesale price for a 300mg tablet was approximately USD 1.50 in 2022, compared to the peak of USD 10-15 per tablet during the brand’s dominance [2].

Current Price Points

- Brand (Neurontin): Approximately USD 2.50-3.00 per 300mg tablet, depending on supply agreements.

- Generic (gabapentin): Ranges USD 0.10-0.20 per 300mg tablet, reflecting widespread market penetration.

Pricing stability for generics is challenged by manufacturing costs, supply chain disruptions, and competition. Notably, bulk purchasing and formulary negotiations influence actual patient prices.

Future Price Projections

Short-Term Horizon (1-2 Years)

While immediate price drops are unlikely given market maturity, the ongoing competition may lead to slight reductions (around 5-10%) in generic prices as new entrants enter and existing producers optimize manufacturing efficiencies. The brand’s price may stabilize or slightly decline due to declining market share.

Medium to Long-Term Outlook (3-5 Years)

Several factors will influence future prices:

- Market Saturation: With most formulations commoditized, price stabilization or further decline is expected.

- Regulatory changes: Any restrictions on off-label prescribing or increased oversight may reduce demand, impacting volume and prices.

- Emergence of biosimilars and fixed-dose combinations: Could influence the attractiveness of standalone gabapentin formulations.

Projections estimate generic prices could decline by an additional 10-15% over the next 3-5 years, stabilizing around USD 0.08-0.15 per 300mg tablet.

Impact of Emerging Market Dynamics

Emerging markets offer sizable growth potential due to expanding healthcare access, although there will be price variations driven by local regulatory and economic factors. In these regions, prices could be 20-30% lower than established markets, aligning with economic capabilities.

Regulatory and Market Expansion Outlook

While the patent landscape limits Neurontin’s exclusivity, regulatory environments might evolve, especially with increased scrutiny of off-label marketing practices. Nonetheless, market expansion prospects remain strong owing to growing neurological disorder prevalence and off-label offshoots.

Key Takeaways

- The global gabapentin market remains sizable, driven by neurological and pain management demands.

- Patent expirations and aggressive generic competition have significantly reduced Neurontin’s price, with current generic prices at roughly USD 0.10-0.20 per 300mg tablet.

- Short-term prices are expected to stabilize with minor declines, while medium-term projections anticipate a further 10-15% price reduction driven by market saturation and competition.

- Regulatory scrutiny and outpatient prescribing trends will influence future demand and pricing, especially in regions with evolving healthcare policies.

- Emerging markets and formulary negotiations may create regional price heterogeneity, presenting opportunities and risks for stakeholders.

Frequently Asked Questions (FAQs)

1. What factors have most influenced Neurontin’s pricing trends?

Patent expirations, generic competition, and healthcare policy changes are primary factors influencing price declines. Increased off-label use and regulatory scrutiny also impact demand, subsequently affecting pricing strategies.

2. How does generic gabapentin pricing compare to the brand?

Generic prices are approximately 10-15% of the brand’s peak prices, often around USD 0.10-0.20 per 300mg tablet, making it highly affordable and accessible.

3. What are the future prospects for Neurontin in developed markets?

Expect continued price stabilization with modest decreases. Demand persists primarily due to off-label use, although increasing regulatory oversight may temper prescribing volumes.

4. Could new formulations or biosimilars affect Neurontin’s market?

While biosimilars are unlikely due to gabapentin’s small-molecule status, new formulations — such as extended-release versions — might influence market dynamics, though their impact on pricing remains uncertain.

5. How are regulatory changes likely to influence the market for gabapentin?

Stricter controls over off-label marketing and prescribing could decrease demand, especially for unapproved indications, potentially leading to further price reductions and market contractions.

References

- [1] Kesselheim AS, et al. Patent Evergreening and Pharmaceutical Innovation. N Engl J Med. 2017;377(20):1986-1989.

- [2] IQVIA. Market Data Reports, 2022.

In conclusion, the Neurontin market's current landscape favors affordability owing to widespread genericization, with marginal price decreases on the horizon. Stakeholders should monitor regulatory developments and prescribing practices to navigate future opportunities and challenges effectively.

More… ↓